Dax hits fresh all time high

An upbeat mood in the market is lifting the

Dax as investors cheer the prospect of additional US fiscal stimulus after Friday’s NFP report.

On Friday the US Senate passed a budget resolution that allows for the passage of the fiscal stimulus package in the coming weeks without Republican support.

Vaccine rollout figures are outweighing concerns over vaccine efficacy

German industrial production 0% vs 0.3% exp.

Eurozone Sentix consumer confidence up next.

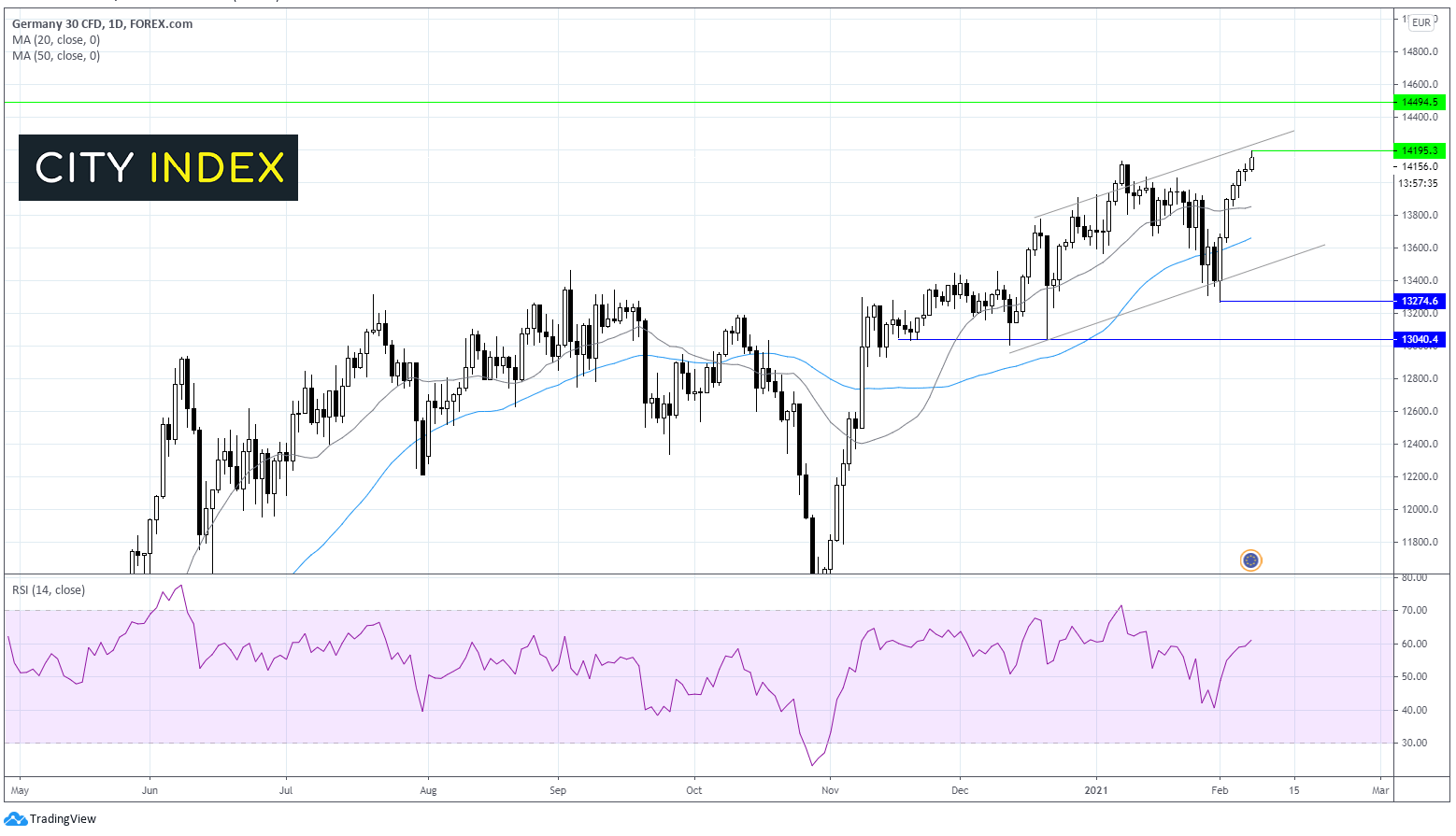

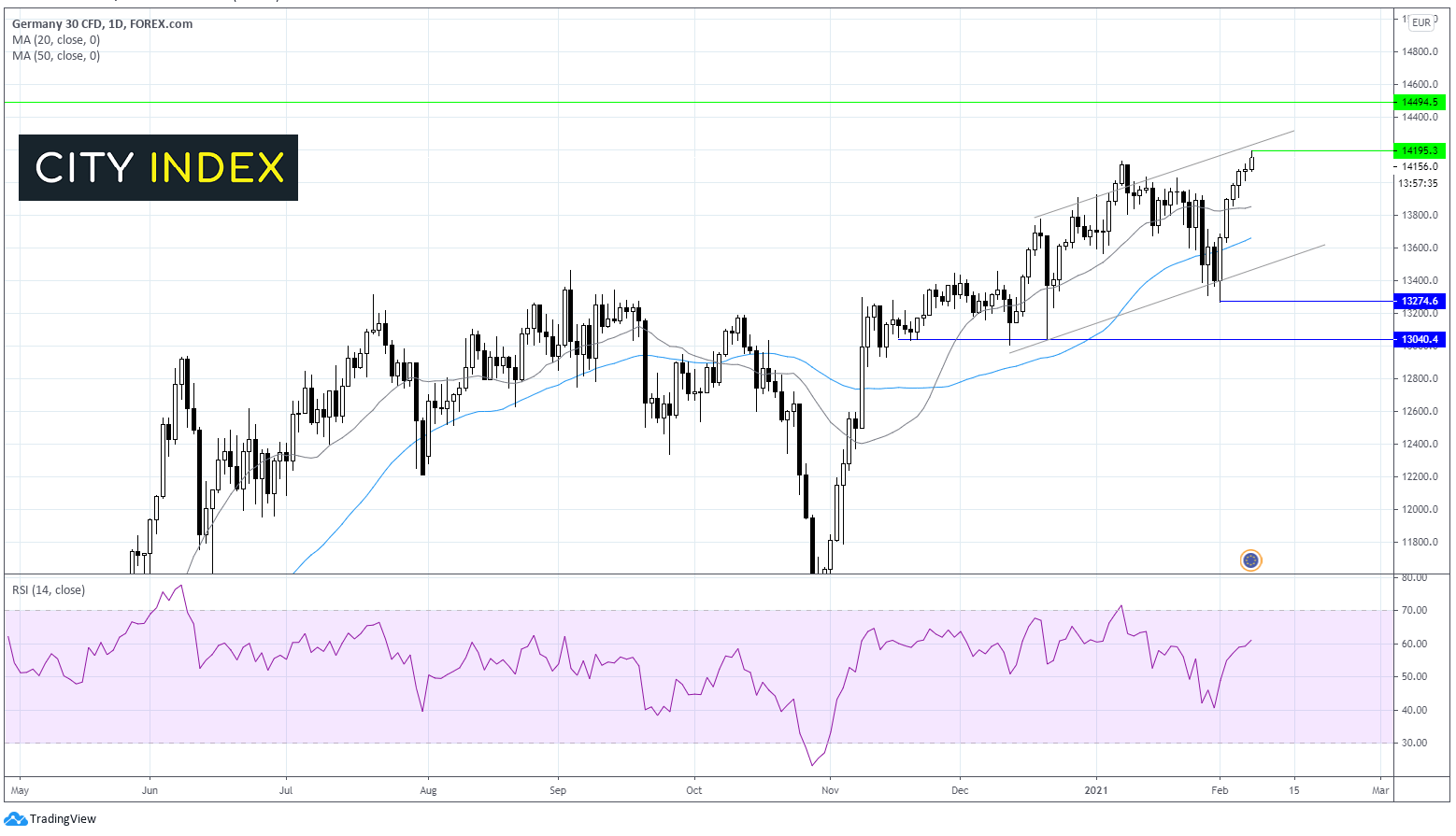

Dax technical analysis

After slipping lower in late January, the Dax found support from the lower band of the ascending trend line pattern on the daily chart. It rebounded steeply higher.

The Dax trades above its 20 & 50 sma on the daily chart confirming a bullish trend.

The RSI is above 50 but below the key overbought 70 level supportive of further gains.

Immediate support can be seen at 14195 the fresh all time high hit today. The price has since eased back slightly, a move over this level which also coincides with the upper band resistance of the ascending trendline is needed before the Dax targets 14500.

On the downside support can be seen at 13850 20 sma prior to 13650 the 50 sma. A move below 13500 lower band of the ascending channel would negate the current uptrend.

Learn more about trading indices

Brent strikes $60 per barrel, appears overbought

Oil hit a fresh yearly high on Monday boosted by supply cuts among key producers and hopes for additional US stimulus measures which would boost demand.

Short term demand weakness is being overlooked by the demand recovery expected later in the year.

Weaker USD is also supporting oil making it more affordable for holds of other currencies.

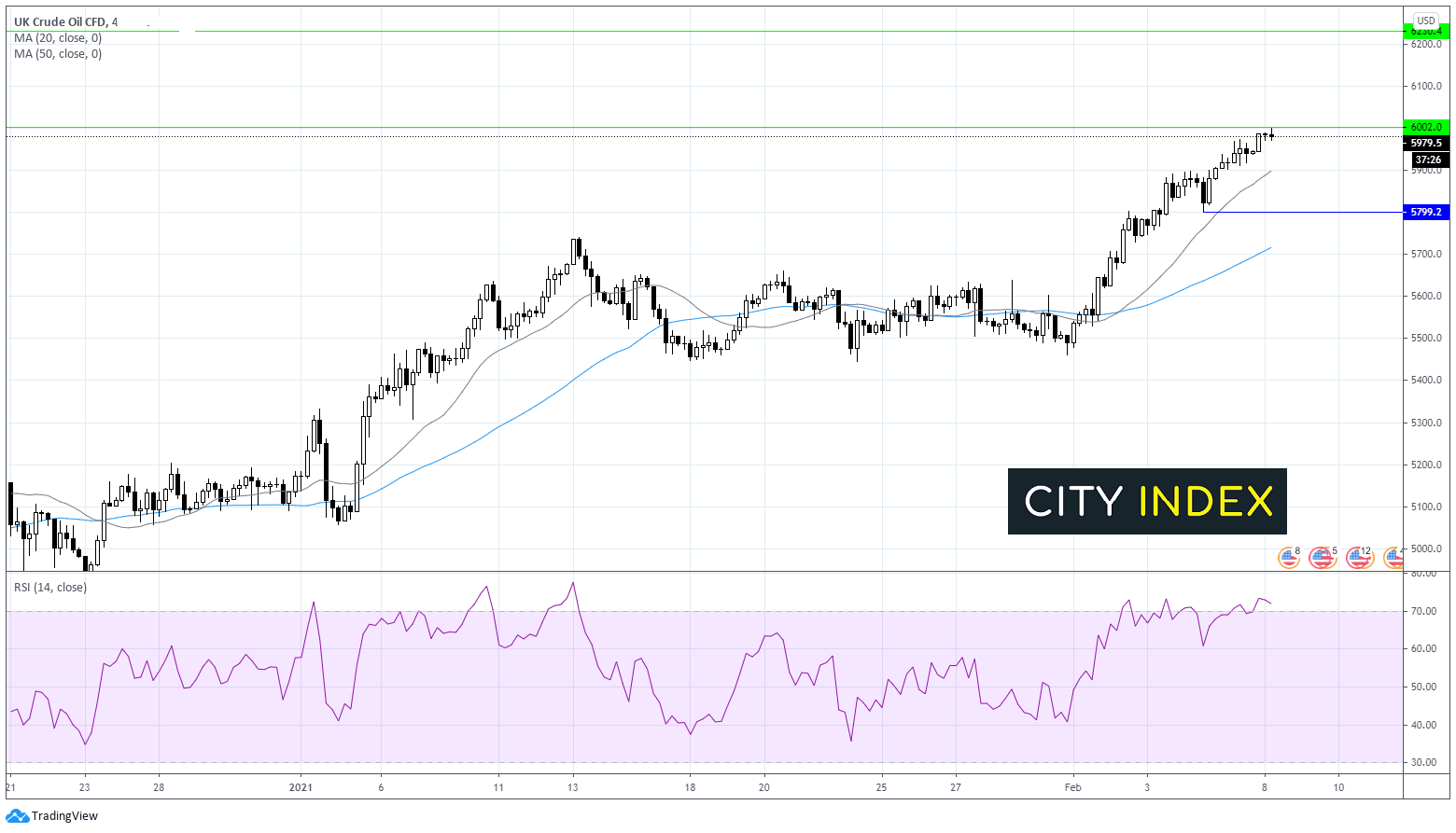

Brent technical analysis

Brent has climbed steeply since the start of February, reaching $60 overnight a level last seen pre-pandemic.

Brent trades +0.9% at the time of writing above its 20, 50 & 100 sma on the 4 hour chart, showing an established bull trend.

However, the RSI has moved into overbought territory. suggesting a pull back could be on the cards.

Immediate support can be seen at 59.00 the 20 sma prior to horizontal support at 58.00 (swing low 4th Feb) and 57.15 50 sma.