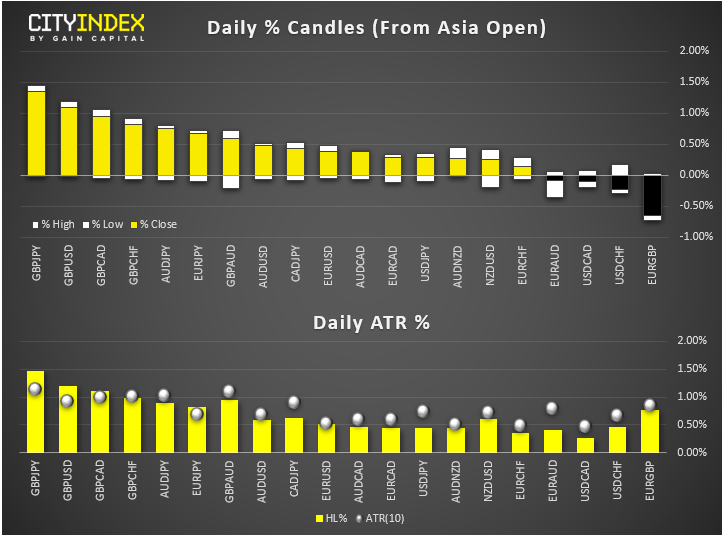

- GBP has been the standout winner in what has been a day of above-normal range in nearly all pound crosses. Could we see some retracement on profit-taking during the NY session? USD has extended its falls for the second day following that poor manufacturing PMI report from yesterday.

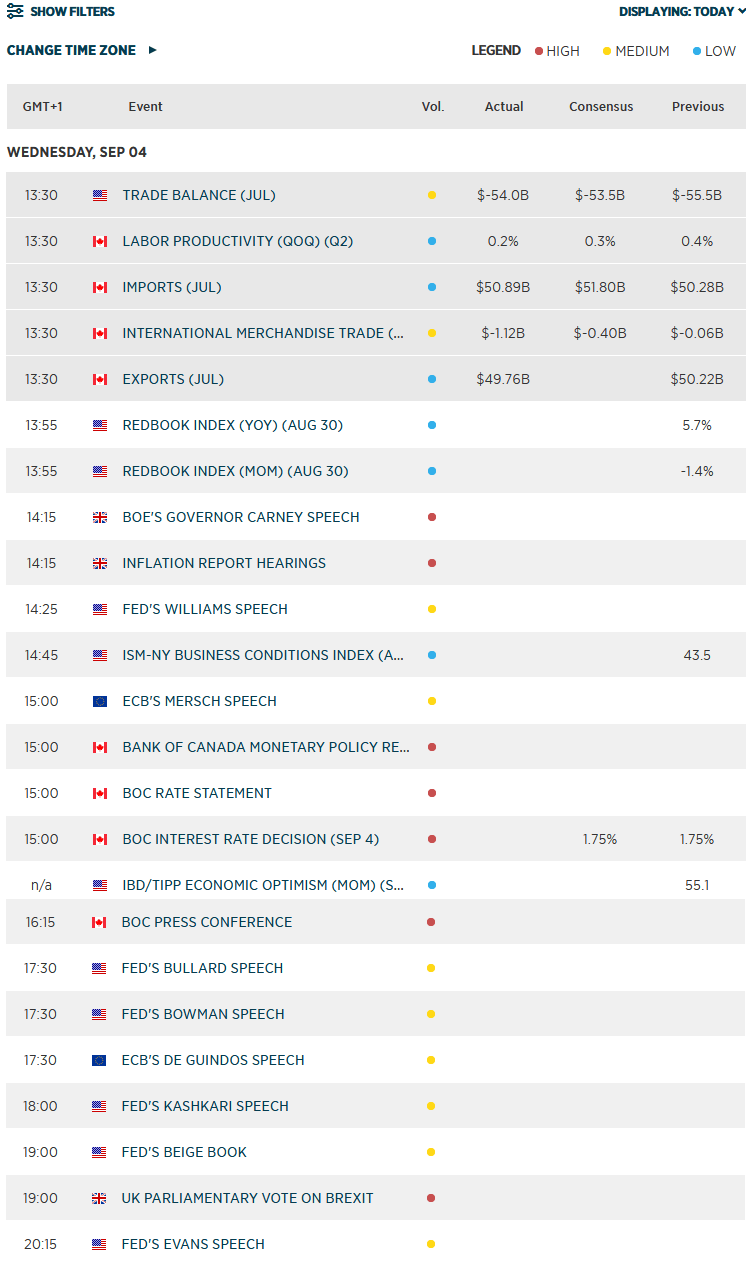

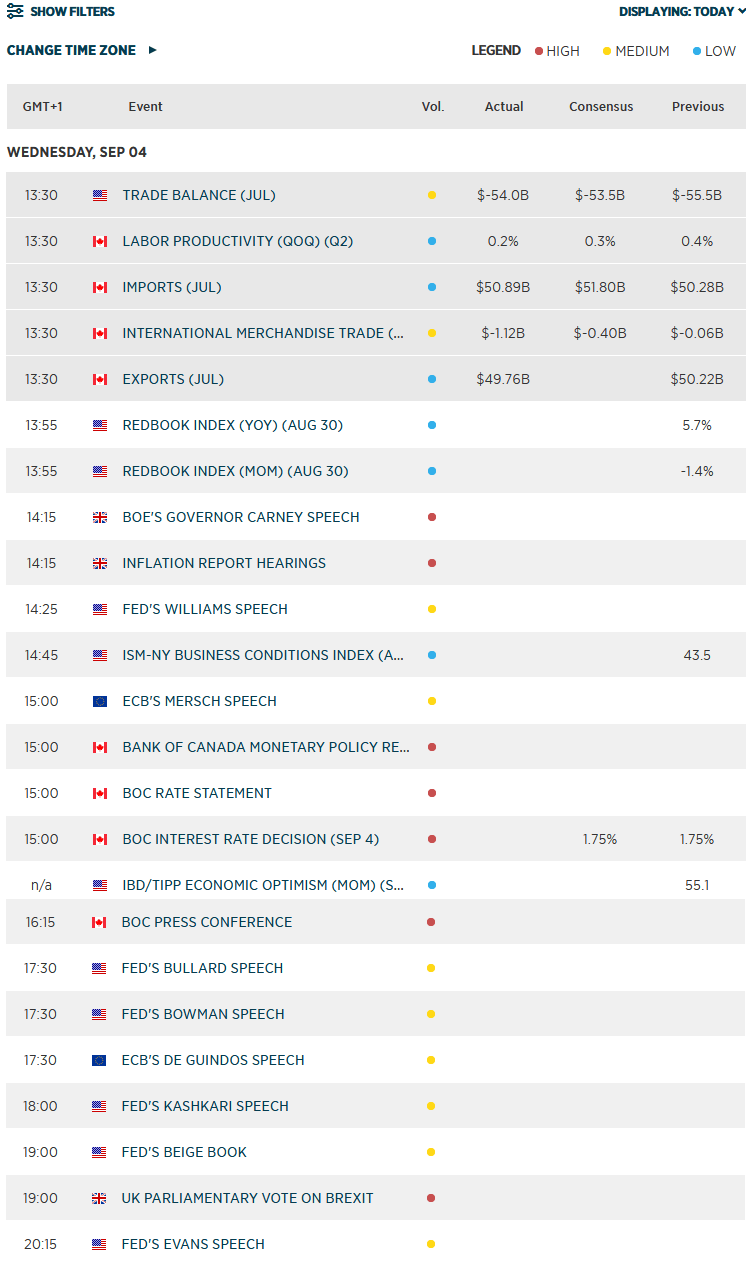

- UK services sector PMI was expected to ease to 51.0 from 51.4 but came in at 50.6 – not that it mattered much for the pound, which continued to squeeze the shorts after the dip to sub $1.20 proved to be short-lived yesterday as UK parament seized control of the Commons in a bid to stop no-deal Brexit. MPs will vote later today on a bill that would force Boris Johnson to ask EU for Brexit delay. If the bill passes, the PM has said will call a general election. Today’s services PMI miss means we now have a hat-trick of bad news after both manufacturing and construction PMIs fell deeper into contraction territory earlier this week. Earlier, Eurozone final services PMI was revised a tick higher to 53.5 from 53.4 thanks to upgrades for Germany and Spain. Eurozone retail sales came in -0.6% m/m as expected.

- BOC rate decision is today’s main event from North America, at 15:00 BST.

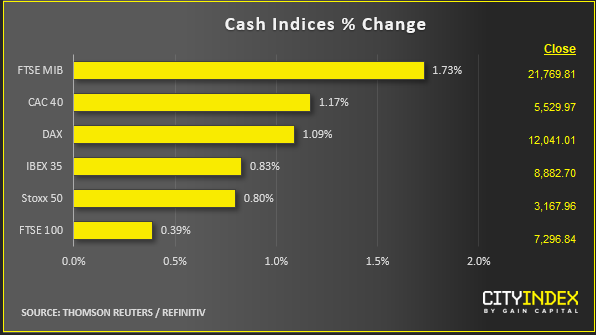

- Stocks have risen sharply so far in the day. Hong Kong chief executive Carrie Lam has said the controversial extradition bill has been fully withdrawn – this sent the Hang Seng sharply higher overnight, indirectly supporting the European markets and US index futures. We also had China’s services PMI come in ahead of expectations at 52.1 overnight. Along with the other markets, the UK’s FTSE 100 also rose – but less so because of the sharp rally in the pound.

- Crude oil also found support from the positive tone towards risk assets, even if the fundamental backdrop remains somewhat bearish for the black stuff.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM