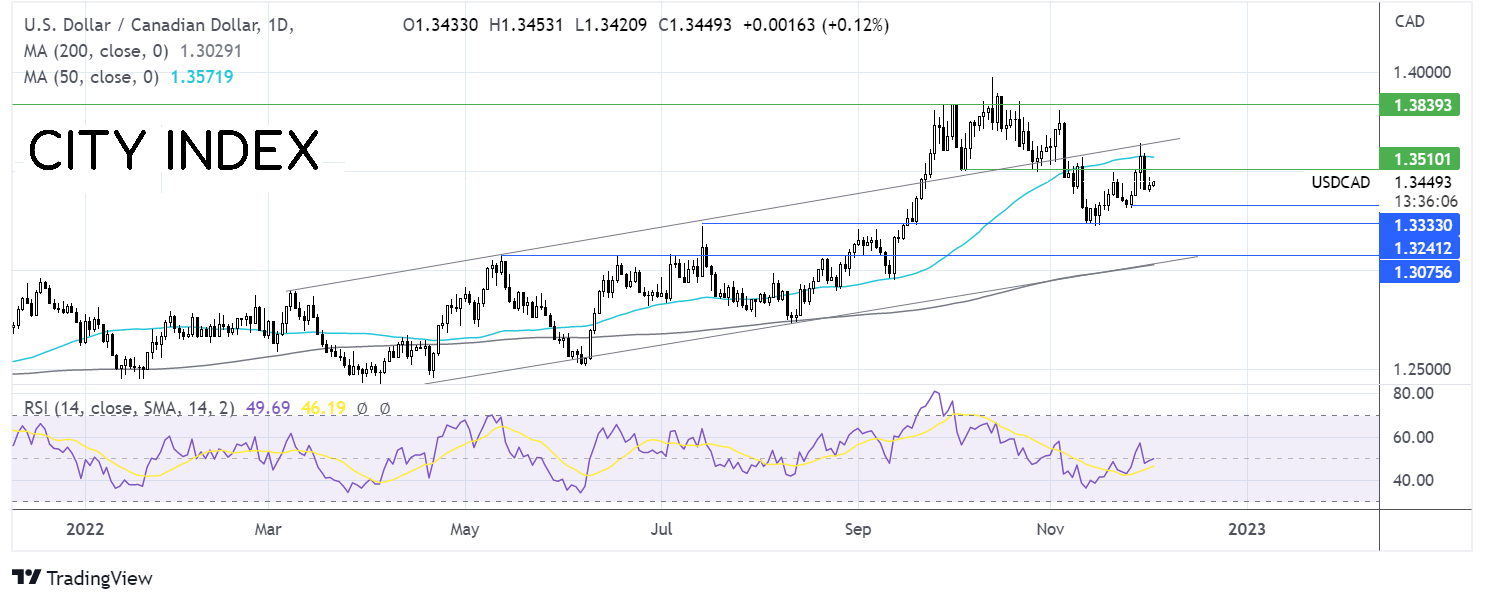

USD/CAD looks to US & Canadian jobs data

USD/CAD lacks direction ahead of the jobs reports from the US and Canada.

The loonie has failed to track oil prices higher across the week. Canada’s main export has risen over 6% this week, while the loonie trades roughly flat against its US counterpart.

That said, the BoC’s more hawkish bias compared to the Federal Reserve could keep bears hopeful of further downside.

Attention is now on the NFP and Canada’s jobs report. In October, Canada saw a blowout jobs report with 108.3k jobs created as such, November’s report is expected to be more muted, with just 5k jobs added. Unemployment is due to tick higher to 5.3%, up from 5.2%.

The BoC’s interest rate decision is next week. Inflation is showing signs of slowing. Weakness in the jobs market could fuel hopes of a less aggressive BoC.

Where next for USD/CAD?

USD/CAD has been trending higher over the past two weeks. However, gains have been capped by the 50 sma. Buyers could look for a rise over 1.3515, the October low, to expose the 1.3570 and the rising trendline at 1.3645.

Sellers could look for a fall below 1.3325, the Friday 25 low, to bring into 1.3220, the November low. A fall below here creates a lower low.

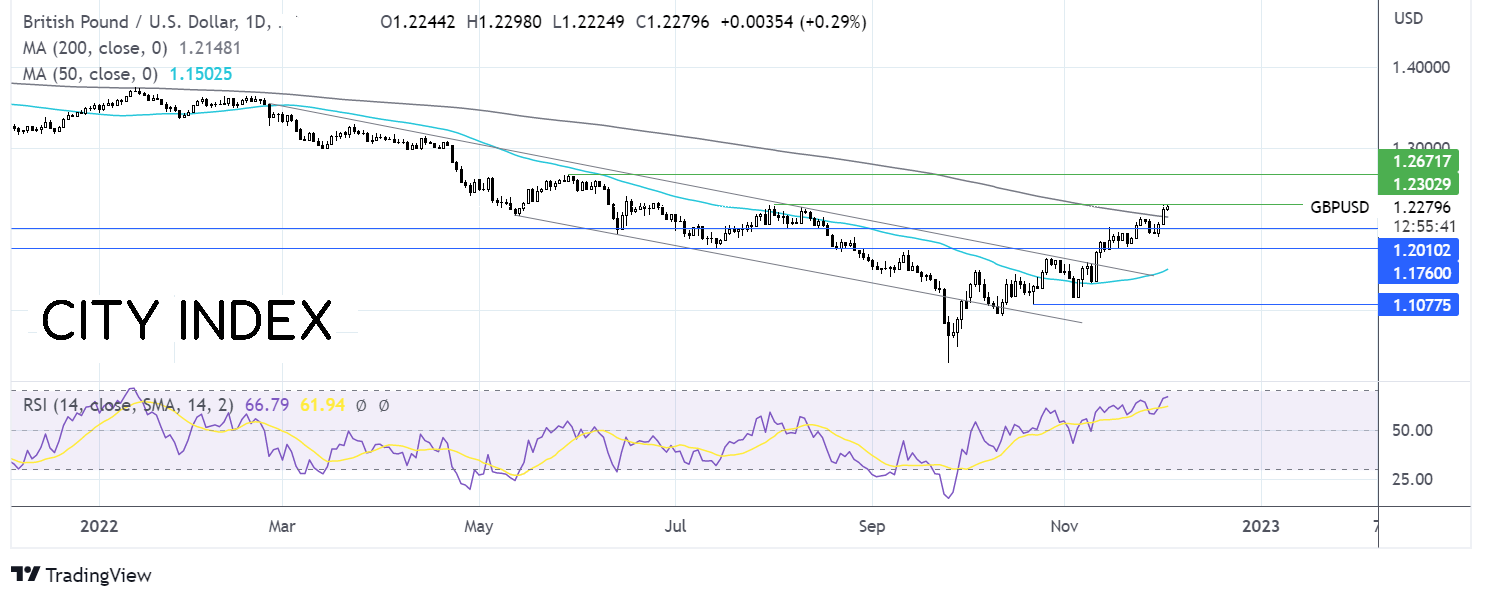

GBP/USD rally continues ahead of the NFP

The pound’s rise has been impressive given the dire UK economic outlook. Sterling is capitalizing on the weaker USD. However, it is worth pointing out that the pound is performing well against other major peers.

With inflation at 11.1% and showing few signs of slowing, the BoE could be forced to stick with a more hawkish approach to monetary policy than the Fed, which is set to adopt a more dovish stance from the December meeting.

Attention is now on the US non-farm payroll, which is expected to show 200k jobs were added in November, down from 261k in October and 315k in September.

Unemployment is set to tick higher again to 3.8%, up from 3.7%, and wage growth is set to ticker lower to 4.6%.

Given that Fed Powell has said that the Fed is hiking by 50 basis points in December, the NFP could have a smaller impact than usual on the market. A weak report, or even a goldilocks report of slower wage growth but moderate job creation, could pull the USD lower.

Where next for GBP/USD?

GBP/USD has risen above the 200 sma and is testing resistance at 1.23, the August high. The RSI supports further gains while it remains out of overbought territory. A rise above 1.23 opens the door to 1.2670, the June high.

On the flip side, should sellers successfully defend the 1.23 level, immediate support can be seen at 1.2150, the 200 sma, ahead of 1.20, the psychological level. A move below 1.1740, the mid-November low, could see sellers gain momentum.