Sterling and UK-tied stocks extend gains; Brexit deal faces another tough test in Parliament

The UK-focused FTSE 250 index has accelerated to a gain of more than 1% to join sterling’s surge by a similar rate on the day after the EU and the UK confirmed a Brexit deal has been reached.

The retailers, housebuilders, business services and property firms that depend on the UK for most of their revenues are extending gains made in recent weeks when hopes began to rise. FTSE 100 banks with large deposit bases in Britain, Lloyds, RBS and Barclays rise to near the top of the FTSE 100 along with British Land – the commercial property giant that could see outsize benefits from completions after years of uncertainty put many deals on hold. Insurer Prudential and homebuilder Persimmon were among top risers too a short while ago for similar reasons.

As for the pound, sterling continues its own surge whilst traders remain on high alert with volatility indicators continuing to flash warnings that some of the biggest whipsaws for years could be seen at any time.

- Just days ago specialised options trades gauged short-term buying sentiment as the best ever, according to Bloomberg data on sterling risk reversal strategies. Earlier on Thursday, the same indicators showed sentiment had slumped to the most pessimistic since September

- One-week sterling/dollar option costs were also quoted at the highest since 2016’s referendum

In other words, whatever is heard over the next 24 hours and beyond, unless such hedging and speculative markets calm down, that’s a sure enough sign that Brexit mayhem isn’t over, in the markets and beyond.

The key fault line now appears to be that the DUP continues to insist that regardless of EU-UK agreement, its stance on Prime Minister’s Boris Johnson’s plans on customs, sales tax and voting consent have not changed. In short, the Northern Ireland unionist party that the government needs on board to give the deal its best chances of being passed in Parliament is signalling that, at worst, it might not support the deal.

It’s one reason market attention will now shift focus to the strength of support among Labour and Conservative Brexit-supporting MPs.

- At least 19 of the former group, who signed a letter saying that the result of the referendum should be respected, and that they wanted a deal, offer the best chance of opposition support

- Commentary from core Conservative Brexit backers, constituted of the European Research Group, has been pared back to a less exacting tone in recent weeks

All told, the chances that the deal can be passed by the House, in a rare Saturday sitting, may not be worse than seen over the past year, but the odds are still not great.

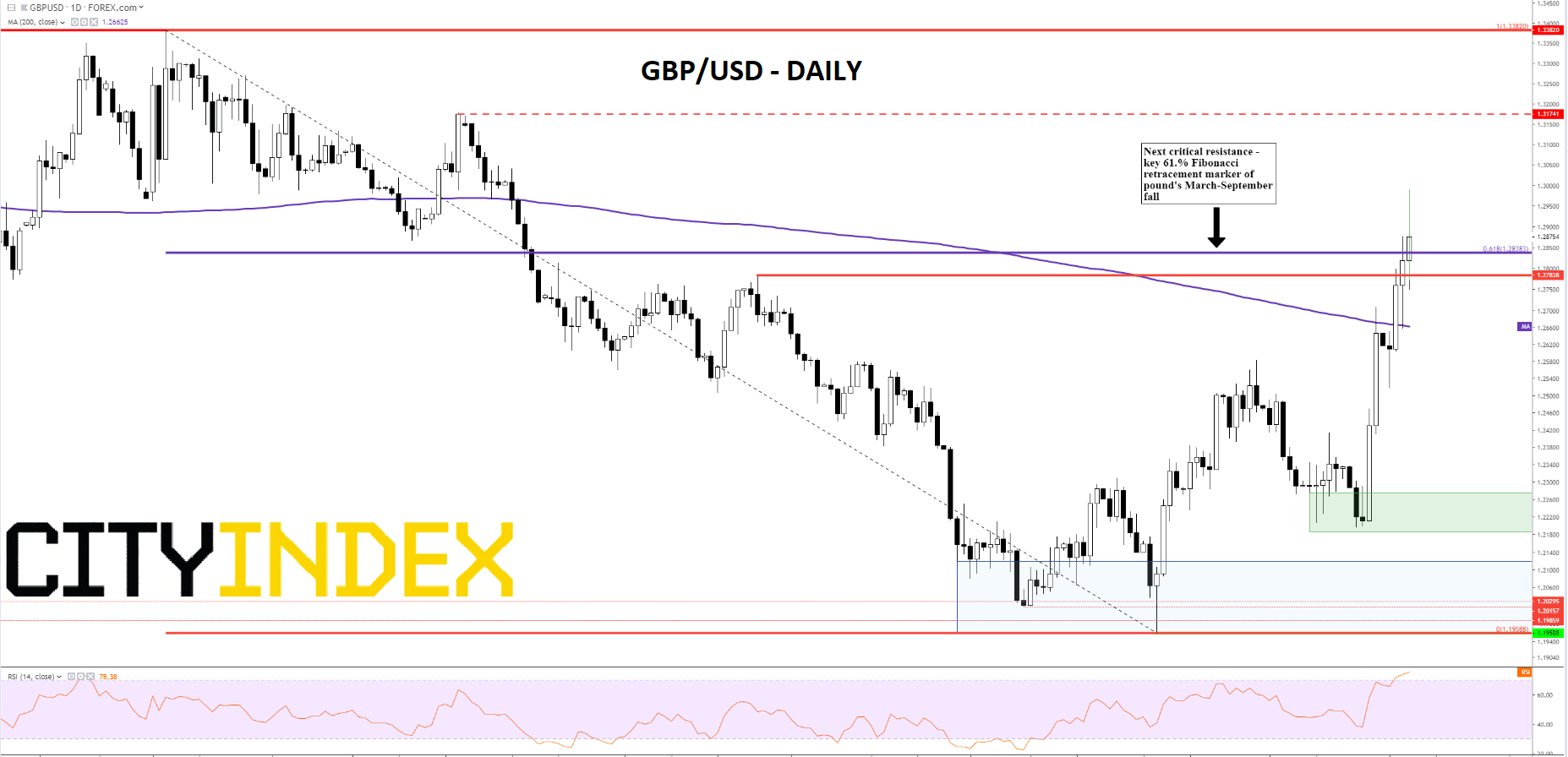

Meanwhile, sterling remains the best, if not the only market-based Brexit barometer, and its elevation that holds 5.6% above prices at the start of the month speaks volumes. In similar fashion to the fundamental focus, the technical emphasis has moved away from the ‘conviction resistance’ of $1.2783, the rule-of-thumb price that demonstrated buyers were convinced that the deal could at least get over the line in Brussels. It oughtn’t to have been a demanding bar to leap, though it proved to be; which in itself is an ambivalent indication for current momentum. Given that it was an intermediate high relative to the year’s peaks, it ought to have been a minimum technical condition.

The 61.8% Fibonacci retracement marker of the pound's March-September fall should be more important, and by extension, more difficult to cross. Indeed, GBP/USD has tested and, so far, failed on a closing basis to breach $1.2838 resistance associated with the Fib. Whilst the rate has on Thursday spiked to just short of $1.30—a level with psychological weight beyond markets—it is unlikely to establish itself above that price without besting key technical markers first. And remember, all of the above are but staging posts to the real prizes—including May’s $1.317 peak and the year’s $1.33 highs.

GBP/USD – Daily

Source: City Index