GBP/USD falls after weak consumer confidence & retail sales

The pound is falling away from 1.24 after weak consumer confidence and an unexpected drop in retail sales.

GFK Consumer confidence fell in January to -45, down from -42 in December and below the -40 level expected. Rising prices and squeezed household budgets limit consumers have started 2023 with a gloomy outlook.

Disappointing sentiment data was perhaps unsurprisingly followed by disappointing retail sales data. Retail sales slumped 1% MoM in December, defying expectations of a 0.5% increase. November sales were also downwardly revised to -0.5.

The data suggests that the UK consumer hello is under increasing pressure as the UK economy is expected to tip into recession in the current quarter. on a slightly more positive note BoE Governor Andrew Bailey said that he didn't think the UK recession would be as deep as initially feared. he also said that for the Bank of England terminal rate could be around 4.5%.

Meanwhile, the USD is edging higher after losses in the previous session. The greenback shrugged off hawkish Fed speak and stronger than forecast jobless claims yesterday, to settle 0.3% lower.

Today, US housing starts and building permits will be in focus, as well as more Fed chatter ahead of the blackout period.

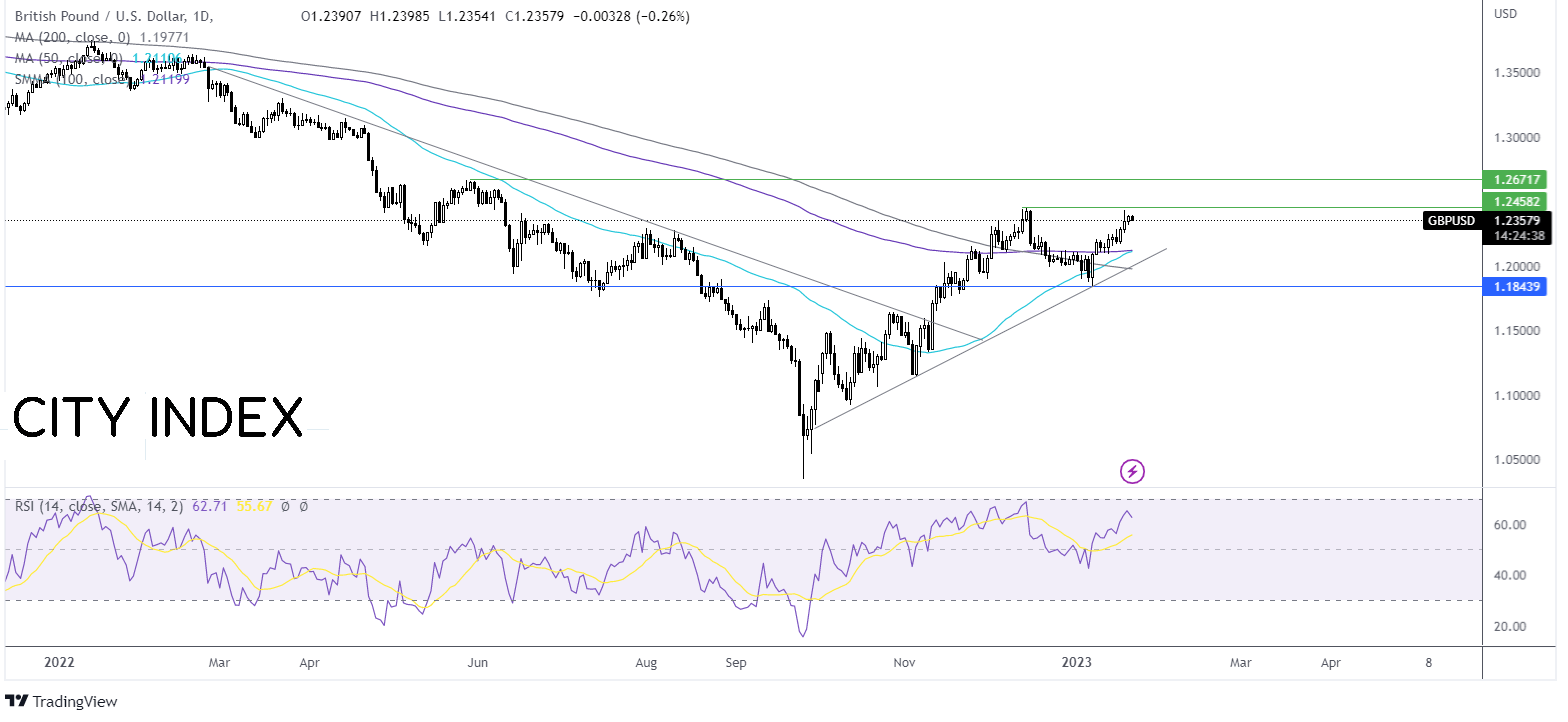

Where next for GBP/USD?

GBP/USD continues to hover around a monthly high. The pair trades above its 50, 100 & 200 sma, and the 50 sma has crossed above the 100 & 200 smas in a golden cross bullish signal. This, along with the RSI above 50 keeps buyers hopeful of further upside.

Buyers could look to rise above 1.2435, the weekly high, and 1.2445, the December high to open the door to 1.2660, the May high. A rise above here creates a higher high.

Meanwhile, sellers could find support at 1.2120, the 50 & 100 sma, and the May low. A fall below here opens the door to 1.2030 the rising trendline support. A break below 1.1840 creates a lower low.

USD/CAD looks to retail sales

USD/CAD is edging lower for a second straight session at the end of the week. The loonie is finding support from rising oil prices and as USD bears pause for breath.

Oil prices are on the rise again, boosted by optimism surrounding China’s reopening and the upcoming Lunar New Year week-long holiday, which is expected to boost the economy. This is overshadowing concerns of a slowdown in the rest of the global economy

According to the monthly IEA and OPEC reports China reopening could lift oil demand to record levels,

Looking ahead, Canadian retail sales data will be in focus and are expected to fall -0.4% MoM in November after rising 1.4% in December.

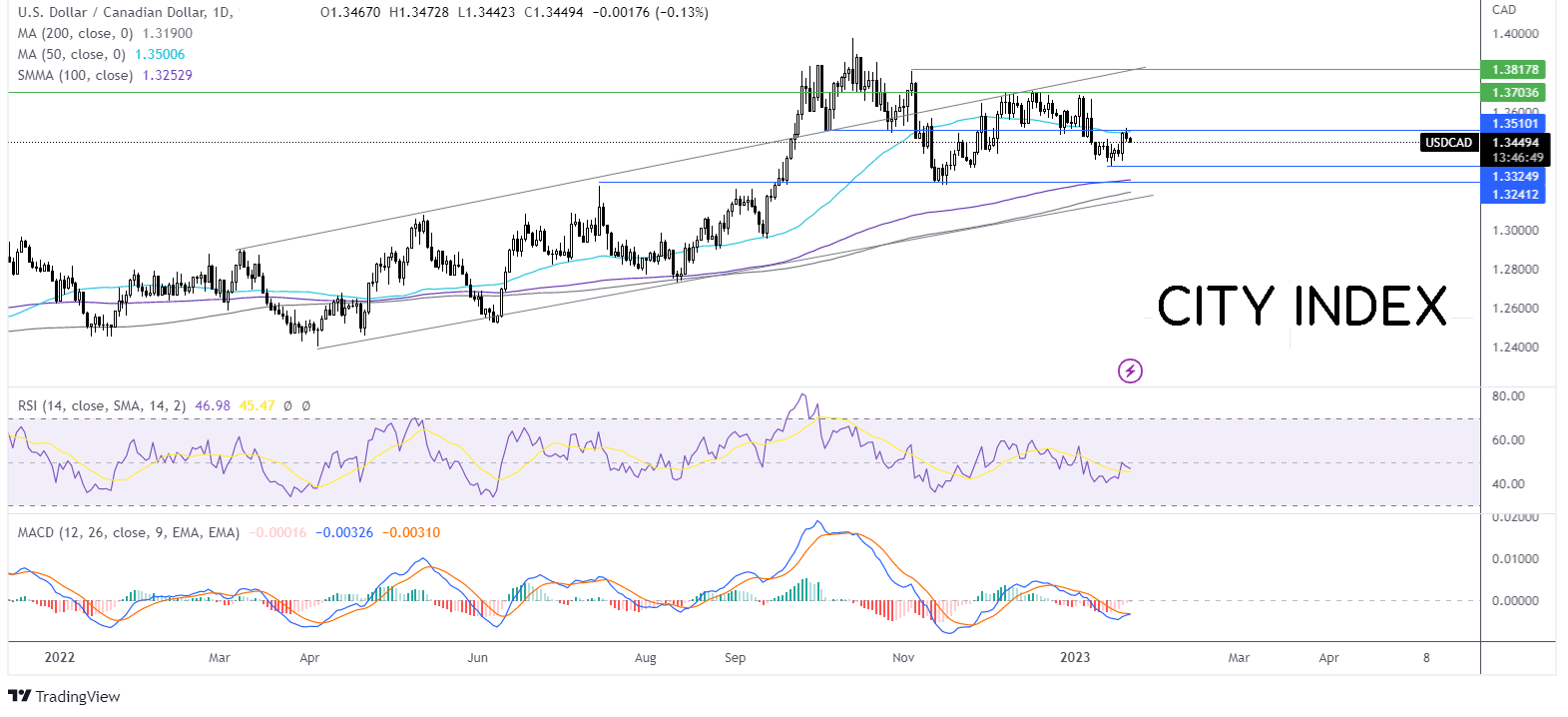

Where next for USD/CAD?

After failing to rise above 1.37 the price has rebounded lower, falling below the 50 sma before finding support at 1.3345.

USDD/CAD is currently trading rangebound, capped on the upside by the 50 sma at 1.35 and on the lower side by 1.3345 the weekly low. The RSI is at 50, neutral, offering few clues.

Buyers could look for a rise above 1.35, opening the door to 1.3680, the 2023 high.

Sellers could look for a break below 1.3345 to create a lower low and to expose the 100 sma at 1.3250. Below here the 200 sma and multi-month rising trendline comes into focus as 1.3175.