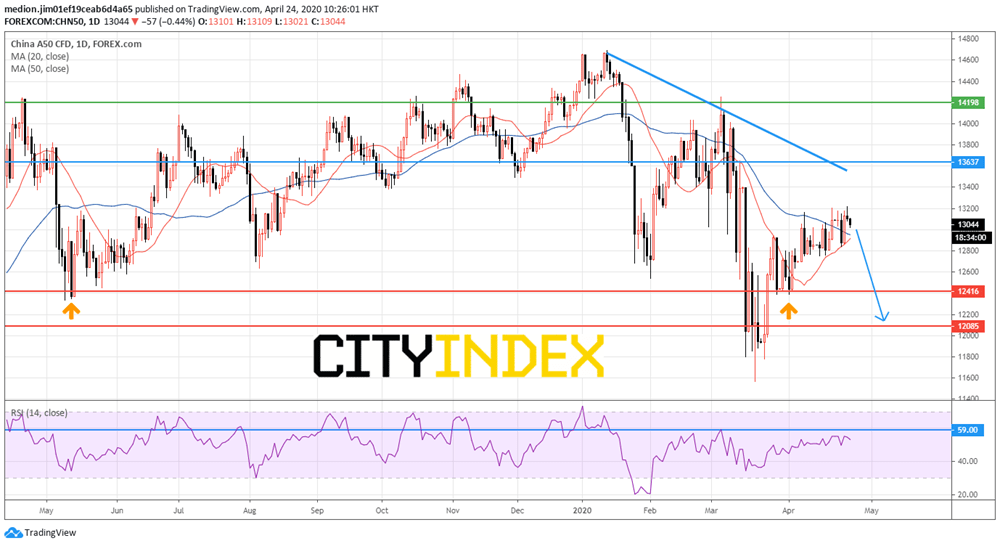

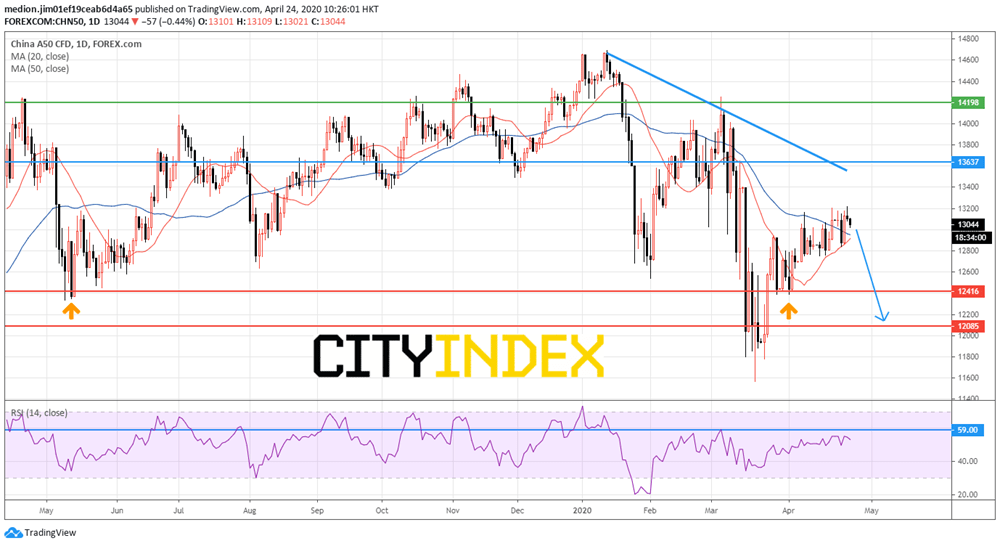

Short Term Outlook of FTSE China A50 Index: Key Resistance Level at 13637

The China economy is affected by an outbreak of Coronavirus. The government announced that 1Q GDP dropped 6.8% on year (-6.0% expected) last week, recording the first contraction within 30 years. Besides, industrial production fell 1.1% in March (-6.2% expected) and retail sales declined 15.8% (-10.0% expected). In addition, China exports dropped 6.6% on year (-13.9% expected) and imports fell 0.9% (-9.8% expected). We can see that industrial production, exports and imports data for March are much better than the expectation. It suggests that China's trading and production activities do not look so bad.

On the other hand, a break above 13637 would indicate a breakout of the declining trend line and bring a stronger rebound to the second resistance level at 14198.

Source: GAIN Capital, TradingView

Secondly, China's economy is reopening as the new Coronaviurs infected cases in China are being low. The new cases of Coronavirus added less than 100 within this week. However, China still faces a challenge for weaker demand of the global economy as the number of new cases in the worldwide remains serious.

The investors should focus on official April manufacturing PMI (51.0 expected) and non-manufacturing PMI (50.5 expected) next week as the data could give an insight of the recent China economic performance.

From a technical point of review, the A50 Index would be bearish as the prices remain capped by a declining trend line drawn from January. The RSI stays around 50 and has not crossed above the previous high at 59, suggesting the lack of upward momentum for prices. Therefore, as long as 13637 (around the high of March 13) holds on the upside, the index prices would return to the overlap support base at 12416 and 12085 in extension.On the other hand, a break above 13637 would indicate a breakout of the declining trend line and bring a stronger rebound to the second resistance level at 14198.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM

Yesterday 11:30 AM