IPO details could remain hazy, even after the start of Uber’s roadshow on Friday

That’s partly due to strict disclosure regulations, but also because info like valuation and the share price at launch could be fluid right up to the stock’s first trading session.

As such, the sum total of official information on Uber’s IPO can mostly be summarised thus:

• Uber aims to raise at least $10bn, by selling around 2.1 million shares at $48-$55

• Total valuation would be about $100bn

•The first day of public trading will be around mid-May

That’s pretty much it! Still, given huge investor interest and with Uber’s management on a mission, enough details have found their way into the public domain to make informed choices.

Here is a selection of key upsides and downsides to consider ahead of the biggest IPO in five years.

UPSIDES

- At the simplest level, $10bn is considered the lowest estimation of Uber IPO proceeds. It follows that the price range bankers are said to have discussed would also be beaten; particularly if the Wall Street hype machine does its job

- Looking deeper, Uber is preparing to pitch itself as a transportation-to-logistics version of Amazon. Remember, the e-Commerce gargantuan grew at a breakneck pace for more than a decade, with share price gains to match, while burning through billions of dollars a year

- U.S. ride-hailing market share: fillings suggest Uber’s market share remained around 70% over 2016-2018

- Leadership of the $400bn-plus taxi-app market is an asset. Statista data suggests Uber market penetration could be 13.2% in 5 years vs. 7.5% in 2017

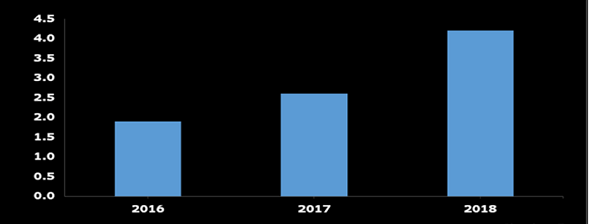

- Ride-hailing growth is still faster than conventional public transportation growth. It was 37% in 2017, rising to 60% in 2018. Uber could be the chief beneficiary, yet accounts for less than 1% of the global transport business

Total rides from apps in U.S. (millions) – 2016-2018

Source: Bloomberg/City Index

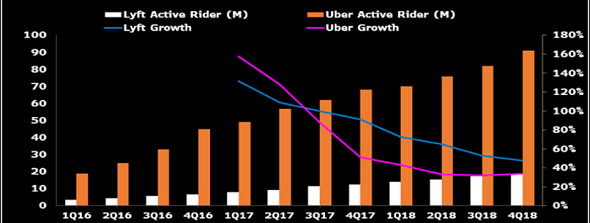

Active rider growth: Uber vs. Lyft

Source: Bloomberg/City Index

- Revenue growth: filings also pin Uber’s 2018 sales growth at more than 40%, three times that of chief rival Lyft

- Rapid expansion of diverse revenue streams backs the premium valuation case

- Food delivery, headed by Uber Eats, is the group’s biggest ancillary business. It serves more than 500 cities via more drivers and restaurant partners – now including Starbucks – than rivals

- Premium valuation has obvious precedents: Wall Street expects Uber to grow between 25%-20% a year, a similar trajectory to companies like Amazon, Facebook and Netflix, all of which have enjoyed valuations out of whack with profitability

- Margins: Uber’s gross and core margins are far healthier than Lyft’s, and unusually high for a $10bn-plus revenue tech firm, according to Bloomberg data

- Self-driving unit: a stake in Advanced Technologies Group was recently valued at $7.25bn with Japan's Softbank and Toyota possible buyers

DOWNSIDES

- The chief risk to Uber’s pre- and post-IPO valuation is eye-watering ‘cash burn'

- Uber toasted $3.04bn in 2018 on revenues of $11.3bn

- The loss from driver/rider subsidies and scaling the platform was over $10bn over the last 3 years alone

- Little wonder Uber wears the claim that it may never be profitable as a badge of honour

- The risk is set to be the key pressure on Uber’s post IPO price. It’s worth noting that Lyft shares have collapsed 20% since its end-March IPO

- The rise of self-driving cars is Uber’s biggest long-term growth and valuation risk.

- The group would need to increase investment in R&D exponentially to compete with advanced self-driving rivals

- Uber has little capacity to hike capex further

- Driver-less competition could destroy Uber’s margins

- Uber spent up to $460m on self-driving projects last year. It had to pause these after the death of a pedestrian

- A JV with a larger self-driving industry leader may be essential to negate the risk that Uber is superseded by a key vulnerability of its business model

- Even if prepared to make a deal with Uber, self-driving leaders may demand terms that are so onerous, they dent the firm’s margins anyway.