Markets update:

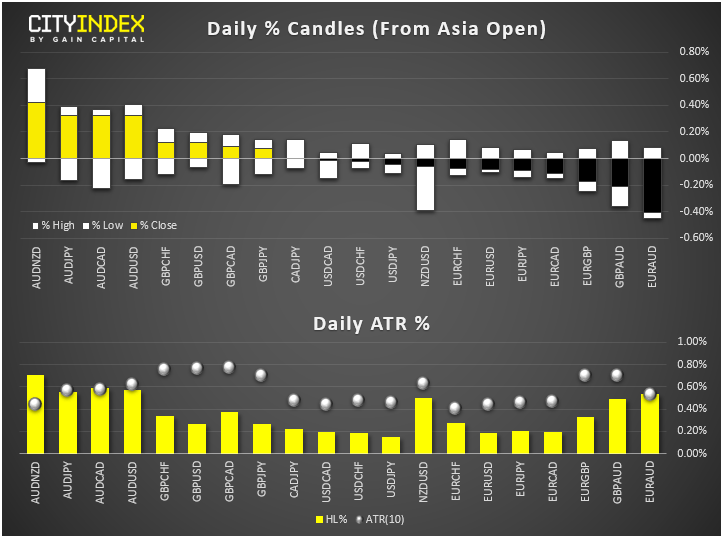

- Ahead of the US session, AUD was the strongest on CPI beat and EUR was among the weakest despite mixed-bag Eurozone data.

- Stocks in Europe still unable to find their feet after yesterday’s sell-off but were coming off their worst levels at the time of this writing.

- Gold was attempting to rise for the fourth day amid renewed weakness for government bond yields, and crude oil was in consolidation mode after yesterday’s rally and ahead of US oil inventories data later on.

- Sentiment remains cagey as investors weigh the impact of today’s positive earnings and mixed economic data against a potential rate cut from the Fed later on. There is growing uncertainty that there will be a breakthrough in US-China trade talks after Trump said the “problem with China [is that] they just don't come through" and "always changes the deal to their benefit."

Data recap

- Eurozone second quarter GDP was in light at +0.2%, a slowdown from +0.4% in Q1. There was good news from Germany for a change: retail sales grew by a solid 3.5% month over month compared to a 0.5% decline expected.

- Eurozone CPI was a tad higher than expected at 1.1% y/y versus 1.0% expected, but down from 1.2% in the previous month. This was not unexpected as German CPI had already come in ahead of expectations the day before. Eurozone core CPI was weaker than anticipated at 0.9%, slowing noticeably from 1.1% previously.

- Overnight

Earnings recap

- Lloyds shares slid 5% after taking a £500m PPI provision, while Next shares jumped 8% after the retailer lifted its sales growth forecast.

- European earnings are also coming in thick and fast now: Airbus beat earnings expectations, while L’Oreal said sales in North American slumped even if overall growth was the best in a decade. Meanwhile the major European banks reporting their results all beat expectations including Credit Suisse, BNP Paribas and BBVA.

- Apple shares rose +4% in afterhours trading last night as revenues topped expectations, although less than half of the group’s sales were generated from its flagship iPhone sales for the first time since 2012. This morning GE reported disappointing results, but shares rose 5% pre-market as the company lifted its EPS forecast.

Coming up

- The focus will now turn to the Federal Reserve’s policy decision, due at 19:00 BST with the press conference half an hour later at 19:30 BST.

- Ahead of this, we will have US ADP private sector payrolls report and oil inventories among a handful of data releases left for the remainder of today’s session:

Latest market news

Today 08:15 AM