Oil tumbled following China’s announcement as the escalation of the trade dispute is knocking the global growth outlook and future oil demand expectations.

Federal Chair Jay Powell indicated that policy makers are more concerned over trade policies than inflation. Powell’s pledge to act as necessary offered some reassurance to the markets that support is on its way. The Fed chair certainly didn’t say anything to indicate a pushing back on a 25 basis point rate cut expected in the coming months. The prospect of support to the US economy, boosted the price of oil.

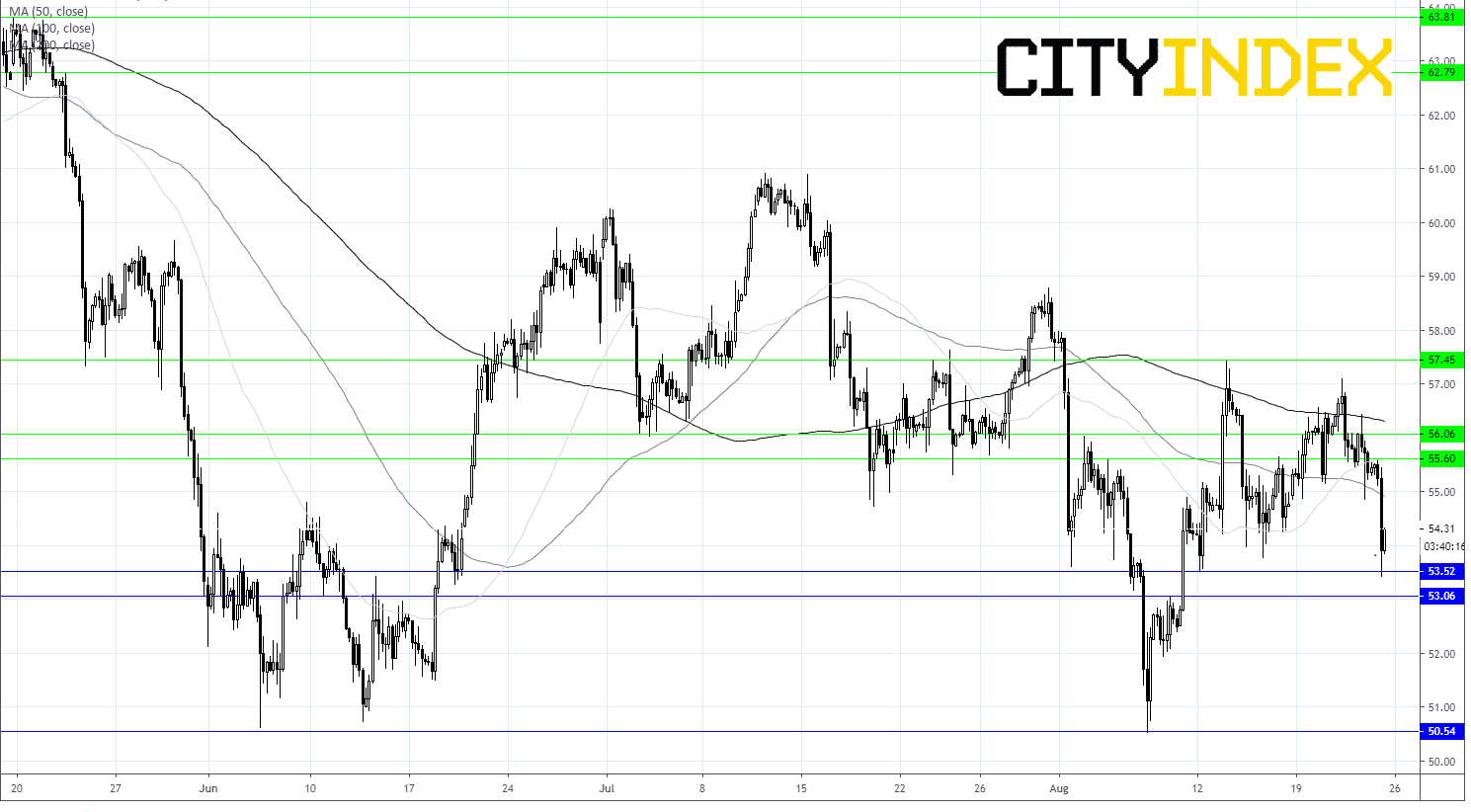

WTI levels to watch:

Oil was trading 2.5% lower following the announcement of the Chinese tariffs, hitting of a low of $53.42. Following Jay Powell’s speech oil pared its losses moving $1 higher. Should oil continue to rise resistance could be tested in the region of $55.60 prior to $56 and $57.50. On the downside support can be seen at $53.50 prior to $53.00.