Top UK Stocks and Shares | Sage Share Price | Gulf Marine Share Price | Sanne Share Price | Crest Nicholson Share Price | LondonMetric Share Price

Top News: Sage Group profits plunge over 30%

Sage Group said it has raised its dividend and its guidance for the rest of the financial year following a ‘strong performance’ in the first half.

The company has been focused on growing Sage Business Cloud and its subscription business, but is also having to invest more money to capitalise on opportunities, which is causing lower profitability. Plus, it has disposed of units such as Sage Pay and other parts of the business, like processing, are producing lower revenue as expected.

Total revenue was down 4% in the six months to the end of March to £937 million. However, organic revenue inched up 1% and recurring revenue was 4% higher, driven by more subscriptions for Sage Business Cloud.

Its operating profit margin tightened to 21.7% from 29.7% the year before, causing operating profit to plunge 30% to £203 million from £289 million. On an underlying basis excluding one-off items, profit fell 11%.

Pretax profits plunged 31% in the period to £190 million. Its basic earnings per share was down 35% to 13.29 pence.

‘Sage performed strongly in the first half against tough comparators, with continued recurring revenue growth and increasing levels of new customer acquisition, principally in cloud native solutions,’ said chief executive Steve Hare.

‘Our deep sense of purpose and experience of supporting small and medium-sized businesses through change has equipped us well to play a vital role throughout the pandemic, and I am proud of the way our colleagues around the world have shown dedication to our customers and partners. We believe that small and medium-sized businesses will lead the recovery, and I am confident that our strategic investment in Sage Business Cloud will continue to accelerate growth, as customers become stronger and more digitally-enabled,’ he added.

Sage said it now expects annual organic recurring revenue growth over the full year to be toward the top end of its 3% to 5% growth target range, and reiterated its goal to deliver an organic operating margin around three percentage points lower year-on-year. It expects its increased investment to start delivering improved recurring revenue and operating efficiencies from the next financial year.

Sage said it has raised its interim dividend by 2% to 6.05 pence from 5.93p the year before. Sage launched a £300 million share buyback back in March that should be completed by early September, funded by recent disposals and improved cashflow. It has repurchased £118 million worth of stock so far.

Where next for the Sage share price?

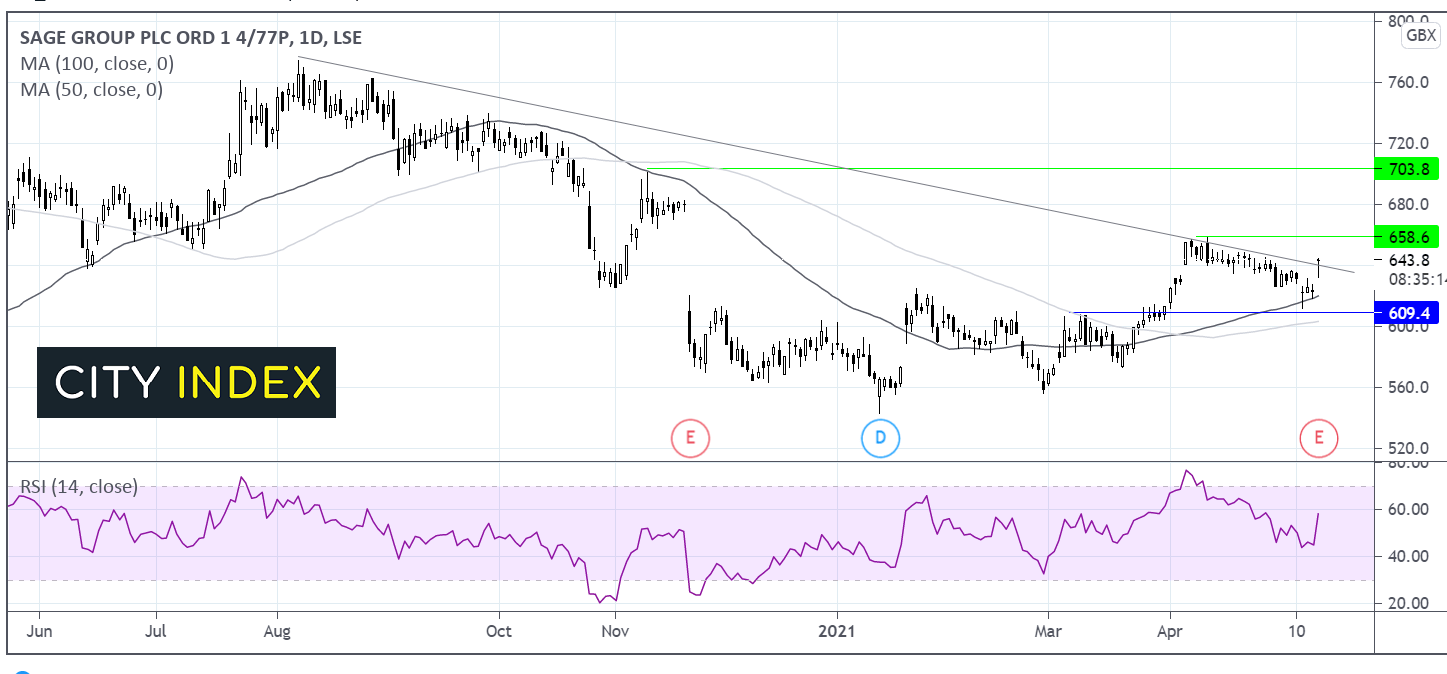

The Sage share price trades above its 50 & 100 sma on the daily chart. Today’s jump has also taken the share price to test the descending trend line resistance which dates back to early August.

The RSI is pointing higher and in bullish territory supportive of further gains whilst it remains out of overbought territory.

A close above the descending trendline could keep buyers hopeful of further gains towards 658p the yearly high. A break above here could see buyers gain momentum and head towards 700p the early November high.

On the downside, failure to hold above 640p the descending trend line support could see sellers test the 50 sma at 620p, 610p horizontal support and 600p the 100 sma.

Gulf Marine Services warns it must raise $25 million within weeks

Gulf Marine Services said it sank into the red during 2020 after having to a book impairments, and warned there is ‘material uncertainty’ and ‘significant doubt’ over its ability to keep the business afloat.

The company, which provides vessels used to build and operate offshore energy projects, said it is required to raise at least $25 million in equity before the end of June 2021 under the terms of its renegotiated bank facilities that its new management secured back in March. However, it will need to gain shareholder approval in order to do so.

‘This indicates a material uncertainty that may cast significant doubt as to the group's ability to continue as a going concern. Notwithstanding this material uncertainty, the directors believe that based on progress to date, shareholder approval will be obtained and $25 million of equity will be raised by 30 June 2021,’ the company said.

Gulf Marine Services is under new management, with its chairman, chief financial officer and virtually all of its non-executive and independent directors having changed over the past year.

The warning came as Gulf Marine Services reported a 6% fall in revenue to $102.5 million in 2020, while adjusted Ebitda dipped 2% to $50.4 million, both in line with guidance issued earlier this year.

The company said it booked impairments worth $87.2 million against two of its E-class vessels and five of its K-Class vessels. That dragged it to a $124.3 million loss for the year after it also had to book over $20 million worth of other one-off costs.

Gulf Marine Services said earnings were in line with expectations since the start of 2021, although said its backlog fell to $199 million from $240 million at the end of March 2020 as companies delay awarding final contracts during the pandemic.

Gulf Marine Services shares were trading 2.7% lower in early trade this morning at 7.2.

Sanne Group turned down takeover offer last week

Sanne Group turned down a takeover offer from Cinven Ltd earlier this month and another, possibly improved offer could be made in the coming days or weeks.

Cinven is a private equity group that invests in companies that ‘want to step-change their growth’. The firm released a statement this morning confirming it made an 830.0 pence offer for each Sanne share on May 4, and said that Sanne shareholders could still be paid the 9.9 pence dividend declared by Sanne in March.

‘The proposal was rejected by the Sanne board of directors on 12 May 2021,’ said Cinven. ‘Cinven is considering its position. There can be no certainty any offer will be made.’

The news sent Sanne shares over 25% higher in early trade at 762.0p, representing a three-year high.

Notably, Sanne Group, which offers asset management and corporate administration services, raised £80 million back in April at just 640.0 pence per share.

Crest Nicholson sells stake in Longcross Studio

Housebuilder Crest Nicholson has sold its interest in Longcross Studio to its joint venture partner Aviva.

The company said it has sold its 50% stake in the film studio, which is situated on the northern side of Longcross Garden Village, as well as an associated parcel of land on the southern side of the site. It is being sold to Longcross General Partner, which is part of Aviva.

Aviva is already involved in the project and the deal should be completed by late summer.

Crest Nicholson said the deal will deliver a one-of £10 million boost to adjusted pretax profit in 2021 and add £45 million in cash.

The company continues to own 50% of the rest of the 195-acre Longcross Garden Village with the rest being owned by Aviva. Crest Nicholson said this site is expected to host up to 1,700 homes and the housebuilder still intends to build its share going forward.

The housebuilder said it has around £142.2 million in net cash and said the additional inflow of cash from the deal can accelerate its strategy. It plans to release interim results covering the six months to the end of April on Thursday June 24.

Crest Nicholson shares were trading 1.5% higher in early trade at 428.8.

LondonMetric buys three logistic warehouses

LondonMetric Property has bought three urban warehouses in Croydon, Dunstable and Warrington for £18.7 million.

The company has acquired them in three separate deals, but combined they represent a net initial yield of 4.3% and a reversionary yield of 5.3%. The weighted average unexpired lease term across the three logistic sites is five years.

‘Through high quality acquisitions, we continue to grow our urban logistics portfolio which now totals £1.0 billion. These purchases are very well located with high residual values, offering attractive yields and strong rental growth prospects through open market reviews and/or re-let opportunities,’ said chief executive Andrew Jones.

The Croydon site is 28,000 square feet in size and is let to HTC Group for the next four years at £9 per square foot. The 19,000 square foot Dunstable site is let at £7 per square foot to Deralam Laminates. The Warrington site is the largest at 73,000 square foot but demands the lowest rent at £6.60 per square foot, which is predominantly let to IKEA.

LondonMetric shares were trading 1% higher in early trade at 225.8.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade