The US dollar’s sharp recovery has not shown any major signs of a reversal yet, and this is keeping precious metals under pressure. While gold eked out a small gain on Monday and was holding its own in the positive territory at the time of writing on Tuesday morning, the damage has already been done and further weakness should not come as surprise.

Gold and silver suffered a sharp two-day sell-off at the back end of last week, as the dollar bounced back with a vengeance on the back of a much stronger US jobs print and ISM PMI report. The stronger US data has seen the market gravitate towards “higher for longer” narrative, helping to provide support for the dollar on the dips, while keeping a lid on precious metals.

Investors are now expecting the Fed to maintain a contractionary monetary policy in place longer than expected in order to dampen inflationary pressures that could arise from a tighter labour market. This is why we have seen the probability of another 25-basis point rate hike in March rise to almost 100%, while that of another 25 bp hike in May has jumped to 67% from about 40% a week ago.

There’s not much data today to help trigger a change in market’s perception of where the Fed might lift interest rates to. But Fed Chair Jerome Powell is giving a speech at 17:40 GMT, so it is possible we could see some movements around that time. Given the strong employment report on Friday Powell may try to strike a hawkish tone to align the market expectations with the FOMC’s central view again.

Ahead of the Powel speech, and as a result of the renewed weakness in prices, the path of least resistance continues to remain to the downside for gold, until the dollar tops out.

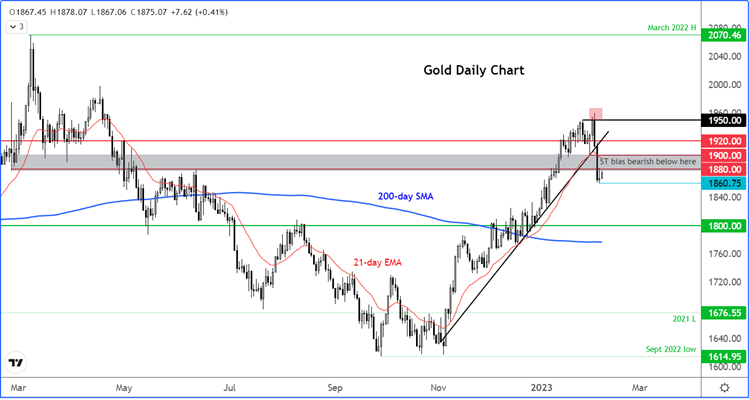

The bears will be happy or as long gold holds below key resistance in the $1880 to $1900 range. This area was formerly support and resistance. But with price now back beneath this area and below the broken trend line and 21-day exponential moving average, the bulls have lost the control they had enjoyed since November.

From here, gold may go on to extend its decline towards $1800, if the macro conditions continue to boost the appeal of the dollar over other currencies. Monday’s low at $1860 is the next immediate target for the sellers.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade