Market Brief: Trump’s Tariff Time-Out Triggers Triumph for Risk Assets

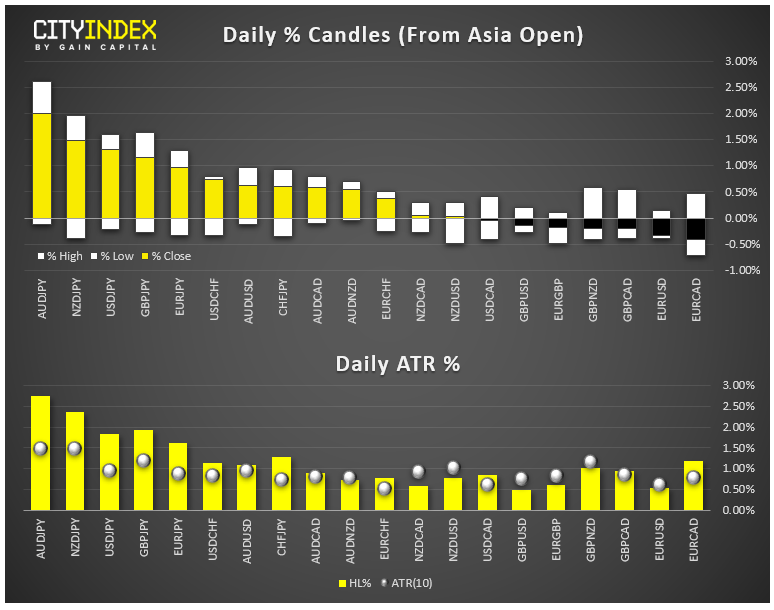

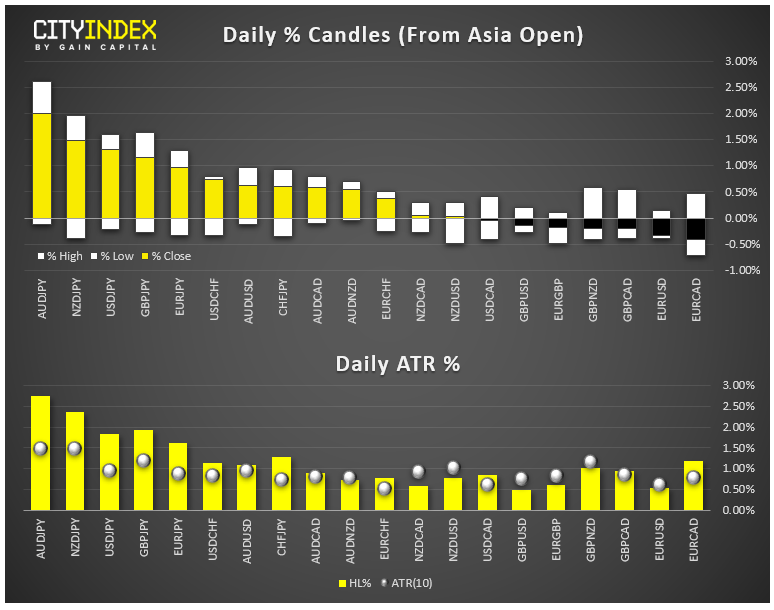

- FX:Risk trades were in demand, despite escalating protests in Hong Kong, making the aussie the day’s strongest major currency and the yen the weakest performer.

- US CPI figures printed a tick hotter than expected at 1.8% y/y, perhaps decreasing the likelihood of aggressive Fed rate cuts in the coming months.

- Commodities: Gold ticked lower on improving risk appetite, while oil (WTI) tacked on another 4% today.

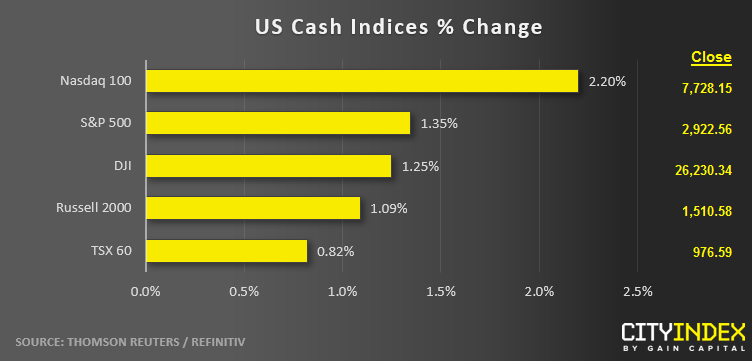

- US indices saw a big bullish turnaround on news that the US would delay 10% tariffs on certain goods, including cell phones, “to help a lot of people” ahead of the Christmas shopping season.

