Market Brief: Traders Calm Their Middle East Fears

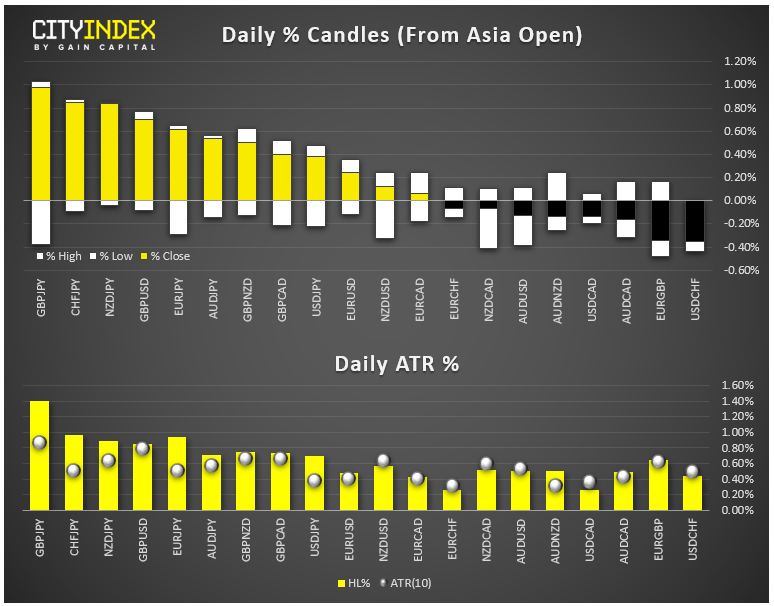

View our guide on how to interpret the FX Dashboard.

- After opening lower on fears of continued escalation in the tensions between the US and Iran/Iraq, markets calmed down throughout today’s US session with traders reassured by soothing comments from France and China. That said, most analysts still expect retaliation and another proverbial “shoe to drop” in one form or another.

- A separate situation to watch will be developments around the planned signing of a “Phase One” trade deal between the US and China next week - China’s Global Times signaled today that “a speedy signing is not of the essence,” raising fears of another potential delay.

- FX: The British pound was the day’s strongest currency, erasing Friday’s losses entirely. The Japanese yen and Australian dollar were the weakest, though AUD/USD is showing several bullish technical signs.

- Commodities: Oil finished the day essentially flat after a big rally in the Asian session; gold tacked on 1% and hit an intraday high near $1600 on the tensions in the Middle East

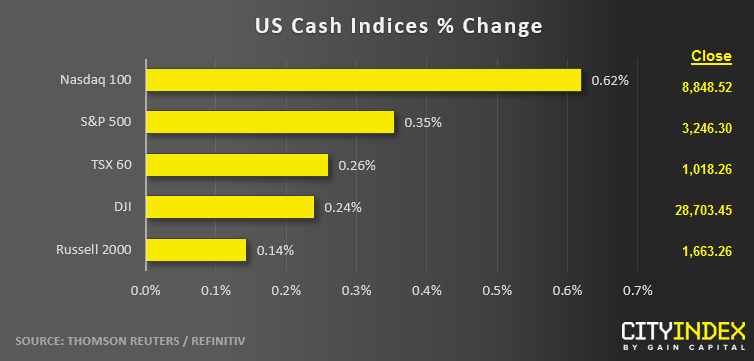

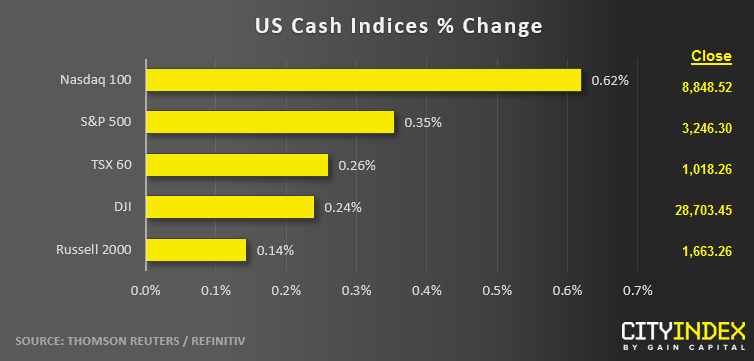

- US indices fought back from early losses to close modestly in positive territory.

- Communication Services (XLC) was the strongest major sector on the day. Industrials (XLI), Materials (XLB), and Financials (XLF) brought up the rear.

- Stocks on the move:

- FAANG stocks led the way higher for broader markets (FB +2%, AAPL +1%, AMZN +1%, NFLX +3%, GOOG +2%).

- Goldman Sachs (GS, +1%) and Morgan Stanley (MS, -0%) shrugged off news that their financial reporting practices were being investigated by the Bank of England.

- Retailer Bed Bath & Beyond (BBBY) gained 3% on a WSJ report that the company was selling roughly half its real estate to a PE firm.

*There are no market-moving macroeconomic releases scheduled for Tuesday’s Asian session*

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM