Oil steadies after two days of declines

- Oil inventories unexpectedly fall

- Global growth worries hurt the demand outlook

- Oil trades in a holding pattern

Oil prices are holding steady after two straight days of losses; Investors weigh up a larger-than-expected draw on crude stockpiles against demand concerns.

Weaker inflation data from China raises concerns over the strength of the economic recovery in the world’s largest oil importer as it moves on from the Covid restrictions of last year. A weak recovery in China would hurt the oil demand outlook. That said, while Chinese oil imports fell at the start of 2023, there are signs of them rebounding in February. OPEC secretary general said that China’s oil demand would grow to 500k to 600k barrels per day in 2023.

Worries over the Fed raising interest rates higher for longer are also adding to demand outlook concerns. Not only does this make a recession in the US more likely, but it also increases the likelihood of a global economic slowdown.

Meanwhile, data from the EIA showed that US crude oil stocks fell by 1.7 million barrels last week, defying expectations of a build and snapping 10 weeks of rising crude oil stockpiles. Gasoline stockpiles fell by 1.1 million barrels.

Looking ahead, US jobs data will likely be the next catalyst, where a strong labour market could fuel rate hike worries.

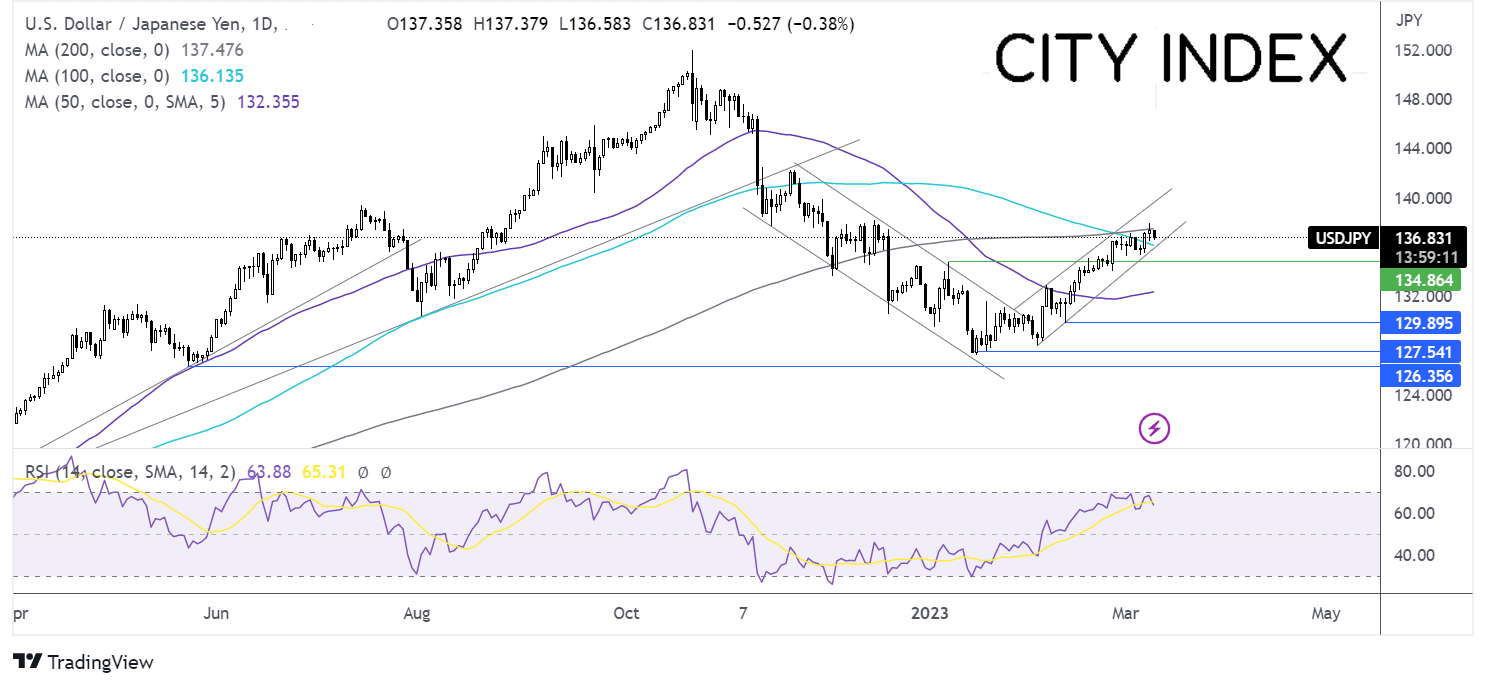

Where next for oil prices?

WTI has been trading within a holding pattern, capped on the upside around 82.20 and on the lower band by 72.70. The failure to rise above the 100 sma and the drop below the 50 sma favours the downside.

Sellers could look for a fall below 72.70 to extend losses towards 71.20 the December low.

Buyers need to rise above the 100 sma and March high at 80.70 ahead of the 82.20 level needed to create a higher high. Beyond here 83.30 the December high comes into play.

USDJPY falls with US jobs & BoJ rate decision in focus

- Yen rises on safe-haven flows

- US jobs data & BoJ in focus

- USDJPY fails to rise above 200 sma

USD/JPY is falling for a second day as the yen is supported by safe-haven flows as after weak Chinese inflation data and as investors fret over a global economic slowdown.

The USD is easing but remains around 3-month highs after stronger-than-expected ADP payrolls supported the Fed’s hawkish stance. The private sector saw 242k jobs added, ahead of the 200k forecast.

Today US jobless claims are in focus and are expected to remain below 200k at 195k, highlighting strength in the labour market.

Looking ahead the BoJ is not expected to adjust its dovish stance in the final monetary policy meeting with Haruhiko Kuroda as governor ahead of Kazuo Ueda taking over as governor next month.

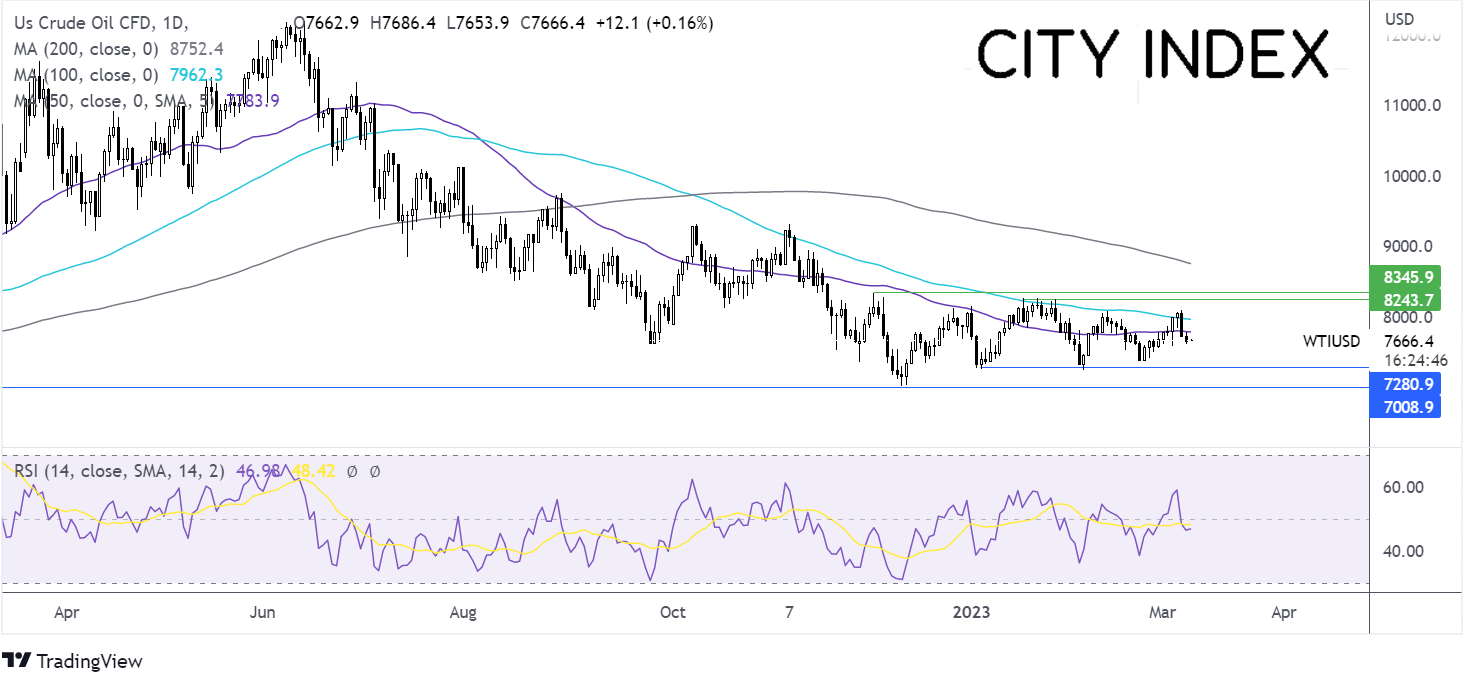

Where next for USD/JPY?

USDJPY trades within an ascending channel, which combined with a rise above the 100 sma and a bullish RSI is keeping buyers hopeful of further upside.

Buyers will need to rise above the 200 sma at 137.50 and the 138.00 2023 high to extend the bullish trend towards 139.75 the upper band of the rising channel.

Failure to rise over the 200 sma could see sellers retest the 100 sma at 136.10, ahead of 134.80, the January high.