Top UK Stocks to Watch: Arcadia picked apart as Boohoo buys brands

Top News: Boohoo buys Dorothy Perkins, Wallis and Burton brands for £25.2 million

Boohoo has purchased the Dorothy Perkins, Burton and Wallis fashion brands from the administrators of Arcadia Group for £25.2 million in cash.

The deal includes the ecommerce and digital assets of all three brands as well as the inventory and customer data, but none of the 214 stores.

The deal by Boohoo represents the picking apart of troubled Arcadia Group, with rival ASOS having agreed to buy the Topshop, Topman, Miss Selfridge and HIIT brands last week for £265 million.

The three brands combined had over 2 million active customers last year and Boohoo intends to ramp-up sales through its own website whilst retaining their individual brand websites. The three brands delivered annual sales of £427.8 million in the year to August 29, 2020, and a loss before interest, tax, depreciation and amortisation of £14.3 million.

Dorothy Perkins and Wallis will be added to Boohoo’s long list of womenswear brands, having bought the likes of Oasis and Warehouse last year, while Burton will bolster its menswear brands and sit alongside BoohooMan and its other recent acquired brands, Maine and Mantaray.

‘Acquiring these well-known brands in British fashion out of administration ensures their heritage is sustained, while our investment aims to transform them into brands that are fit for the current market environment. We have a successful track record of integrating British heritage fashion brands onto our proven multi-brand platform, and we are looking forward to bringing these brands on board,’ said chief executive John Lyttle.

The deal is expected to be done and dusted tomorrow.

The brands will continue to operate as standalone entities until they are fully integrated into Boohoo’s platform, which will incur a one-off cost of around £10 million to £15 million. They are expected to contribute ‘modest revenues’ over the final few weeks of Boohoo’s current financial year and further details will be released when it announces its annual results in early May.

Boohoo is paying for the deal using its £386.9 million cash balance. Notably, that has not taken into account Boohoo’s recent £55 million purchase that will see it revive Debenhams online.

You find out everything you need to know about Boohoo shares here.

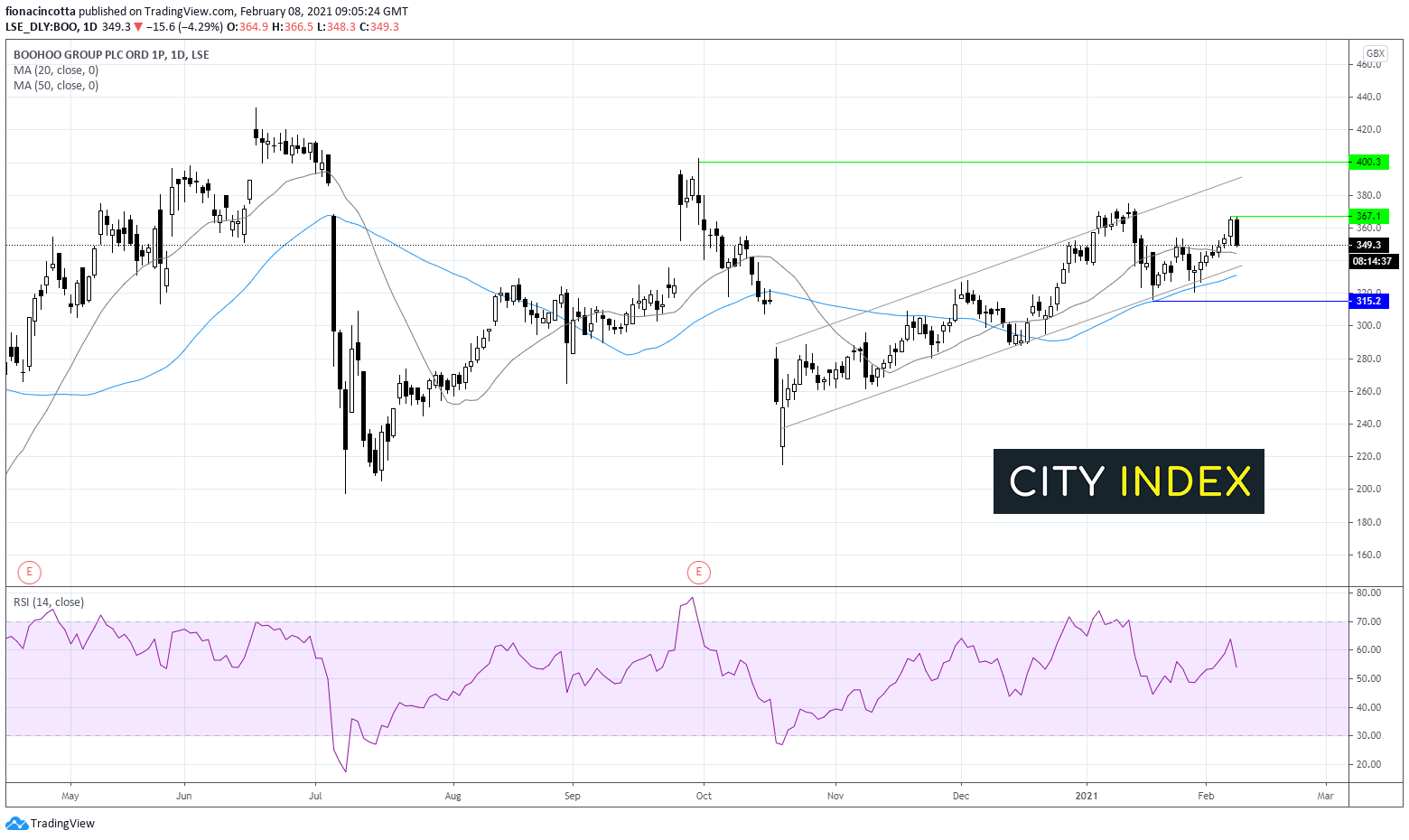

Boohoo share price: technical analysis

Despite today’s almost 4% sell off the recent uptrend in Boohoo shares remains intact, for now. The share price trades above its 20 & 50 sma on the daily chart and remains within the ascending channel dating back to mid-October.

Immediate support can be seen at 345, the 20 sma on the daily chart. A breakthrough here could see the price drop extended to 335/330 the lower band of the ascending trendline and the 50 sma. A breakthrough this level could see a current uptrend negated and open the door to 315.

On the flip side, resistance can be seen at 367, Friday’s high ahead of 380 the upper band of the channel.

FTSE 100 news

Below is a guide to the top news from the FTSE 100 today.

Experian says there is ‘no evidence’ that tech has been compromised

Experian said there is ‘no evidence’ its systems have been compromised as it responded to media reports that some of its customer’s data was for sale on the internet.

Reports suggested some data being illegally offered for sale online had come from Serasa’s non-sensitive marketing data. Experian said it had conducted ‘exhaustive investigations’ so far and suggested the claims were incorrect, but that it was continuing to carry out a detailed forensic investigation.

‘The data offered includes photographs, social security INSS, vehicle registrations and social media login details, which Serasa does not collect or hold,’ Experian said. ‘There is no evidence that positive or negative credit data has been illegally obtained from Serasa.’

‘In spite of exhaustive investigations to date there is no evidence that our technology systems have been compromised,’ Experian added. ‘Protecting the security of data is our number one priority and is an obligation we take extremely seriously.’

Experian shares were down 1.4% in early trade at 2601.0.

FTSE 250 news

Below is a guide to the top news from the FTSE 250 today.

Drax Group to buy Pinnacle Renewable Energy for CAD385 million

Drax Group has agreed to buy Pinnacle Renewable Energy for CAD385 million, helping to more than double its biomass production capacity.

The company said the deal will position Drax as ‘the world's leading sustainable biomass generation and supply business’ and propels it closer toward its goal of becoming a carbon negative company 2030.

The deal will see Drax pay CAD11.30 per share for Pinnacle, representing a 13% premium from its closing share price on Friday. That values Pinnacle’s equity at CAD385 million and represents an implied enterprise value of CAD741 million when CAD365 million worth of debt is included. Drax is paying using existing facilities.

Both sets of shareholders will need to approve the deal for it to go through but both companies hope to seal it in the second or third quarter of 2021. Notably, both boards support the deal and Pinnacle’s biggest shareholder ONCAP, which owns 31% of the business, is also providing its backing.

Drax said the deal will add 2.9 million tonnes of biomass production capacity, helping to ‘significantly’ reduce its production costs. It also allows Drax to enter new markets in Asia and Europe through Pinnacle’s contracted sales worth around CAD6.7 billion. The business is reliable considering 99% of all its capacity will be used to supply these long-term contracts until 2026.

Combined, the pair will have 17 plants producing pellets that are used to create energy. In total, they will have 4.9 million tonnes of capacity from 2022. Notably, only 2.9 million tonnes will be supplied from their own forestry operations with the rest having to be sourced from elsewhere. They will also have 2.6GW of renewable energy biomass power generation capacity.

Pinnacle is already cash generative and the current consensus is that it will deliver annual earnings before interest, tax, depreciation and amortisation of CAD99 million in 2022 and CAD126 million in 2023. Drax said this will underpin its plans to deliver sustainable dividend growth going forward.

Drax shares were up 0.5% in early trade at 389.4.

Electrocomponents sees revenue return to growth

Electrocomponents said like-for-like sales returned to growth during the four months to January, hopefully marking the start of a recovery.

Like-for-like revenue fell 11% in the first quarter to the end of June 2020 and was down 4% in the second quarter to the end of September. On Monday, Electrocomponents said like-for-like revenue grew 8% in the four months to the end of January 2021.

The company, which sells over 500,000 electronic and industrial products as well as providing a range of services, said the improvement was seen in all regions. Like-for-like revenue in Asia jumped 11% in the latest period, 10% in the Americas and 7% in Europe, the Middle East and Africa.

Although the improvement means revenue is likely to be better than expected for the full year, Electrocomponents said it still expects profit to be in line with expectations as it continues to book additional costs. This includes higher freight costs, disruption from Brexit and the impact of coronavirus on its workforce.

The current consensus is that Electrocomponents will make an adjusted pretax profit of between £171.1 million to £175.0 million in the year to the end of March 2021. That would be down from £215.0 million in the last financial year.

‘Despite these pressures, our confidence in our strategy remains strong: customers are increasingly valuing our solutions-led and omni-channel proposition, strong operational capabilities and first-class customer service, which have continued despite the challenging times. This can be seen through the strong revenue growth and deepening customer relationships,’ said chief executive Lindsley Ruth.

‘So, whilst we remain cautious about the external environment, this positive revenue progress underpins our confidence in the group's prospects and the significant growth opportunities in both revenue and margins we see over the medium term,’ Ruth added.

Electrocomponents shares were down 0.7% in early trade at 935.5.

Dechra secures rights to sell pain reliever Tri-Solfen worldwide

Dechra Pharmaceuticals has secured the rights to Tri-Solfen in Australia and New Zealand, meaning it now owns the rights to sell the pain relief drug in all international markets.

The company has entered into a long-term licensing deal with Animal Ethics. Tri-Solfen is already approved for use in sheep and cattle in both countries and currently makes AUD9.1 million in annual sales.

Animal Ethics is part of Medical Ethics, a privately-owned firm that develops pain relief and wound care products for animals and humans. As part of the deal, Dechra is also buying an additional 1.5% stake in the business, taking its total interest to 49.5%.

Dechra is paying AUD32.5 million for the additional stake and the exclusive rights to Tri-Solfen, with AUD5 million being paid upfront and the rest when Dechra makes its first commercial sale of Tri-Solfen in Australia, which is expected to happen in July. Dechra will also pay a royalty on all net sales.

The company is hoping to expand the use of Tri-Solfen so it can help other animals other than cattle and sheep. The main target is to get approval for it to be used on pigs in the EU, Dechra said.

Dechra shares were up 1.5% in early trade at 3687.0.

How to trade top UK stocks

You can trade all these UK stocks with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading the opportunities with UK stocks.

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade