The Bank of Canada (BOC) hiked rates by 50bps, as expected. This was the largest increase in the overnight rate in 20 years. The key rate now sits at 1%, its highest level since the pandemic began in March 2020. In addition, the BOC said it would stop reinvesting the proceeds of its maturing bonds as of April 25th, therefore ending its Quantitative Easing program. The central bank said that it will need to increase interest rates to neutral or above neutral due to the expected increase in inflation.

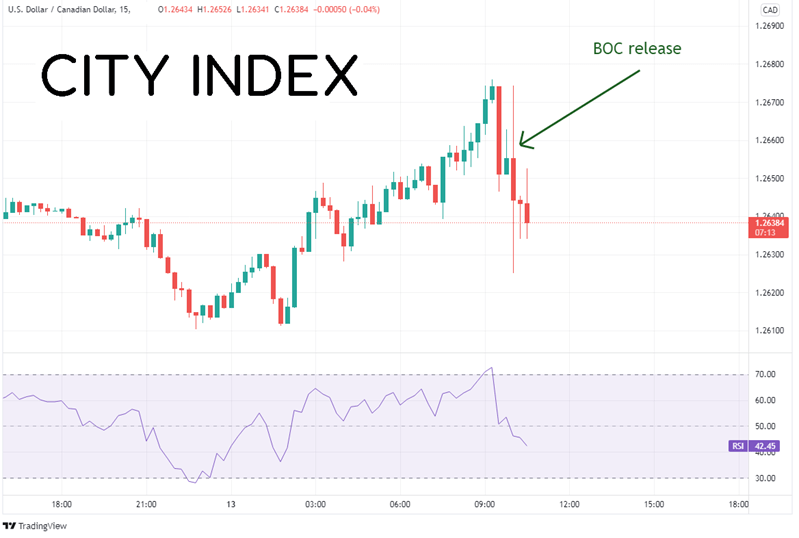

USD/CAD initially sold off on the release of the statement as traders expect more interest rate hikes to come. Price was very volatile within the first 15 minutes of trading after the release, trading between 1.2625 and 1.2675.

Source: Tradingview. Stone X

Trade USD/CAD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

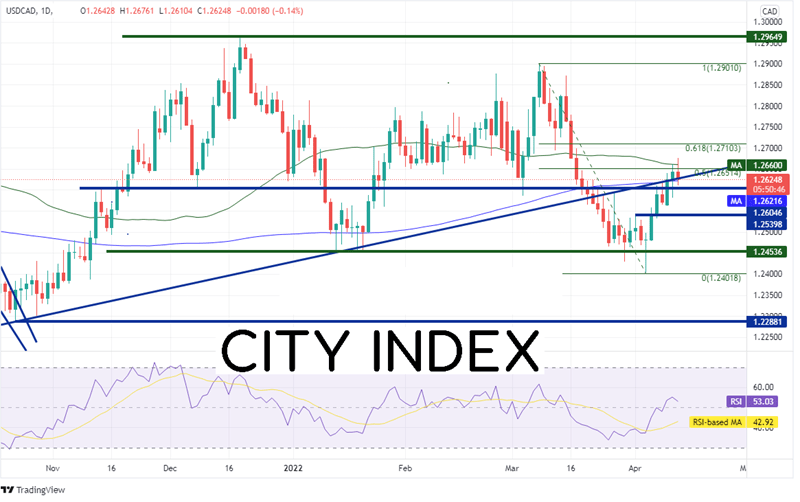

On a daily timeframe, USD/CAD has been trading in a range between 1.2453 and 1.2964 since mid-November 2021. On April 5th, price tested the bottom of the range and formed a hammer candlestick, indicating the possibility for a reversal. Indeed, price did reverse and moved higher. Price hasn’t looked back since. Over the last 3 days, price has broken above several key resistance levels. These include:

- Horizontal resistance at 1.2604

- The 200 Day Moving Average at 1.2622

- The upward sloping trendline dating back to June 1st at 1.2640

- The 50% retracement of the move from the highs of March 8th to the lows of April 5th at 1.2647

- The 50 Day Moving Average at 1.2660

Source: Tradingview, Stone X

Given the pullback after the BOC statement release today, this puts price in a current range between 1.2604 and 1.2660. If price moves higher out of the range, first resistance is at the 61.8% Fibonacci retracement from the March 8th highs to the April 5th lows at 1.2705. Above there, price can move up and test the highs from March 8th at 1.2901 and then the highs from December 20, 2021 at 1.2665. However, if price breaks below 1.2604, horizontal support sits at 1.2540. Below there, support is at the bottom of the recent range at 1.2454 and then the April 5th hammer lows at 1.2402.

The Bank of Canada hiked rates by 50bps today to bring the key interest rate to 1% and has said they’ll need to hike further. Currently, USD/CAD is caught in a zone between 1.2604 and 1.2660. The breakout of this zone could provide the markets with information as to where USD/CAD may be headed next!

Learn more about forex trading opportunities.