Following the hawkish Fed shift and a hot local inflation print last week, the NZ rates market has repriced higher to reflect a full 25bp hike at the RBNZ meeting in February, with a 30% possibility of a 50bp hike before a terminal rate of 3% by mid-2023.

Tomorrow sees the Q4 labour force data release, which is likely to support the market's aggressive pricing of interest rate expectations.

New Zealand’s Q3 labour market report was stronger than expected as the unemployment rate fell to a record low of 3.4%. Q4 labour force data is expected to confirm that the market remains tight and translate into stronger wages growth.

For the record the market is looking for the unemployment rate to stay at historic lows of 3.4%. The Labour Cost Index (another name for Wages inflation) is expected to rise by 1% q/q, taking the annual rate of wages inflation to 3%, its highest level since 2009.

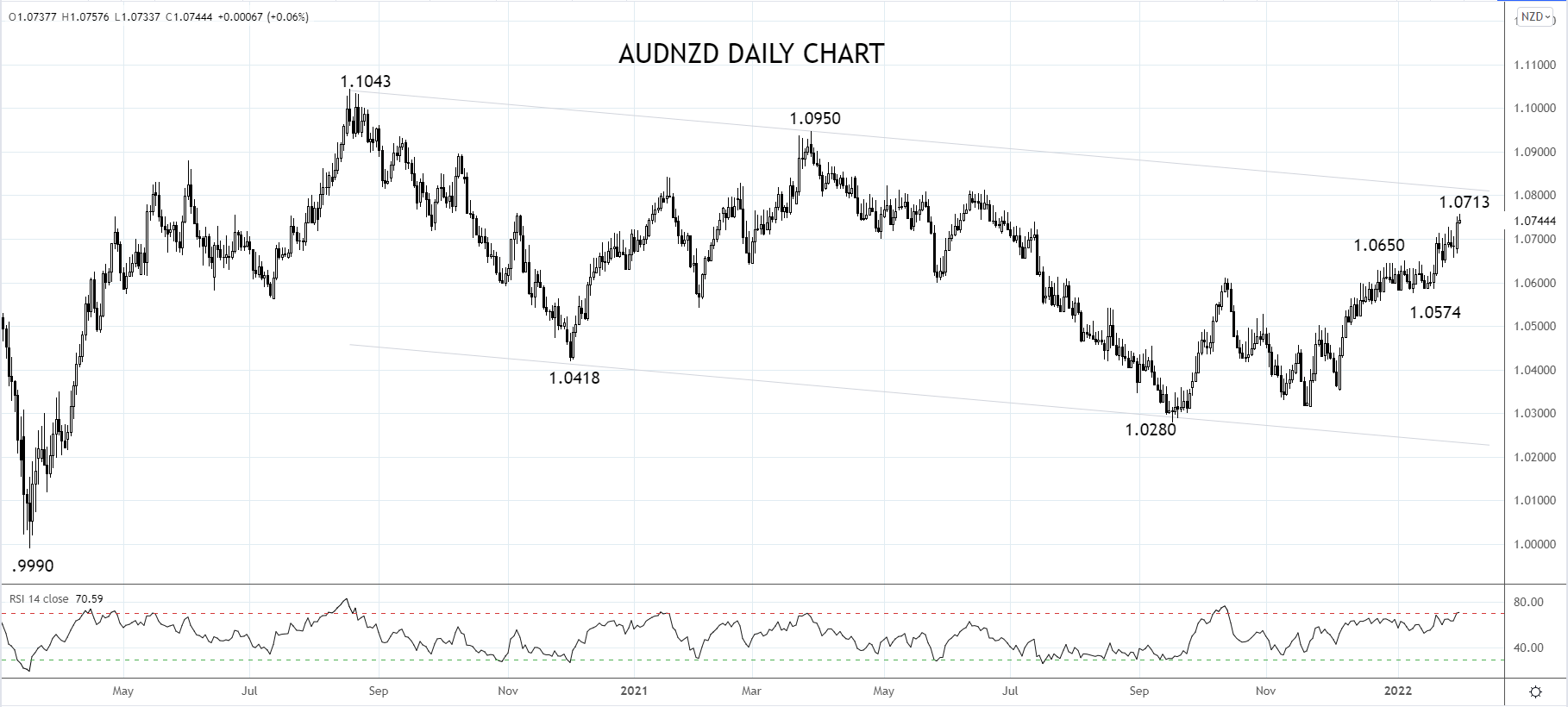

The expectations of RBNZ rate hikes drove the AUDNZD cross rate below 1.0300 in September of last year.

However, monetary policy easing in China in early December and stronger than expected Australian labour force and inflation data in January has provided the impetus for a turnaround in the cross written about here.

For those who followed the trade idea contained in the article above, “use dips back towards 1.0665/45 to open longs in AUDNZD, looking to take profit 1.0800/20. Stops should be placed below the 2022 range lows at 1.0565.” raise the stop loss to breakeven (1.0655).

Remain with the original target of 1.0800/20ish to take profit in the coming sessions, after which we will then reassess the next move for our favorite cross rate.

Source Tradingview. The figures stated areas of February 1st, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade