Downing Street would see a vote to block ‘no-deal’ as a ’no-confidence’ vote; so will sterling

As dire as Britain’s latest set of disappointing economic data were, they’re a sideshow in the context of headlines suggesting that Prime Minister Boris Johnson would treat any vote that succeeds in blocking a no-deal Brexit as tantamount to a ‘no-confidence’ vote. Every new spending announcement from the PM—the latest came on Sunday when he pledged billions more in a Sunday Times interview—seems to increase the chances of an election anyway. Johnson’s Monday comments underline that he may not be shying away from such a prospect as much as Downing Street say. Almost simultaneously, No. 10 reiterated that the PM “doesn’t want a general election”. Westminster is already discounting the difference between the government’s official view on an election. Markets are too.

Developments are coming thick and fast again. For now, here’s what must be watched:

- The Labour Party’s planned legislation to block an exit from the EU without a deal is key; and it’s likely to come up as soon as Tuesday. De facto deputy leader John O’ Donnell says they’re “looking to see how on Tuesday and Wednesday of next week we can introduce a legislative measure which will enable us to prevent a no deal without parliamentary approval”

- Bloomberg reports Labour’s strategy would compel the government to seek a three-month Brexit delay if MPs can’t agree on a new deal by 19th October

- Johnson is mulling an option to blackball Tory rebels who back Labour’s plan, effectively removing Conservative Party affiliation. That would also shave the party’s thin majority further, ratcheting market anxieties even higher

- The move against rebels is likely to be one topic of discussion at a Cabinet meeting reportedly set for today

- Michael Gove, responsible for no-deal planning has signalled the government could ignore Parliament’s instruction to seek an extension from the EU

- Ireland’s Prime Minister Leo Varadkar has described some alternatives to the all-important, intractable backstop as “interesting”. It’s a possible first signal that there may be some mileage, however little, to begin with, in discussions to drop the device, despite the EU’s insistence that negotiations will never be reopened

For what it’s worth, Monday’s key economic data showed Britain’s manufacturing sector slumping to the weakest in 7 years. Already well into economic contraction territory, July’s Purchasing Managers Index of UK factory output was more of a moderate negative surprise than a shock. At 47.4, it was 1 point lower than forecast though down just 0.6 from August’s 48.

Chart thoughts

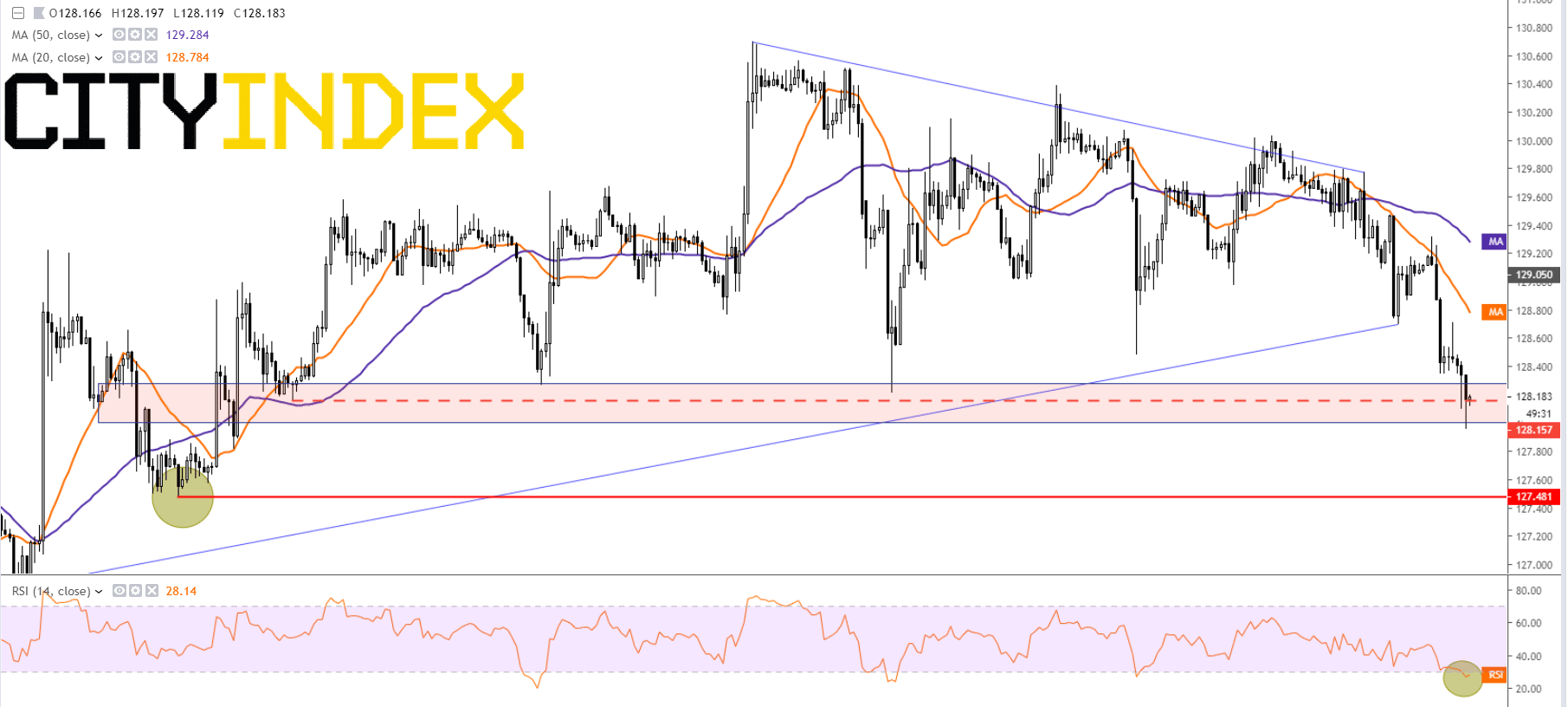

For some weeks now the watch has returned to the question of ‘when’ in the near term the pound will weaken significantly further, and ‘how much’, rather than ‘if? The typically more volatile GBP/JPY cross also captures aversion to broader risks and began cracking late-October 2016 lows as the U.S. session kicked off. The next staging post looks like the two-week double bottom over early to mid-August comprised of ¥126.55 and ¥126.66. An hourly ‘spinning top’ candle on 14th August highlighted virtually the whole ¥128 handle as key and that’s where the battle rages at time of writing. A further consolidative region can be found between high ¥127s and the more decisive kick-back low of ¥127.48, from around the same time. As most reasonable gauges of day-to-day trend show (20 and 50-day moving averages are included below) the bias is firmly on selling pressure. So ¥127.48 looks to be an almost inevitable next target. The pair does adhere to RSI prescriptions quite well on an intraday basis and that oscillator is now beyond overbought. Sellers will therefore be wary of the risk of an elastic retracement. Even if it occurs, all signs suggest that it too will unwind rapidly.

GBP/JPY – hourly

Source: City Index