- Technology stocks (XLK) were the strongest sector on the risk asset revival; utilities (XLU) brought up the rear today.

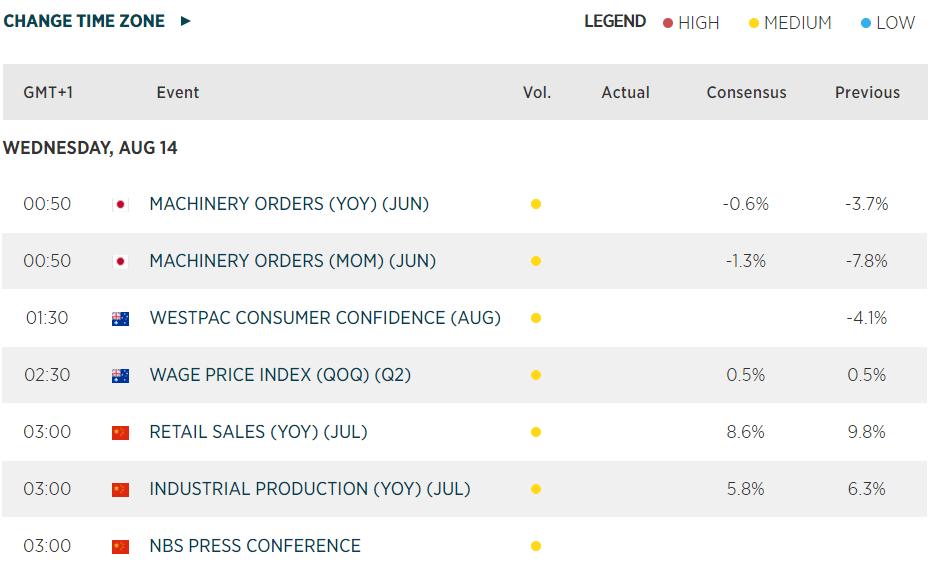

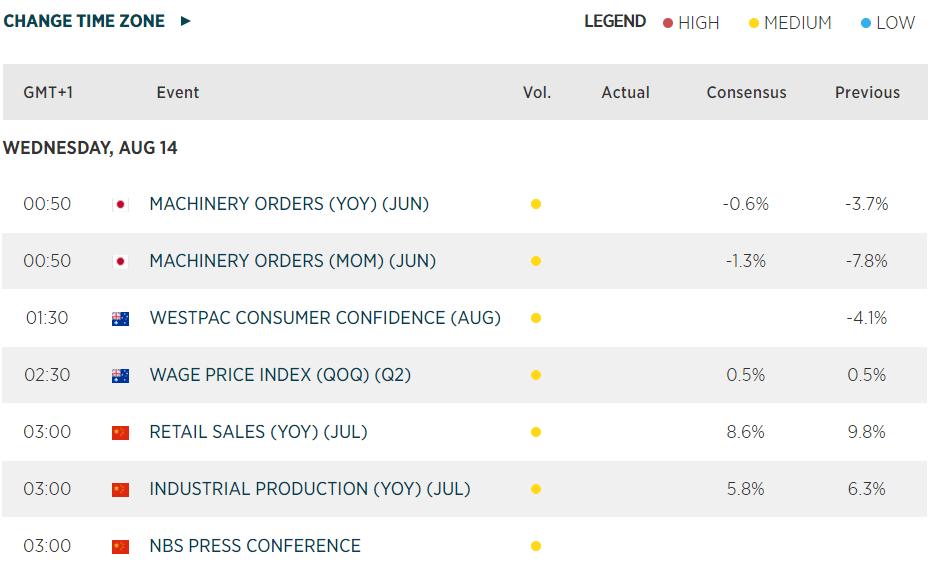

- Traders will be keeping a close eye on tonight’s release of Chinese industrial production, retail sales and fixed asset investment data for any negative impact from the ongoing trade tensions with the US.

- Stocks on the Move:

- Big tariff delay winners today include Apple (AAPL, +4%) and Best Buy (BBY, +6%)

- US-listed shares of JD.com (JD) surged 13% following a better-than-expected earnings report from the Chinese online retailer.

- Insurer Genworth Financial (GNW) gained 16% after announcing a deal to sell a majority stake in its Canadian subsidiary.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM