Its latest multi-billion dollar pay-out isn’t entirely welcome

Rio's decision to pump out even more cash to shareholders, on top of a yield that already surpasses FTSE 100 rivals has not pleased investors. The group also reports an £800m write-down related to its troubled Oyu Togloi project in Mongolia. Stripping out a one-off $4bn from an asset sale included with the half-year pay-out last year, the sum totalled $3.2bn. That’s less than the $3.5bn package announced on Thursday, including a $1bn special dividend.

Dependence on the steel-making metal also causes misgivings. Soaring iron ore values buoyed the interim performance, lifting underlying H1 earnings 12% to $4.93bn, comfortably above the $4.86bn average forecast. Yet at $11.6bn of consolidated sales over the six months to 30th June, iron ore constituted over half of Rio's $20.2bn total sales. Forecasts of a price a retreat abound. The futures fair value curve points below $100/MT in a year, from around $140/MT for the front-month contract on China’s Dalian Commodity Exchange right now.

Rio spending is up, with a focus on copper, though large projects are mostly at initial stages. The group itself cites "continued cost pressures...primarily reflecting an increase in iron ore unit costs.”

Rio’s shares still over-perform FTSE 100 peers so far this year. They face similar problems, but at a lower magnitude. Rio's stock could have a heavier negative bias in the second half of 2019.

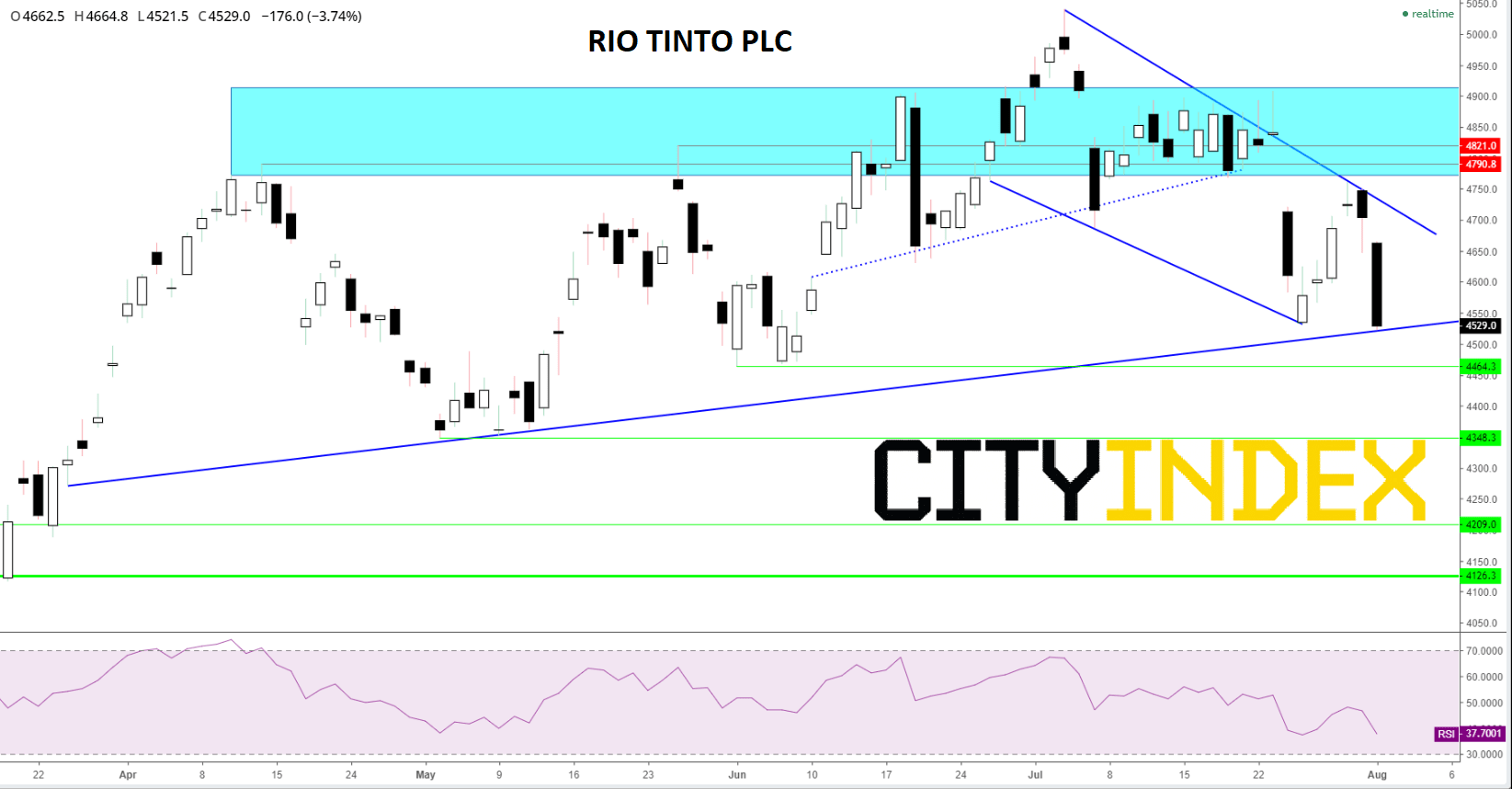

Chart thoughts

For buyers, it’s now crucial for RIO to close above its rising line since April to avoid damaging the longer trend since early 2016. The conundrum is that the cluster of failures somewhat below the years 5040p high were quite emphatic, marking out 4914p-4773p as a formidable barrier. So, any recovery at current prices will need to be solidly-founded to have a chance of progressing higher. The slump off the years high within a short channel resembles a declining flag that could certainly be a continuation pattern. So long as the trend holds. If not, sellers will be looking beyond possible support at kick back lows of 4464p and 4348. More aggressive support of 4209p and 4126p would be required if the current down leg becomes a trend

Rio Tinto CFD – daily

Source: City Index