Summary of today’s RBNZ statement:

- Increased the Official Cash Rate (OCR) to 1.50 percent

- Appropriate to continue to tighten monetary conditions

- High level of geopolitical tension and related economic sanctions on Russia

- Underlying strength remains in the economy in New Zealand

- RBNZ to remain focused on ensuring high inflation does not become embedded into longer-term inflation expectations

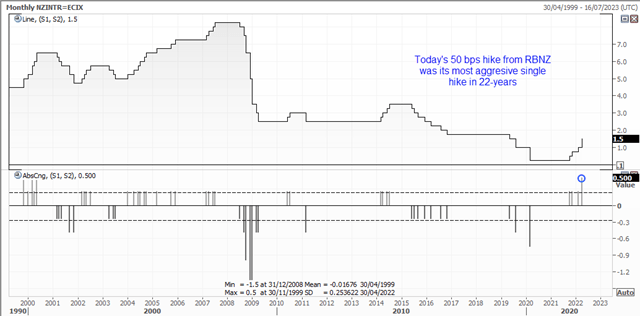

Heading into today’s meeting it was widely debated as to whether the RBNZ would hike by 25 or 50 bps points, given they had themselves described the choice as “finely balanced”. Well, today they hike by 50 bps for the first time in 22 years (to the month) which is in itself a signal that inflation is indeed getting too hot handle, despite concerns from geopolitical tensions and the latest round of COVID-19.

Today’s hike is to soothe fears of higher for longer inflation, as it was aimed at lowering inflation expectations. And by keeping the door open for more hikes and as soon as their next meeting, this meeting was about as hawkish as it could have been without just going for a 75-bps hike today.

NZD trades broadly higher following RBNZ meeting

The fact that NZD prices rallied after the meeting tells us that the 50-bps hike was not priced in. And as it was coupled with a hawkish statement then it potentially leaves room for further gains in later sessions.

NZD traded broadly higher against its peers with NZD/JPY leading the way, as the Kiwi took full advantage of an uber-dovish BOJ. NZD/USD is holding above trend support on the daily chart having printed a bullish outside candle yesterday. Whilst this hints at a swing low around 0.6800, the pair is now trapped between the 50 and 200-day eMA’s. Furthermore, it has handed back around a third of today’s gains and its high has met resistance at 0.6900 and near the 200-day eMA.

Whilst NZ now has a 100-bps yield differential over the Fed, that is likely to be reduced back to 50 bps at next month’s FOMC meeting. And as NZD/USD has handed back most of today’s gains already it appears markets are placing a greater emphasis on reduced differential in future. Either way, we need to see either daily close above 0.69 or below 0.68 before we become confident its next directional move is underway.

A close above 0.6900 brings 0.7000 into focus for bulls, whilst a daily close beneath 0.6800 invalidates trend support and strong suggests a lower high has been seen.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade