Top UK Stocks to Watch: IAG reports record loss in 2020

Top News: IAG reveals extent of coronavirus damage

International Consolidated Airlines Group said it has continued to run at a fraction of its usual capacity as less people travel during the pandemic, but said there is ‘pent-up demand for travel and people want to fly’ as it hopes a recovery can start this year.

The company, which owns airlines including British Airways and Iberia, said it only operated at a third of its usual capacity during 2020. This caused revenue to plunge to just EUR7.8 billion from EUR25.5 billion in 2019.

The airline reported an operating loss of EUR7.42 billion compared to a EUR2.61 billion profit in 2019, whilst it swung to a post-tax loss of EUR6.92 billion from a EUR1.71 billion profit. They were brought down by hedging losses on fuel and write-downs on the value of its fleet.

‘Our results reflect the serious impact that COVID-19 has had on our business. We have taken effective action to preserve cash, boost liquidity and reduce our cost base. Despite this crisis, our liquidity remains strong. At 31 December, the group's liquidity was EUR10.3 billion including a successful EUR2.7 billion capital increase and £2 billion loan commitment from UKEF. This is higher than at the start of the pandemic,’ said chief executive Luis Gallego.

IAG ended the year with EUR5.91 billion in cash and had EUR2.1 billion in loan facilities to bring total liquidity to EUR8.1 billion. It also has access to EUR2.2 billion through the UK Export Finance facility.

The company said it was not providing guidance due to the uncertainty that plagues its outlook for this year.

‘The aviation industry stands with governments in putting public health at the top of the agenda. Getting people travelling again will require a clear roadmap for unwinding current restrictions when the time is right,’ said Hester.

‘Vaccinations are progressing well and global infections are going in the right direction. We're calling for international common testing standards and the introduction of digital health passes to reopen our skies safely,’ he added.

Where next for the IAG share price?

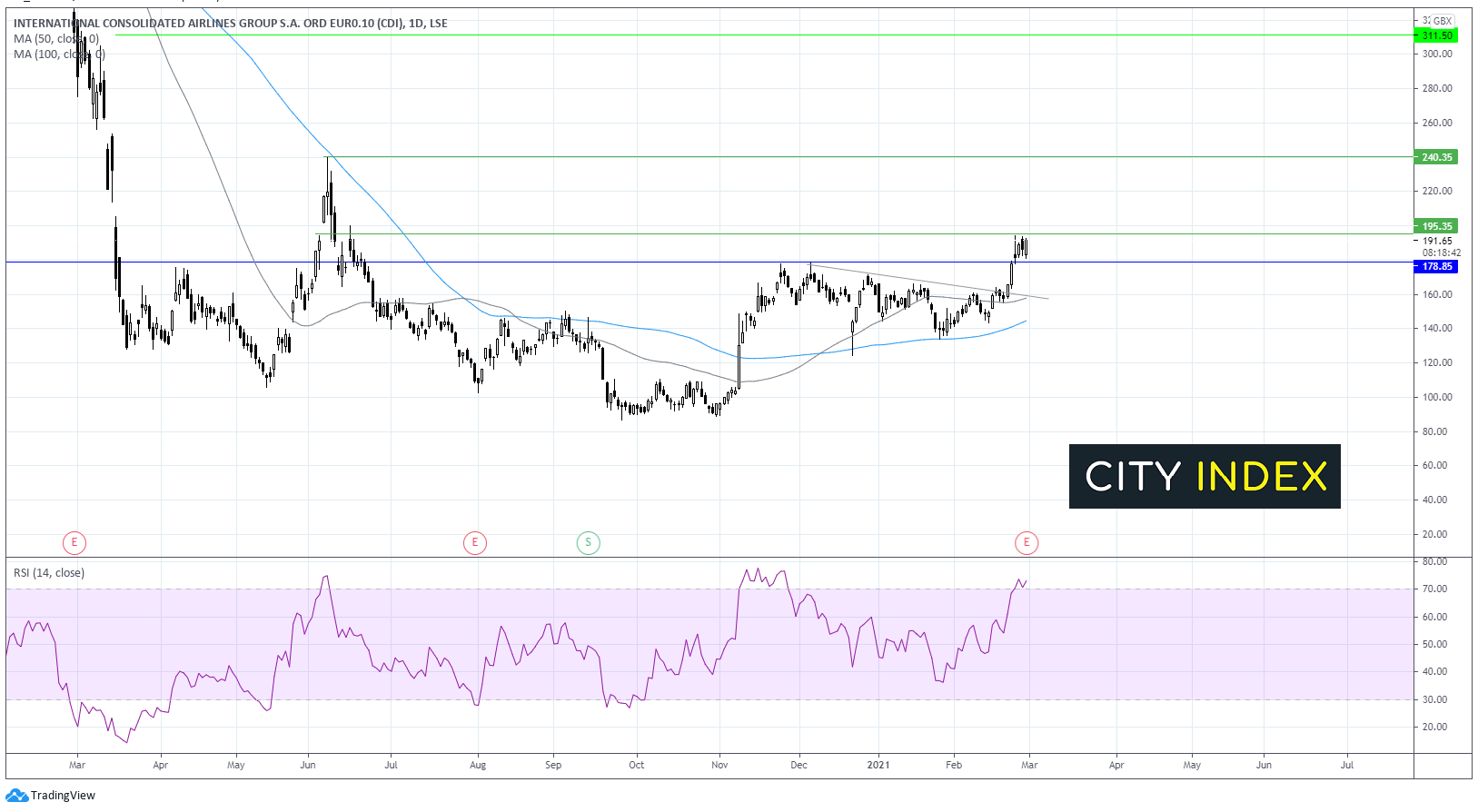

The IAG share price broke above its three month descending trend line mid-February. It pushed above resistance of 178 to trade at a fresh 8 month high of 194 where the bulls are looking tired. The RSI is over 70 so overbought suggesting further consolidation could be on the cards.

Immediate resistance can be seen at 194, prior to 200 round number. A breakthrough here could see the bulls target 240 the June high.

On the downside, strong support sits around 158 the 50 sma asnd the descending trendline. A break below this level would negate the current uptrend and could see the bears attack 145 the 20 sma.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Rightmove sees revenue and profits plunge in 2020

Rightmove said revenue and profits both plunged in 2020 as estate agents and other customers curtailed spending during the pandemic, but said it sold more homes than any of its rivals and saw a surge in traffic to its website.

Revenue plunged 29% in 2020 to £205.7 million from £289.3 million in 2019. Rightmove said revenue was down primarily because of the discounts it offered to its customers between April and September.

That, combined with its operating margin contracting to 66% from 74%, resulted in operating profit plummeting 37% to £135.1 million from £213.7 million. Basic earnings per share fell to 12.6 pence from 19.6p.

Rightmove said it will pay a 4.5p final dividend. That is up from the 2.8p paid in 2019, when it only made an interim payout and cancelled the final dividend as the pandemic erupted. Rightmove said it purchased £30.1 million worth of shares through its buyback programme during the year and that this will resume in March.

Despite the tough conditions, Rightmove said over 1 million properties were sold on its site during the year, up from 900,000 in 2019 and ‘more than anywhere else in the UK’. It said website traffic continued to grow and surged 31% in the year, with people staying on it for longer.

Membership numbers dipped 3% in the year as it lost estate agent branches and new home development sites.

Average revenue per advertiser was down 28% to £788 per month from £1,088 in 2019. Notably, this had recovered well by the end of the year and was up year-on-year in December.

‘The UK housing market has, for the most part, shaken off pandemic-related challenges to forge an optimistic start to 2021. In the absence of further economic shocks, we think it is likely that the current shortage of new listings will correct once the immediate lockdown is lifted and will have no lasting impact on estate agency branch numbers. We expect to see a modest short-term decrease in development numbers, given the ongoing high sales rate being seen across developments. Overall, we anticipate membership numbers for the year to be broadly in line with 2020,’ said Rightmove.

‘In 2021, we believe Agents will continue to leverage our extensive suite of property advertising solutions to compete effectively and efficiently for new listings. Currently, we expect ARPA to increase from the December 2020 level at a rate of growth towards that seen in 2019. We will continue to closely manage our operating costs, although some of the short-term reductions seen in 2020 will reverse, and we will return to more usual levels of investment in our offering,’ Rigtmove added.

Rightmove shares were down 1.9% in early trade at 594.7.

RSA Insurance reports record underlying profits

RSA Insurance delivered record underlying profits in 2020 but said reported profits were dragged down by costs related to the coronavirus pandemic, M&A activity and restructuring costs.

RSA Insurance said underlying pretax profit jumped 15% to £718 million in 2020 but said reported pretax profit was down 2% to £483 million.

‘We are pleased to report excellent results for RSA in 2020. Underwriting profits are sharply up to new record levels and return on tangible equity has risen above our target range,’ said chief executive Stephen Hester.

‘Naturally, the impact of COVID-19 was the major feature of our year, as for society as a whole. We prioritised the safety of our employees and sustaining service to customers. The group paid out some £4.6 billion in 'normal' claims whilst also providing for over £250 million in COVID-19 specific claims, together with offering a range of other customer support measures,’ he added.

RSA Insurance said it was not paying a final dividend because of the proposed acquisition for the business by a consortium of two companies, Intact Financial Corp and Tryg. Shareholders were paid an 8.0p interim dividend.

‘We have built a high performing company and 2020's results showcase the value creation thereby achieved. This in turn drove the 52% premium we were able to negotiate in Q4 through an all cash bid from Intact and Tryg. The offer is on track to complete in the coming months, ending a chapter for RSA but not the whole story..." said Hester.

RSA Insurance shares were trading broadly flat in early trade at 675.1.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Pets at Home ups guidance yet again

Pets at Home said it has raised its expectations for the full year yet again after performing better than expected during the initial months of 2021.

The pet store chain said it now excepts to deliver an underlying pretax profit of around £85 million, up from its previous target of £77 million. Notably, the new guidance includes the repayment of business rates relief worth £28.9 million. It is not the first time it has raised its guidance for the year.

For context, Pets at Home generated an underlying pretax profit of £99.5 million in the last financial year and a reported pretax profit of £91.9 million.

‘In our trading update on 8 January 2021, our guidance for full-year profit out-turn reflected a number of ongoing uncertainties over the near-term outlook, including renewed challenges from higher Covid infection rates and restrictions on a national level, as well as potential supply disruption relating to the UK's exit from the European Union,’ said Pets at Home.

‘Notwithstanding this challenging external environment, our performance over the last eight weeks has been ahead of expectations, with continued strong and broad-based growth across all channels and categories,’ it added.

Pets at Home will released annual results on May 27.

Pets at Home shares were up 5% in early trade at 401.8.

Jupiter Fund Management reaps rewards of Merian Global Investors acquisition

Jupiter Fund Management said it ended 2020 with a record amount of assets under management as it reported strong growth in underlying profits and rewarded shareholders with a special payout.

The fund said it had £58.7 billion worth of assets under management at the end of the year, up from £42.8 billion a year earlier. This was boosted by £16.6 billion by the acquisition of Merian Global Investors in July 2020.

‘This transformational deal has expanded our product and geographic offering while reinforcing our position as a market leader in UK retail. Financially it has exceeded our expectations, delivering greater than expected synergies and already making a significant contribution to group profits. While more time is needed to stabilise flows from certain products, these near-term challenges were well-anticipated and factored into the terms of the deal, giving substantial protection to our shareholders,’ said chief executive Andrew Formica.

Underlying pretax profits jumped 10% to £179 million. Its dividend, which is equal to 40% of underlying earnings, was held flat at 17.1 pence. However, it said it would pay an additional special payout of 3.0p, taking the total dividend to 20.1p.

Notably, reported profit was down 12% to £132.6 million after £46.4 million worth of costs related to the acquisition were taken into account.

‘Market volatility weighed heavily on investor sentiment resulting in net outflows for the year, gross inflows were robust at £16.5 billion, and, pleasingly, Jupiter branded strategies recorded three consecutive quarters of positive net flows. We have selectively added to our product range and expanded our environmental, social and governance investment capabilities, where we have a strong heritage. We have also made progress with our international reach through developing our partnership with NZS Capital in the US and building upon Merian's relationship with Ping An in China, deepening our access to the largest and fastest growing investment markets in the world,’ said Formica.

‘Against a backdrop of strengthening investor sentiment and improved momentum as we turn the corner in the battle against Covid-19, I am confident that Jupiter is strongly positioned for future growth,’ the CEO added.

Jupiter Fund Management shares were up 2.2% in early trade at 299.0.

Law Debenture outperforms benchmark and raises dividend

Law Debenture Group said it outperformed its benchmark during 2020 and was ‘pleased again to propose to increase our full year dividend at a time of widespread dividend cuts across the market’.

The company boasted that its ‘unique structure’ – being an investment trust with a professional services business – allowed it to perform well during a tough year for markets.

ISP, its professional services business, saw revenue rise 8.5% and earnings per share increase 9.5% in 2020. Law Debenture said ISP ‘helps support dividend growth’ and that this was ‘a key differentiator to other investment trusts’.

Its investment trust reported a 3.6% rise in net asset value and a share price total return of 12.9% in 2020. That significantly outperformed its benchmark, the FTSE Actuaries All-Share Index, which recorded a 9.8% decline in the period.

The solid performance prompted Law Debenture Group to raise its dividend by 5.8% to 27.5 pence from 26.0 pence in 2019. Having transitioned to quarterly dividends during the year, shareholders will be paid an 8.0p dividend for the final quarter.

‘Our investment portfolio's long-term performance remains well ahead of its benchmark and our IPS business has now delivered three years of strong, high single-digit growth, despite some significant macroeconomic headwinds. Long-term income sustainability is a key priority and the group's aim is to continue to deliver gradually increasing dividend payments in excess of inflation over time,’ said chairman Robert Hingley.

Law Debenture shares were down 2.3% in early trade at 704.5.

IMI dividend is cut despite higher profits and cashflow

IMI said profits increased during 2020 as better margins offset a dip in revenue during the year and said its rationalisation programme was making it more efficient.

The engineering business said revenue fell 3% in 2020 to £1.82 billion from £1.87 billion the year before. However, with all three of its businesses reporting better margins, adjusted operating profit rose 7% to £285 million from £266 million, and leapt 11% on a reported basis to £227 million from £204 million.

Its adjusted pretax profit was up 9% to £274 million while its reported pretax profit jumped 13% to £214 million.

Operating cashflow remained strong and increased to £335 million from £299 million. That allowed it to reduce net debt to £316 million from £438 million a year earlier. However, IMI’s dividend for the year was cut to 22.5 pence from 41.1p after IMI reset its policy earlier in the year.

IMI said it is aiming to deliver adjusted earnings per share of 75p to 82p in 2021. That would compare to the 79.7p delivered in 2020, which in turn was up 9% from 73.2p in 2019.

IMI shares were up 0.2% in early trade at 1327.5.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade