NFP preview: Can the jobs report keep the door open for a Jackson Hole taper announcement?

Overview

Heading into last month’s NFP report, traders were getting edgy following back-to-back disappointing jobs reports (while US inflation figures simultaneously rose to multi-decade highs). Thankfully, the release showed a reacceleration in the labor market, with 850K net new jobs created.

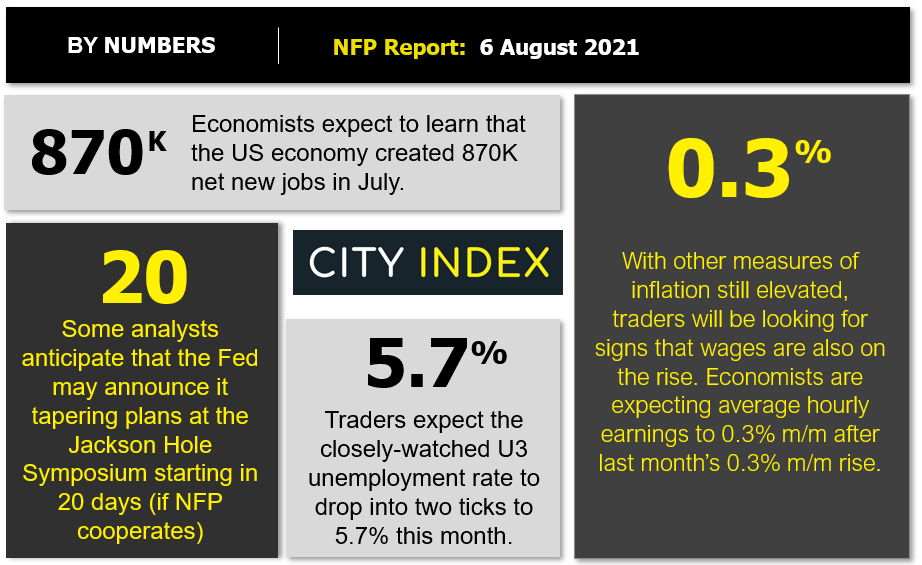

This month, traders and economists are expecting another solid reading of 870K net new jobs, with the average hourly earnings figure expected to rise 0.3% m/m, in line with last month’s wage reading:

Source: StoneX

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Manufacturing PMI Employment component printed at 52.9, up 3 points from last month’s 49.9 reading and back in positive territory.

- The ISM Non-Manufacturing PMI Employment component printed at 53.8, up more than 4 points from last month’s 49.3 reading and back in positive territory

- The ADP Employment report came in at 330K net new jobs, well below last month’s downwardly-revised 680K reading.

- Finally, the 4-week moving average of initial unemployment claims rose marginally to 394K from last month’s 393K reading.

As a reminder, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic. That said, weighing the data and our internal models, the leading indicators point to a below expectations reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 500-700k range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.3% m/m in July, will likely be just as important as the headline figure itself.

Potential NFP market reaction

|

Earnings < 0.2% m/m |

Earnings 0.2%-0.4% m/m |

Earnings > 0.4% |

|

|

< 700K jobs |

Bearish USD |

Slightly Bearish USD |

Neutral USD |

|

700K-1M jobs |

Slightly Bearish USD |

Neutral USD |

Slightly Bullish USD |

|

> 1M jobs |

Neutral USD |

Slightly |

Bullish USD |

After probing highs in mid-July, the greenback has settled in the middle of its 1-year range against most of its major rivals, leaving no clear technical bias on the world’s reserve currency heading into this month’s jobs report.

In terms of potential trade setups, readers may want to consider EUR/USD sell opportunities on a strong jobs report, which could leave the door open a crack for a taper announcement at Jackson Hole later this month. In that scenario, the most-traded currency pair could have room down to test its year-to-date low near 1.1700.

Meanwhile, a weak jobs report (and subsequent delay to the Fed’s normalization schedule) could present a buy opportunity in GBP/USD. Following last month’s false breakdown below support near 1.3700, rates are primed for a potential rally toward the 2021 highs around 1.4200 if US economic data stumbles.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.