- US indices staged impressive recovery on Thursday but looks could be deceiving

- Bond yields remain supported amid hawkish Fed talk, strong data

- US ISM PMI up next

Sentiment remained positive towards equities in the first half of Friday’s session, after the markets staged a sharp short squeeze rally on Thursday. US bond yields have edged lower only a tad, while cryptos have fallen to provide a mixed picture for risk appetite. Investors will look forward to the release of US services data for direction, ahead of a busy next week. I remain doubtful that the markets have bottomed just yet. The second half of the day should be interesting. Will the rally hold, or are we going to see another no-show of the bulls today?

While US index futures have expanded their gains along with European indices, we are seeing some of the other risk assets drop. Bitcoin, for one, was down more than 5% at the time of writing – hardly providing a bullish signal for risk assets.

Clearly, not everyone is feeling the sort of optimism the markets displayed yesterday, which means there is a possibility that yesterday’s rally may not hold. Even so, it is best for the bears to look for clear bearish signals first before dipping their toes on the short side again after the aggressive rebound the day before.

Rising bond yields will make some stocks less attractive, especially those with high valuations and/or low dividend yields. Yet the market completely ignored this to stage a sharp rally on Thursday, which also weighed on the dollar. It is important to remain objective and not to attach too much importance to Thursday’s price action, as after all there was no news behind the move.

That sort of price action is quite common after markets go down for several days, and when there are conflicting macro factors pushing sentiment in all sorts of direction.

On the one hand, good data is good news for the economy, which in turn is good news for stocks. But on the other, good data also keeps inflationary pressures elevated for longer, which leads to more interest-rate hikes and for longer, and eventually weigh on the economy and the outlook for certain sectors of the stock markets.

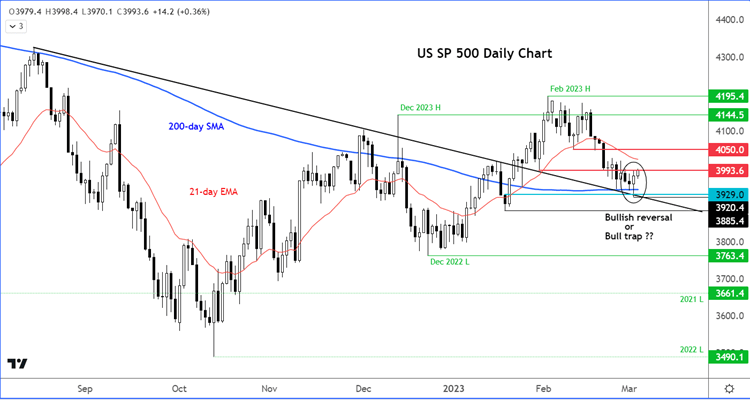

This is precisely what has torn the bulls and bears alike in recent weeks. With the market becoming very sensitive to incoming data and FedSpeak, the bulls should think twice before declaring that markets have bottomed – even if those big hammer candles on the charts of the S&P and Nasdaq look quite juicy:

Source: StoneX and TradingView.com

But note that the structure of the market has been bearish, with the US benchmark stock index printing lower lows and lower highs in recent weeks. What’s more, the rebound on Thursday looks far too ‘clean’ in that it bounced right from where it needed to – suggesting it could just have been a technical move rather than something more profound. It will be game over if we retest Thursday’s lows later in the session.

That said, the US stock markets have had a habit of proving the doubters wrong time and again. A clean break above 3993 resistance would tip the balance back in the bulls’ favour, which may then pave the way towards the next potential hurdle around 4050.

A lot depends on incoming data. On that front, we have US ISM services PMI to look forward to in the afternoon. Earlier, European final PMIs were mixed while Caixin services PMIs for China (55.0 vs 52.9 last) beat expectations overnight.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade