Market Brief: No Fireworks from Fed Minutes, Retails Rejoice

- FX: Today’s trade had a slight risk-on flavor, with the risk-sensitive loonie and aussie leading the way higher among the majors and the “safe haven” Swiss franc bringing up the rear. The Canadian dollar was boosted in part by hotter-than-expected CPI data 2.0% y/y vs. 1.7% eyed).

- Traders ramped up preparations for a potential no-deal Brexit after an unnamed French official stated that the current baseline scenario is for a no-deal Brexit.

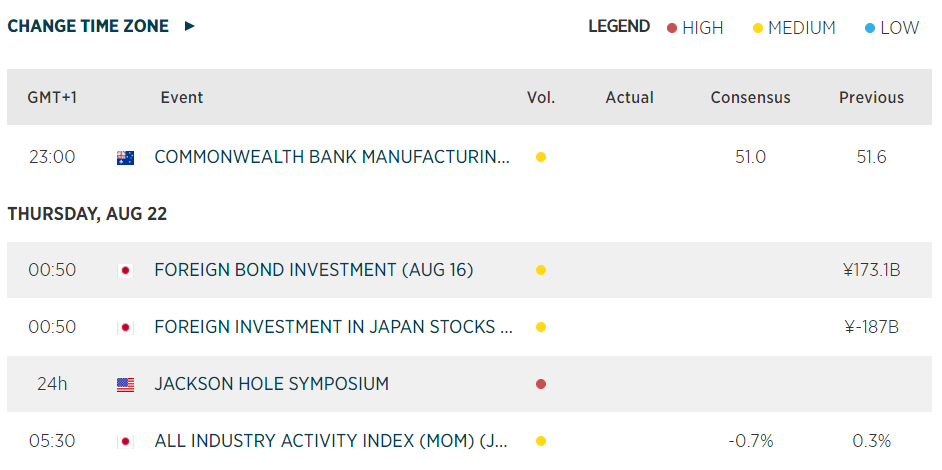

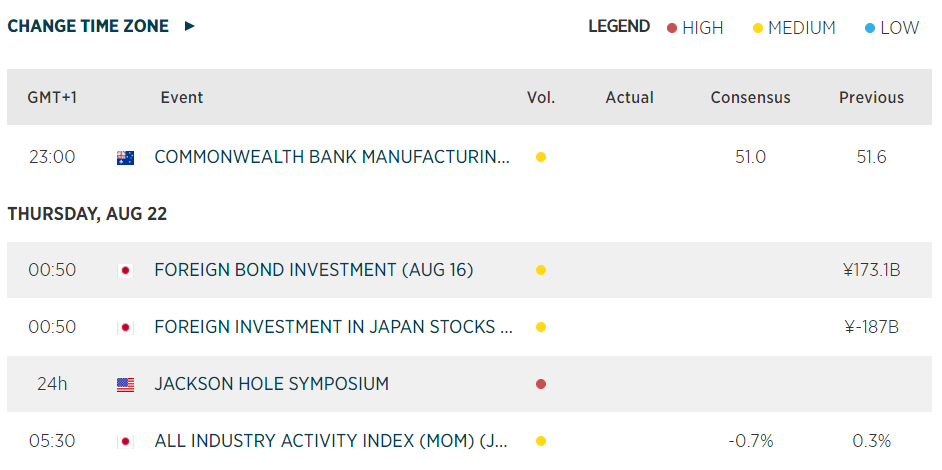

- The FOMC minutes affirmed the Fed’s relatively optimistic domestic/cautious global outlook and raised the stakes for Friday’s Jackson Hole speech by Fed Chairman Powell.

- Commodities: Both gold and oil fell by less than 1% on the day.

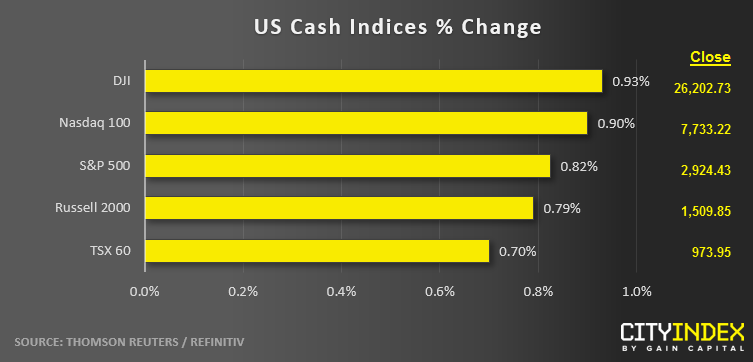

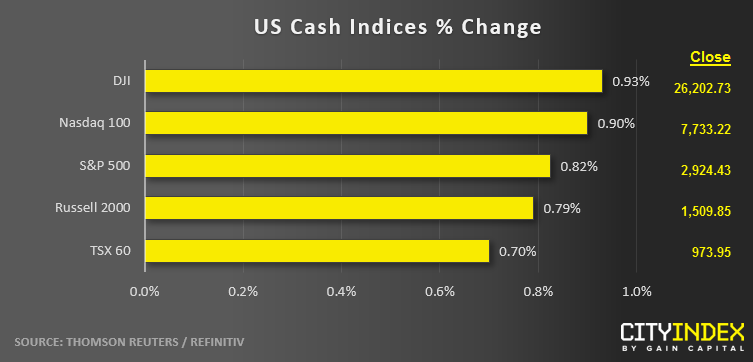

- US indices closed a bit below 1% higher on the day. Even FX traders are keeping a close eye on stock indices, given USD/JPY’s close correlation with the S&P 500.

- Consumer Discretionary (XLY) stocks led the way higher for the second straight day, with Consumer Staples (XLP) bringing up the rear. All eleven major sectors rose on the day.

- Stocks on the Move:

- Retailers rejoiced after strong earnings reports from Target (TGT, +19% to a record high) and Lowes (LOW, +10%).

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM