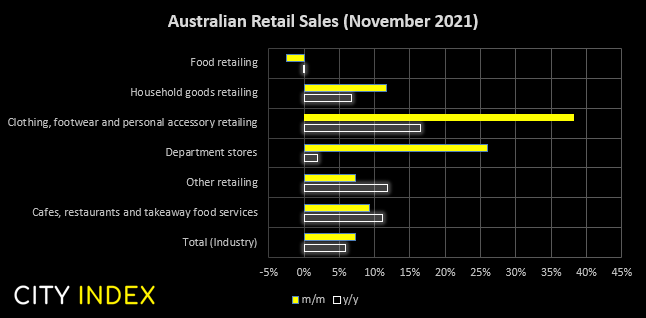

Australian shoppers continued to ‘do their bit’ in November with retail trade rising 7.3% in November, up from 3.9% in October and exceeding the 3.5% forecast. This makes it the largest monthly rise post-pandemic and, if measured the same period the prior year, retail trade rose 5.8%.

If we take a peek behind the headline number, we note that clothing and department store shopping accounted for the baulk of the spending spree, with clothing rising 38% (or 16.5% y/y) and department store trade rising 26% (or 2% y/y). Cafes and restaurants rise 9% in November (11% y/y) and it was only food retailing which contracted, down a mere -2.5% m/m (or -0.4% y/y).

At this stage we can only assume December’s figures will extend the run, which is ultimately a good thing for growth figures. That said, RBA will likely remain as dovish as ever, but it was enough to see AUD as the strongest major currency in Asia today which rose against all its major peers.

Read our guide on the Australian Dollar

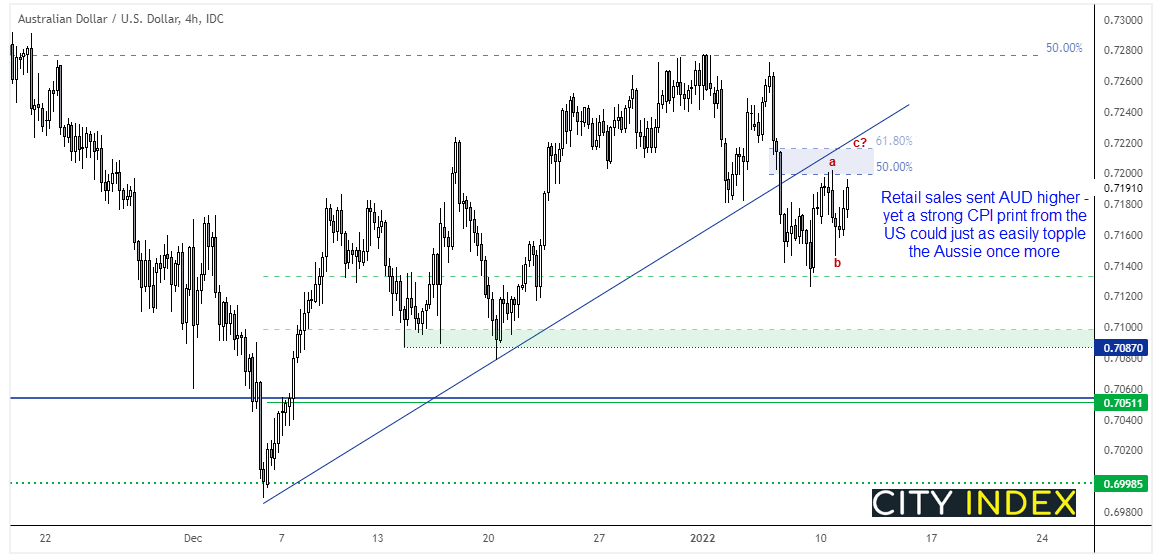

AUD/USD is up around 0.5% at the time of writing, although it remains below the 0.72 handle. And whilst retail sales has given it an extra spring in its step we remain sceptical that it will extend these gains by much if US CPI comes in strong tomorrow. A strong inflation print is likely to be a proxy for 4 hikes from the Fed, with the first being in March, and that will more than negate the positive flows form today’s retail figures. Of course, should US CPI disappoint (which is not likely) then we have a bullish case for AUD/USD over the near-term.

Technically, AUD saw a decent break of trend support and is now within a potential 3-wave correction against its bearish move. We’d prefer to fade into rallies towards or up to the 61.8% Fibonacci ration / broken trendline and favour a re-test of last week’s low, with the potential for an extended run to 0.7100.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade