Top UK Stocks and Shares | Vodafone Share Price | Oxford Biomedica Share Price | Britvic Share Price | Cranswick Share Price

Top News: Vodafone targets profit growth as it pushes ahead with transformation

Vodafone shares plunged this morning as the company missed expectations, as the telecoms giant continues to push ahead with its transformation plan.

Annual revenue was down 2.6% at EUR43.80 billion in the year to the end of March, as the acquisition of Liberty Global offset reduced demand for some services, such as roaming, during the pandemic. Service revenue, which accounts for the bulk of income, managed to return to growth in the second half.

‘I am pleased that we achieved full year results in line with our guidance and we exited the year with accelerating service revenue growth across the business, with a particularly good performance in our largest market, Germany,’ said chief executive Nick Read.

Adjusted Ebitda was down 1.2% at EUR14.38 billion. That was just below the low-end of Vodafone’s guidance range and missed the EUR14.50 billion expected by analysts. Pretax profit jumped to EUR4.40 billion from just EUR795 million the year before, driven by lower impairment and financing costs.

Vodafone is targeting adjusted Ebitda of between EUR15.0 billion and EUR15.4 billion in the new financial year, with adjusted free cashflow of at least EUR5.2 billion.

Vodafone delivered EUR5.0 billion in free cashflow excluding the cost of buying spectrum, restructuring the business and integrating Liberty Global, down from EUR5.70 billion the year before as it upped investment in its network performance. Net debt stood at EUR40.5 billion at the end of March compared to EUR42.0 billion a year earlier as Vodafone paid down its debt following the spin-off of its towers business Vantage Towers earlier this year.

It has also offloaded a number of other assets, such as those in New Zealand and Malta, and is consolidating its operations elsewhere such as in Australia and India as part of a wider transformation programme initiated in 2018 that will see it focus more on fixed and mobile connectivity in Europe and mobile data and payments in Africa.

Vodafone said it will pay a 9.0 eurocent dividend for the year, flat from the year before, after declaring a 4.5 eurocent final payout. This will be the minimum annual payout over the medium-term, Vodafone said.

‘The world has changed. The pandemic has shown how critical connectivity and digital services are to society. Vodafone is strongly positioned and through increased investment, we are taking action now to ensure we play a leadership role and capture the opportunities that these changes create. The increased demand for our services supports our ambition to grow revenues and cash flow over the medium-term. We remain fully focused on driving shareholder returns through deleveraging, improving our return on capital, and a firm commitment to our dividend,’ said Read.

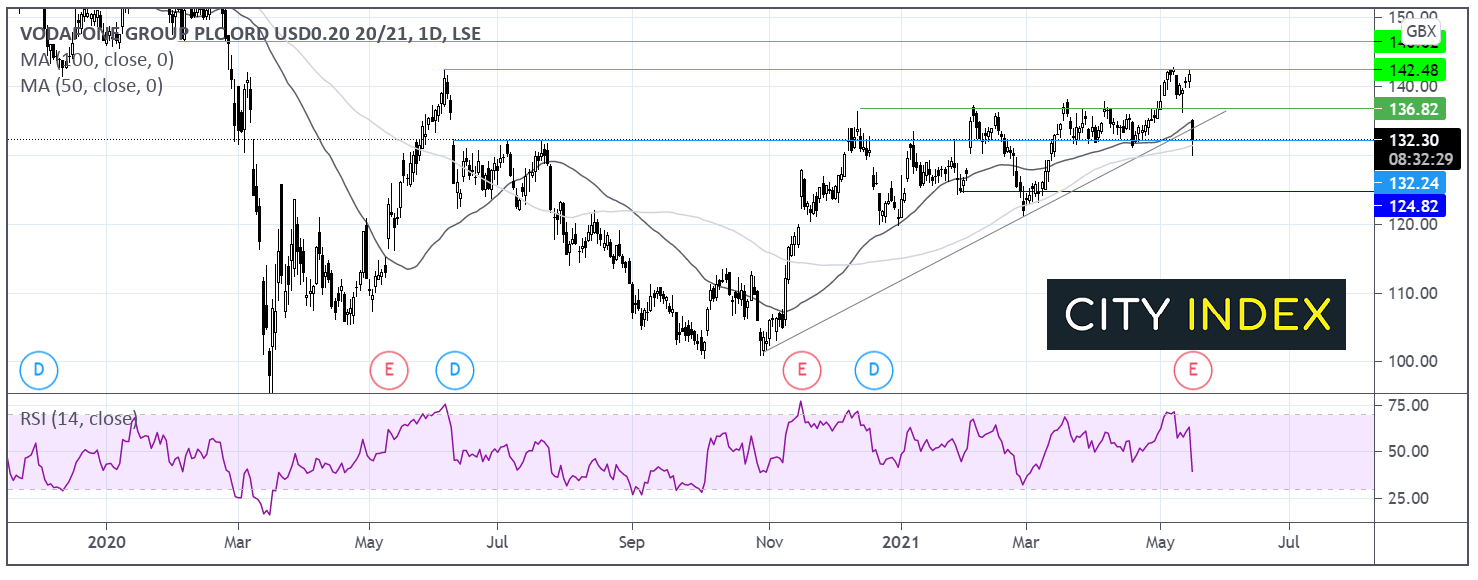

Where next for the Vodafone share price?

Vodafone had been trending higher, trading above its ascending trendline dating back to early November. The share price struggled at resistance at 142p its post pandemic high.

Today the Vodafone share price has tumbled over 6% lower in early trade, taking the price through its 50 sma on the daily chart and the ascending trendline support at 134p. The price is found support at the key psychological level 130 and has since retaken the 100 sma at 131.50p.

The RSI is supportive of further losses whilst it retains out of oversold territory.

A close below 132.75 could keep the sellers hopeful and target 124p in a deeper selloff.

It would take a move above 136/137p for the buyers to gain traction and look towards resistance at 142p the post pandemic high.

Imperial Brands sees improved performance in tobacco and vaping

Imperial Brands delivered growth in revenue and profits during the first half of its financial year thanks to higher prices for cigarettes and an improved performance from its next-gen vaping and heated tobacco products.

The tobacco giant said net revenue was up 6.1% in the six months to the end of March to £15.56 billion. Operating profit jumped 77% to £1.64 billion and basic earnings per share almost quadrupled to 191.2 pence from just 55.6 pence the year before.

‘In tobacco, we have put in place a clear market prioritisation to increase focus on our best opportunities for sustainable profit delivery. We have begun to stabilise the aggregate market share performance across our top five priority markets reflecting the changes we have made to tighten performance management and the good underlying momentum established over the past year,’ the company said.

‘Our Next Generation Products performance has improved, albeit against a weak comparator period. We have focused investment more tightly behind our NGP market strongholds and are on track to activate market trials in vapour and heated tobacco later this year. Our aim is to create a successful NGP business that meets consumer needs and, over time, can make a meaningful contribution to harm reduction,’ Imperial added.

Imperial Brands said it ended the period with £11.00 billion of net debt, having trimmed over £3 billion over the past 12 months.

An interim dividend of 42.12 pence will be paid, up 1% from the 41.70p paid out last year.

Imperial Brands shares were trading 2.1% higher in early trade this morning at 1623.5.

Britvic reinstates dividend as lockdown eases and confidence grows

Soft drinks giant Britvic reported lower revenue and profits during the first half of the financial year as demand from the on-trade and for beverages on-the-go slumped during lockdown, but came in better than expected and prompted it to reinstate its dividend.

Britvic shares were trading 3.8% higher in early trade this morning at 945.5, their highest level since December 2019.

The company said revenue was down 6.3% on a comparable basis at £617.1 million, and down 11.7% on a reported basis to reflect the lost sales from offloading its French juice business. Adjusted Ebit was down 15.4% at £60.1 million and down 20.6% on a reported basis.

