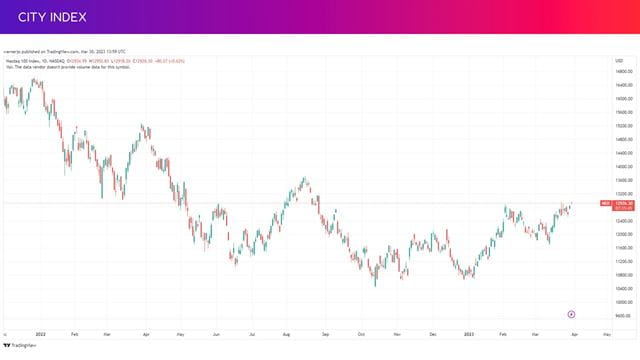

Nasdaq 100 tests 7-month highs

The Nasdaq 100 is up 0.7% in early trade today. If it can keep hold of these gains then it will close at its highest level in seven months.

This content will only appear on City Index websites!

Big Tech is providing much of the support considering Apple is up 0.7% and set to close at six-month highs while Microsoft is up 1.1% and at seven-month highs. Tesla and Amazon are also on the rise while NVIDIA is up 1%. Together, these five stocks account for over 40% of the Nasdaq 100.

Read more: The Nasdaq 100 Outlook is Underpinned by Just Seven Companies

Here are the biggest movers in the Nasdaq 100 as markets opened this morning:

|

Biggest Gainers |

Biggest Losers |

|

JD.com (+7.8%) |

Alphabet (-1.2%) |

|

PDD Holdings (+5.7%) |

Regeneron (-1.2%) |

|

Enphase Energy (+4.8%) |

Mondelez (-0.7%) |

|

AMD (+3.1%) |

Dexcom (-0.6%) |

|

Netflix (+3.1%) |

Paychex (-0.5%) |

NVIDIA stock to record best gain in two decades

Semiconductor stock NVIDIA has been one of the best performers in the Nasdaq 100 this year, with the stock up 90% since the start of 2023. With March drawing to a close, NVIDIA is on course to lock-in its largest quarterly gain since 2001, according to Dow Jones Market Data.

NVIDIA has significantly outperformed its rivals and the wider market. Markets have effectively decided that NVIDIA is the semiconductor stock to own in order to gain exposure to the growing hype around artificial intelligence. NVIDIA is providing the critical hardware needed to power AI and CEO and founder Jensen Huang said that revenue from generative AI will be ‘quite large’ in 12 months’ time during the company’s recent developers conference, adding ‘exactly how large it’s hard to say’.

The conference only reinforced the belief that NVIDIA has a lead in AI over its rivals. Rosenblatt Securities said the conference ‘showcases NVIDIA’s scary leadership in what we believe is the biggest semi cycle that we call the Mother of All Cycles’. JPMorgan agreed that NVIDIA is ahead of its peers while Bernstein said NVIDIA is the stock you want for exposure to the opportunities in generative AI.

This bullish view on NVIDIA’s prospects, which are also underpinned by expectations that tough conditions for its existing markets will ease this year and fuel some form of recovery in the second half, has seen its average target price rise to $271.58 from below $200 less than two months ago. Still, that implies there is limited further upside available as far as brokers are concerned.

Where next for NVDA stock?

NVIDIA shares have marched higher in 2023 and is up 1% this morning at over $272. It will close at its highest level in a year if it can keep up the momentum today.

The RSI is once again testing overbought territory to suggest it will face more resistance going forward, and we have also seen trading volumes drop in recent days. The rising trendline should remain intact if it does come under renewed pressure, suggesting support somewhere around $263. Any break below here could see it swiftly slump toward $240 first and then $230, in-line with the ceiling we saw in September 2021 and in-line with the 50-day moving average.

The next upside target is toward $284, followed by the peak a year ago at $289.

How to trade NVIDIA stock

You can trade the NVIDIA shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘NVIDIA’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.