Oil set for weekly gain despite OPEC warning

- Oil rises on China optimism

- OPEC highlights recession concerns

- Oil tests resistance at 200 sma

Oil is rising, recovering from losses yesterday, and is on track to gain over 2% this week, which would mark its fourth straight week of gains.

Oil prices are being lifted by signs of increased demand in China which is helping offset warnings from OPEC. China imports jumped 22% in March to the highest level since June 2020 as refineries ramped up amid higher export demand and as domestic consumption picked up post-pandemic.

The data is fueling optimism that China will help boost oil demand to record highs this year, as predicted by OPEC. China GDP data due early next week will be under the spotlight.

Oil prices fell yesterday after OPEC’s monthly report warned that oil markets are not as tight as they were 12 months ago. The oil cartel noted that demand was improving. However, inventories also remained high. The group also highlighted concerns over a potential recession as interest rates rise. High-interest rates in the US could also affect the key driving season.

Despite these concerns, OPEC maintained that global oil demand would rise by 2.32 million barrels per day.

The weaker USD is also offering support to oil prices, making oil cheaper for buyers with other currencies. The USD has fallen to a yearly low as investors become increasingly convinced that the Fed will pause rate hikes soon and could start cutting rates in H2.

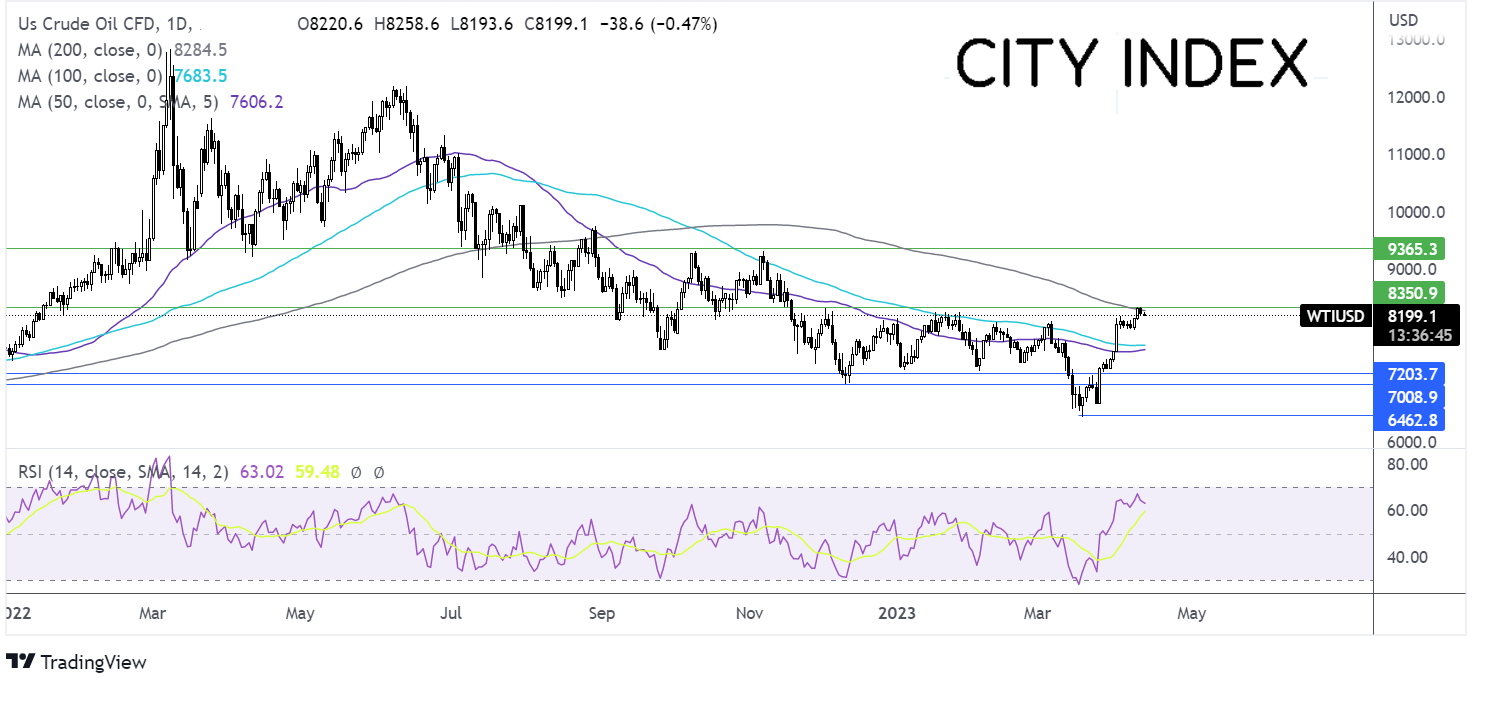

Where next for oil prices?

Oil has been consolidating since the start of December, capped by 83.30 on the upside and 72.40 on the lower side.

The price has risen to the upper band of the horizontal channel, running into resistance around 82.50 the 200 sma. The RSI above 50 supports further upside.

Buyers need a rise above 82.50 and 83.30 to extend the bullish upside towards 90.00 round number and 93.20 the November high.

Should sellers successfully defend the 200 sma and upper band of the channel, support can be seen at 77.00 the 100 sma ahead of 72.40.

DAX rises, bringing the all-time high into focus

- DAX hovers around 2023 high

- German wholesale price index falls to 2% YoY

- DAX rises above 15700 resistance

The DAX, along with its European peers, is pointing to a positive start adding gains from the previous session. A strong close on Wall Street is transferring across to Europe after falling US PPI and weaker jobless claims fueled bets that the Fed could soon pause rate hikes.

Inflation in Germany is also showing signs of cooling thanks to falling energy prices. German wholesale price index dropped to 2% YoY in March from 8.9% in February.

The data comes after CPI figures confirmed that inflation cooled to 7.4% YoY down from 8.7%.

The ECB still has work to do and is widely expected to hike rates again by 25 if not 50 basis points in May.

However, the broader market is upbeat on hopes that the Fed will soon pause its rate hikes with a dovish pivot being priced in for this summer. The DAX index has rebounded over 8.5% from its March 20 low and trades at a yearly high.

US retail sales and the University of Michigan confidence could drive sentiment later today.

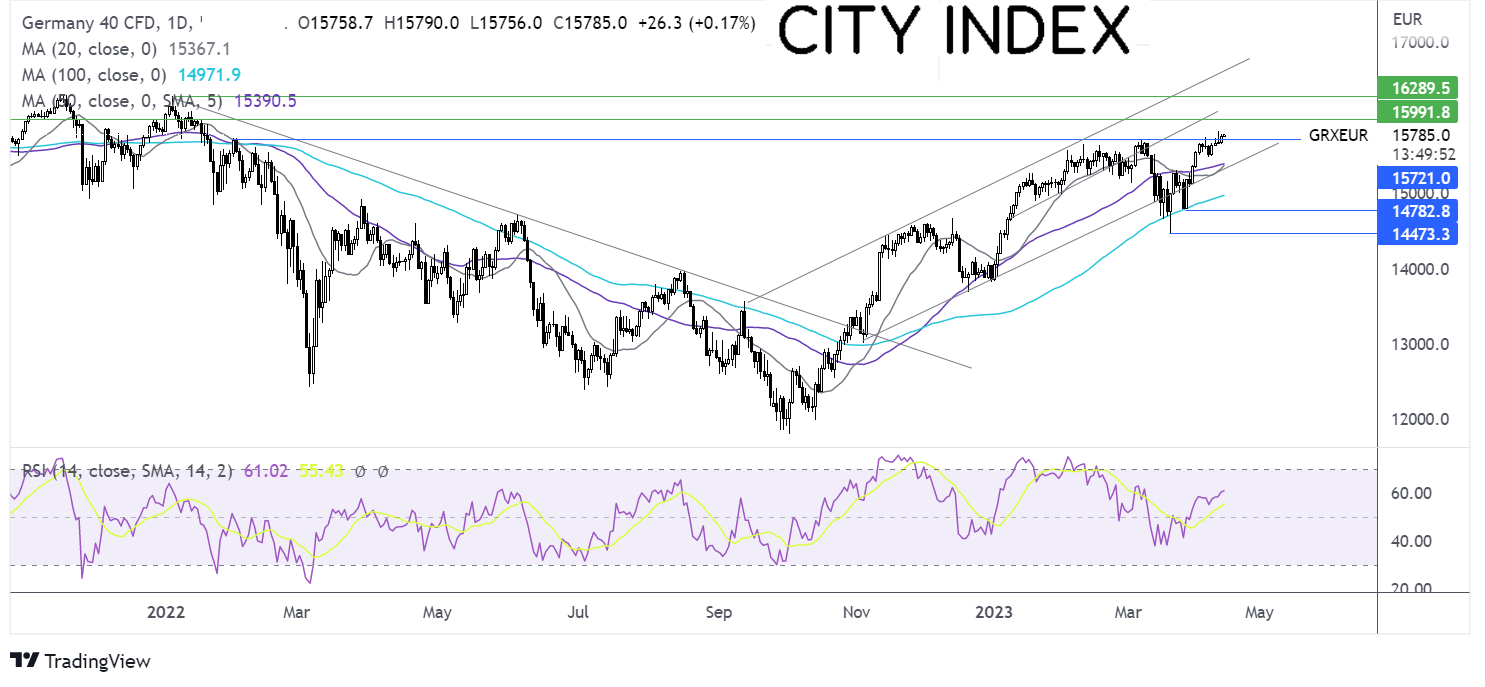

Where next for the DAX?

After rebounding from the 14450 March lower, the DAX has risen above its 100, 50 & 20 smas. It continues to trade within the rising channel dating back to October last year.

A rise above the March high of 15700, the 20 sma crossing above the 50 sma and the bullish RSI keep buyers hopeful of further upside.

Buyers will look to rise above 15830, the 2023 high to extend the bullish trend towards 16000 the psychological level and 16290 the all-time high.

Immediate support can be seen at 15700, with a break below here opening the door to 15375/35 zone, the 20 & 50 sma and the rising trendline support. A break below here exposes the 100 sma at 15000.