Despite the steep declines, the results were better than the £602.1 million in revenue and £59.0 million in Ebit expected by analysts. Profit after tax was down 14.7% to £33.2 million.

Demand through at-home channels has remained strong, but Britvic has suffered as restaurants and other hospitality outlets have had to close during lockdown, while limited travel also means fewer people are buying the likes of Tango or Fruit Shoots whilst they are out and about.

However, Britvic said it has seen ‘encouraging trading’ in recent weeks as lockdown rules are eased in the UK and it hopes increased investment in the second half will allow it to fully capitalise on the recovery.

Britvic said it has reinstated its dividend with a payout of 6.5 pence for the period.

‘In challenging circumstances, we have delivered a robust first half performance, demonstrating the resilience and agility of our business. We have continued to win in the channels open to us and have gained share in our key growth markets of GB and Brazil. Our cash management has been particularly strong, and I am pleased to reinstate our interim dividend,’ said chief executive Simon Litherland.

‘In the second half we plan to rebuild investment behind our brands to ensure we emerge strongly and are best positioned for the recovery as it evolves. As lockdown restrictions have started to ease in some of our markets, early trading has been encouraging. Although some uncertainty does remain, I am confident that our strategy and focus on people, planet and performance will ensure we deliver growth for all our stakeholders, both in the short and long term,’ he added.

Oxford Biomedica ups production target for AstraZeneca vaccine

Oxford Biomedica said it will produce more batches of AstraZeneca’s coronavirus vaccine than originally thought this year, leading it to raise its revenue and profit guidance for the rest of the year.

AstraZeneca has asked Oxford Biomedica to produce more batches than first planned in the second half of 2021. Precise details and figures were not disclosed, but Oxford Biomedica said it now expects to secure £100 million in revenue from AstraZeneca this year – double the £50 million previously expected.

Meanwhile, there will also be ‘significant growth’ in operating Ebitda during the year too.

‘Everyone involved with production of the COVID-19 vaccine can be truly proud of their achievement in manufacturing batches of vaccine from our Oxbox manufacturing facility. We are delighted to be a key supplier of the vaccine and the group is proud to be part of this world-leading vaccination project that is saving many lives,’ said chief executive John Dawson.

Oxford Biomedica was signed up to produce AstraZeneca’s vaccine last September under a three-year deal.

Oxford Biomedica shares were trading 6.8% higher in early trade this morning at 1071.0.

Cranswick hikes dividend after revenue and profits jump

Cranswick, which makes meats spanning from gourmet sausages to pastries, delivered double-digit growth in revenue, earnings and cashflow during its recently-ended financial year, prompting it to raise its dividend.

Revenue soared 13.9% higher in the 12 months to March 27 to £1.89 billion, rising 12.1% on a like-for-like basis. A better margin of 7% versus 6.3% led to adjusted operating profit leaping over 26% to £132.5 million.

Adjusted pretax profit was also up over 26% to £129.7 million, while reported profit was up 10.9% at £113.8 million.

Cranswick said there was exceptional demand across all its product ranges during the year, with store sales and its newer online channel both performing well.

Net cash from operations was 55% higher year-on-year at £181.4 million. Net debt was slashed by 37% during the year and ended March at £92.4 million.

The full-year dividend was hiked 16% to 70.0 pence from the 60.4p payout the year before, representing 31 consecutive years of dividend growth.

Cranswick shares were trading 5% higher in early trade this morning at 3905.0, hitting their highest level since August 2020.

‘The start to the current year has been particularly positive and the outlook for the group is very encouraging,’ said chairman Martin Davey.

‘The business has a strong balance sheet and comfortable financial headroom to support plans for growth that include further broadening of the range of products, increasing capacity and maintaining the asset base as the most modern and efficient in the sector. The board is confident in its strategy and looks forward to the continuation of the successful long-term development of the business,’ he added.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade