Top UK Stocks and Shares | Morrisons Share Price | Capita Share Price | Kerry Group Share Price | Silver Bullet IPO

Top News: Morrisons rejects 230p takeover offer

Morrisons has confirmed that it has rejected a £5.5 billion takeover offer for the company because it ‘significantly undervalues’ the business.

The rejection came after Sky News reported over the weekend that private equity firm Clayton, Dublier & Rice (CD&R) had approached the UK’s fourth largest supermarket chain about a possible takeover.

The offer made was for 230.0 pence per share, with Morrisons shareholders also offered the final 5.11p dividend that was declared by Morrisons in March.

‘The board of Morrisons evaluated the conditional proposal together with its financial adviser, Rothschild & Co, and unanimously concluded that the conditional proposal significantly undervalued Morrisons and its future prospects. Accordingly, the board rejected the conditional proposal on 17 June 2021,’ Morrisons said.

CD&R released a statement confirming the offer and will now have until July 17 to make a firm offer or walk away, but there is no certainty that another bid will be tabled.

Sky News reported that, if a deal can be reached, that it could see former Tesco boss Terry Leahy make a return to the UK supermarket sector as he is expected to play a key role in any deal as one of CD&R’s operating partners in Europe. Notably, Morrisons CEO David Potts and chairman Andrew Higginson had both worked at Tesco before joining the business.

The unsolicited offer, which sat at around a 28% premium to the 178.5p closing share price on Friday, could lead to more potentially interested suitors entering a bidding war. For example, Amazon is a long-standing partner of Morrisons and it has been rumoured in the past that the supermarket could be the main door for Amazon to make a big push into the UK grocery market.

There could also be other interest from private equity. For example, Asda has just been bought in a £6.8 billion deal by the Issa brothers, renowned for running petrol forecourts, and private eqity partner TDR Capital. Notably, that came after regulators blocked Asda’s attempt to merge with Sainsbury’s back in 2019.

Morrisons prides itself on being different from its rivals because of its large freehold estate and the fact it makes a lot of its own food from its string of manufacturing sites around the country.

Where next for the Morrisons share price?

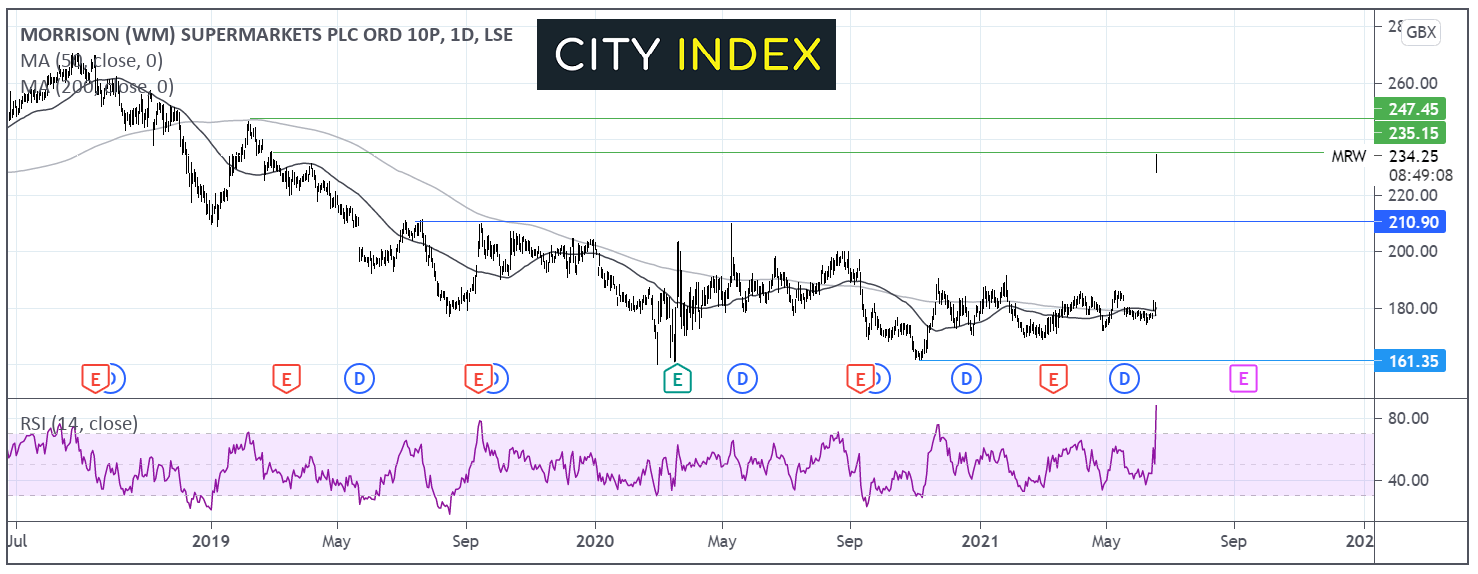

Morrisons share price has surged over 30% on the open pushing above 230p a level last seen in April 2019.

The RSI has shot deeply into overbought territory. Buyers should be cautious over taking additional bullish bets at these levels. A period of consolidation or a move lower could be on the cards, although the timing of such a move is unclear.

Immediate resistance can be seen at 235p high late February 2019, followed by 250p the early February 2019 high.

On the flip side support can be seen at 210p.

Capita to return to growth for first time in six years

Capita said it expects revenue to grow for the first time in six years in 2021 despite the problems posed by the pandemic.

Capita shares were trading 4% higher in early trade this morning at 39.18p.

The company said it has won a number of notable contracts since the start of the year, including a £925 million deal to assist with Royal Navy training and the extension to an existing deal with a European telecoms giant worth another £528 million. It has also won an extension to its contract with Tesco Mobile worth £58 million.

‘As a result, we currently expect half year adjusted revenue to be flat on prior year adjusted revenue,’ said Capita. ‘Capita remains on track to deliver revenue growth in 2021, for the first time in six years, despite the ongoing impact of COVID lockdowns, in particular in its Specialist Services division.’

Capita said cash collection levels have improved in line with its trading performance, while operating leverage should improve when it releases its interim results thanks to the progress being made with cost-cutting programme. Capita said it is still aiming to deliver £50 million of annualised cost savings from 2022 onwards.

Capita also revealed it has made another disposal under the plans outlined in March to transform the business. It has sold its 51% stake in AXELOS, a joint venture with the Cabinet Office, to PeopleCert International for net proceeds of around £183.6 million, which will be used to shore up the balance sheet and pay down debt.

Capita is aiming to book £200 million in proceeds from asset disposals in 2021 on top of the £299 million initial payment secured after selling ESS in February. The transformation will see it focus on two core divisions – Capita Public Service and Capita Experience, with everything else to be put into a non-core unit named Capita Portfolio.

‘I’m pleased with the progress that we have made so far this year. We remain on track to meet our priorities for 2021: to deliver revenue growth for the first time in six years, improve operating cash flow, strengthen the balance sheet, and implement our new organisational structure. Looking forward, we are confident of delivering positive sustainable free cash flow in 2022,’ said chief executive John Lewis.

Frasers Group launches another share buyback ahead of results

Frasers Group, the high street staple that owns a slew of brands from Sports Direct to Game, said it is launching a share buyback programme today that will see it purchase up to £60 million worth of shares from investors over the coming weeks.

The company said it will buy a maximum of 10 million shares under the buyback. Liberum Capital has been instructed to purchase them during its closed period, which is between today and when it releases its full-year results, which are expected sometime in August.

The aim of the buyback is to reduce the number of shares Frasers Group has in issue.

The programme matches the size and value of another buyback programme that was launched in May 2021.

Frasers shares were trading 0.1% higher this morning at 574.8p.

Kerry Group to buy preservation specialist Niacet for EUR853 million

Kerry Group has agreed to buy Niacet Corp, a global specialist helping preserve food and drugs, for a total of EUR853 million from funds advised by SK Capital Partners.

Niacet, formally known as Hare Topco, is a leader in providing technology that helps preserve bakery and pharmaceutical products and also has a low-cost preservation system for meat and plant-based food products. It is operating in over 75 countries and has key manufacturing plants in the US and the Netherlands.

Niacet is expected to report annual revenue of around $220 million and Ebitda of around $66 million in 2021. For context, the price is equivalent to about $1.01 billion.

The new business will be integrated into Kerry’s existing preservation and food protection platform.

Kerry Group said it is expecting Niacet to benefit from being part of a larger group and is expecting it to outperform the wider market by delivering ‘at least mid-to-high single digit volume growth’ going forward. Kerry’s margins and growth rate should both improve as a result and adjusted earnings will benefit in the first year.

‘The acquisition of Niacet's complementary product portfolio enhances our leadership position in the fast growing food protection and preservation market and significantly advances our sustainable nutrition ambition. Niacet is a business with market leading positions, differentiated technologies and a strong and highly experienced management team. We are pleased to welcome the Niacet team to Kerry and we are excited at the potential the combination of our two businesses offers to outperform in this important and attractive market,’ said chief executive Edmond Scanlon.

Last week, Kerry Group agreed to sell its Consumer Foods’ Meats and Meals business in the UK and Ireland for a total of EUR819 million to Pilgrim’s Pride Corp as part of its restructuring that is seeing it focus more on its Taste & Nutrition business.

Kerry Group shares were down 2.1% in early trade this morning at EUR108.35.

Silver Bullet Data Services plots AIM IPO

Silver Bullet Data Services has announced it plans to go public on AIM by launching an initial public offering next week.

The company said it hopes its stock can be admitted to trading next Monday, on June 28. It is hoping to raise £9.5 million and start of life as a publicly-traded business with an initial valuation of around £34.5 million.

Silver Bullet helps brand owners and advertisers optimise their digital marketing investment. It specialises in making the most out of first-party data and contextual intelligence. It currently works with major brands such as Heineken, Dolce & Gabbana and Channel 4. It also has a joint venture with global media agency Local Planet.

The IPO will help accelerate Silver Bullet’s growth by funding the roll-out of its 4D products and by allowing it to offer more services to its existing clients.

‘The group's flagship digital marketing product, 4D, is a contextual intelligence cloud-based platform that seeks to improve brand engagement and marketing return on investment, which the board believes will enable the group to deliver scalable revenues with low marginal costs,’ said Silver Bullet.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index. Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade