The stock market sell-off gathered pace when Wall Street opened for trading earlier. At the time of writing, the Dow was more than 600 points worse off, while the Nasdaq was 3% lower and S&P 500 about 2.5%. Sentiment has remained bearish ever since the middle of last week when US President Donald Trump unexpectedly announced fresh tariffs on China. Beijing’s response was to allow its currency to fall sharply through the 7-yuan hurdle against the dollar to a record low today. And this has clearly annoyed Trump, who earlier in a tweet labelled China a currency manipulator, adding this was a “major violation which will greatly weaken China over time!”

The sell-off has been exacerbated by concerns over the global economy. In Europe, the closely-followed Sentix investor confidence fell further into pessimism territory, printing -13.7 versus -6.9 expected and -5.8 in July, while revisions showed German services PMI had expanded at a much slower pace than anticipated in July. In the US, growth in the dominant services sector slowed to its weakest level in nearly three years last month, according to the ISM.

As a result of the escalation in US-China trade spat and weakness in US data, calls for another 25-basis point rate cut have increased further. Consequently, we have seen fresh falls for the Dollar Index and benchmark US government bond yields.

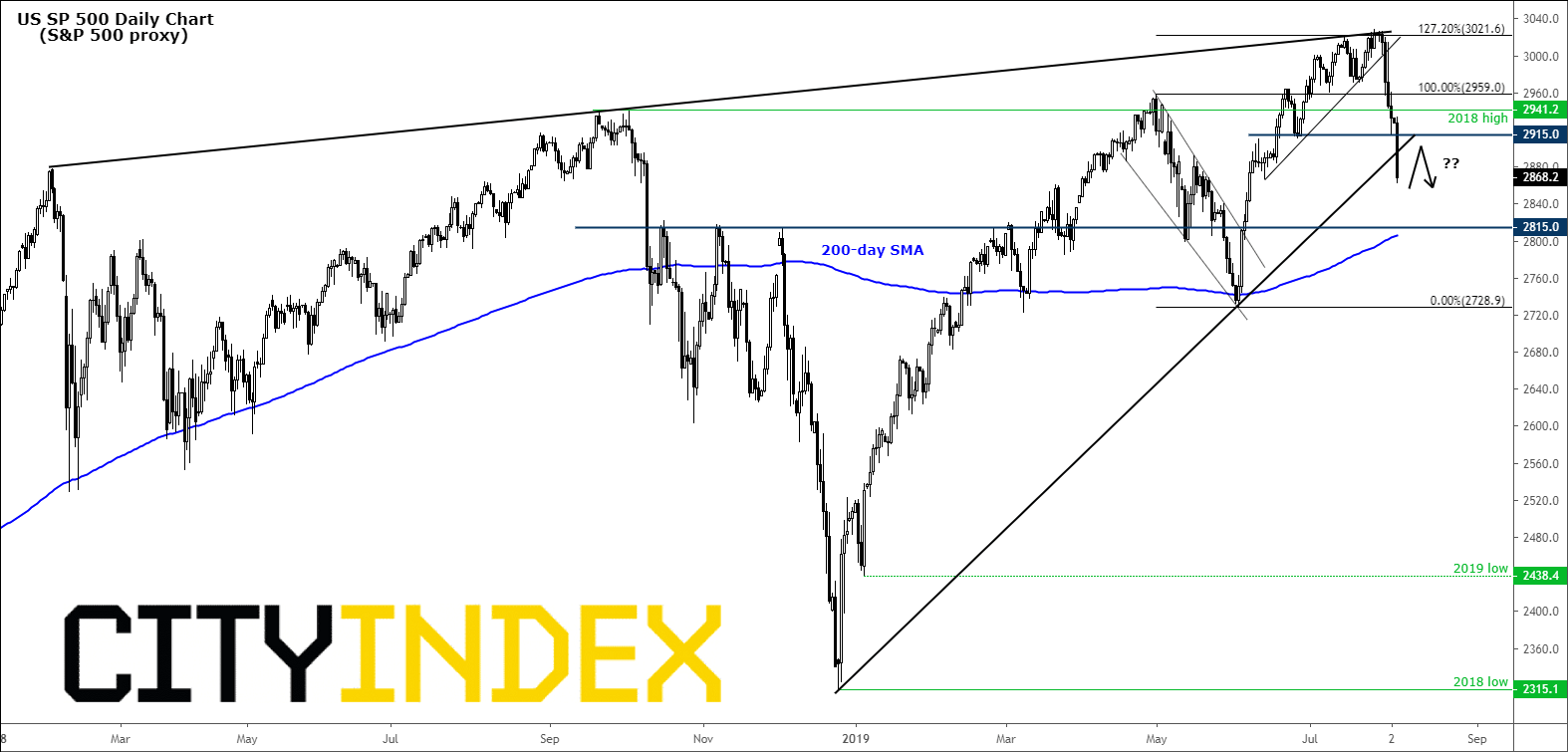

As far as the S&P 500 is concerned, well it is not looking too good at the moment. After breaking back below key levels such as 2959 and 2941, today it has broken another old support at 2915 – this level will now be the key resistance to watch on any short-term rebound. The S&P has also broken its bullish trend line in a further blow to the bulls. As things stand therefore, the path of least resistance is now to the downside and will remain that way until and unless we see a clear bullish reversal pattern emerge.Source: Trading View and City Index. Please note this product may not be available to trade in all regions.