As the Australian electorate found out last weekend, the concept of a “sure thing” can be a dangerous one. If there is such a thing as a “sure thing” in the world of financial markets and Central banks, it now appears highly likely that the Reserve Bank of Australia (RBA) will cut interest rates to 1.50% at its next meeting on June 4th.

At the close of business yesterday, interest rate markets had priced in 17basis points or approximately 69% of a rate cut at the June meeting. Following RBA Governor Philip Lowes speech to the Economic Society of Australia in Brisbane today, markets are now almost 90% priced for an interest rate cut next month.

In their recent communique, the RBA stated it would look through persistently low inflation and would only consider cutting interest rates should the labour market deteriorate. Evidence of that deterioration was firmly on display last week as firstly the employment index of the NAB business survey fell to its lowest level since 2015. Soon after, labour force data for April showed the unemployment rate rose to 5.2% from 4.9% in February.

The key sentence from today’s speech highlighting the RBA’s concern over the softening labour market and an imminent rate cut is “A lower cash rate would support employment growth and bring forward the time when inflation is consistent with the target. Given this assessment, at our meeting in two weeks' time, we will consider the case for lower interest rates.”

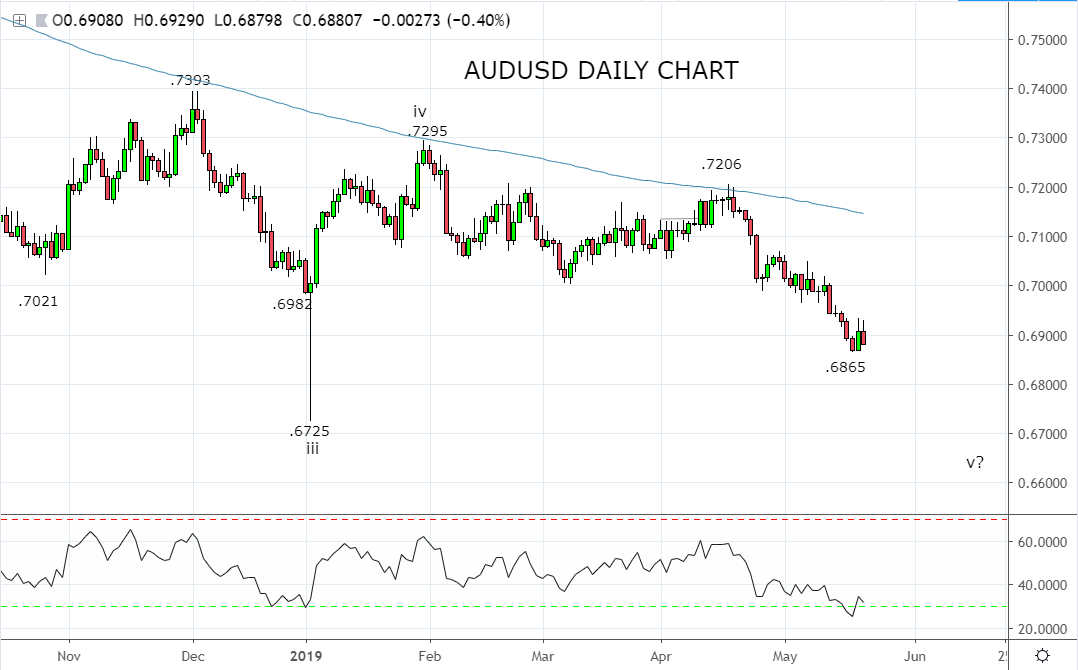

A June rate cut is likely to be a followed by another one before year, most likely in August or November which will take the RBA cash rate to just 1%. This is likely to result in the interest rates that banks offer on term deposits falling below 2%. In comparison, the 6.8% yield on a stock like Westpac should result in investor rotation into banks and other high yielding stocks. Elsewhere the AUDUSD is likely to continue lower and may even eventually become a funding currency, used to fund carry trades.

Source Tradingview. The figures stated are as of the 21st of May 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.