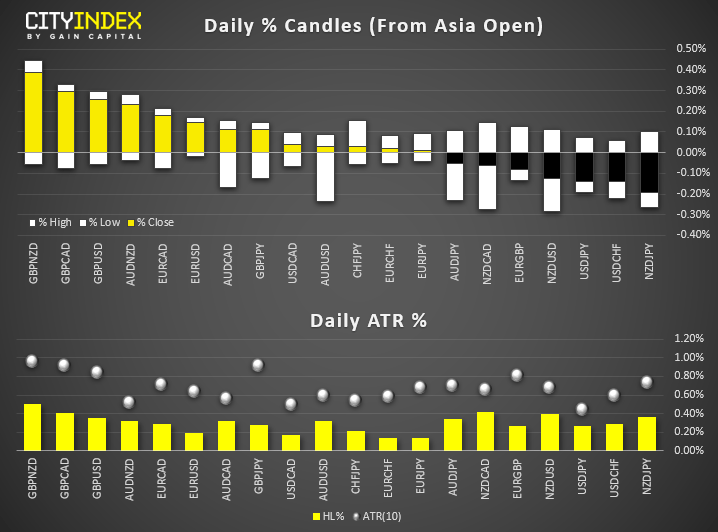

- A higher unemployment rate for Australia and negative full-time jobs print weighed on AUD, rekindling expectation for RBA to cut by 25 bps next month. AUD/USD is back below 68c and AUD/JPY is today’s biggest mover, exceeding its typical daily range by over 60%.

- Not wanting to miss out, New Zealand’s GDP underwhelmed, also bringing forward expectations for RBNZ to cut sooner.

- Bank of Japan stood pat on policy, keeping rates at -0.1% and the 10-year JGB target around 0%. However, they’ll re-examine price developments at their next meeting and see they need to pay more attention to the chance momentum towards their price goal has been hit.

- The yen broadly strengthened and the US10-JP10 year differential narrowed, weighing on USD/JPY which is on track for a bearish outside day.

- Asian stock markets have traded mix so far in today’s Asian mid-session post Fed FOMC where the Fed has slashed its key Fed funds rate lower as expected by 25 bps to 1.75% -2.00% but adopted a less dovish stance on future rate cuts.

- Hong Kong’s Hang Seng Index (HIS) has retained the “top underperformer” spot where it tumbled by -1.24% after a relief bounce seen yesterday. Share price of AIA Group, the highest weightage component stock in the HSI is the biggest drag on the Hang Seng Index where it has dropped by almost 3% and printed a 10-day low of 76.50. Secondly, negative spill-over sentiment from a stronger USD/CNH (offshore yuan) can be another catalyst where the pair has continued its up move since 13 Sep low of 7.0311 and printed a 5-day high of 7.1065 seen in today’s Asian session.

- Japanese central bank, BOJ has kept its key short-term interest rate unchanged at -0.10% and maintain its yield curve control programme to guide the 10-year government bond (JGB) yield at around 0%. However, it has signalled the chance of expanding monetary stimulus as early as its next policy meeting in Oct after it issued a stronger warning on a deteriorating economy. The Nikkei 225 has continued to extend its gains and it is now coming close to 5-month high of 22362 printed in Apr 2019.

Up Next

- BOJ Governor Kuroda press conference at 0600 GMT where market participants will look for hints on whether BOJ will start to implement more easing policies in Oct that may see the USD/JPY to recover from its current intraday low of 107.79.

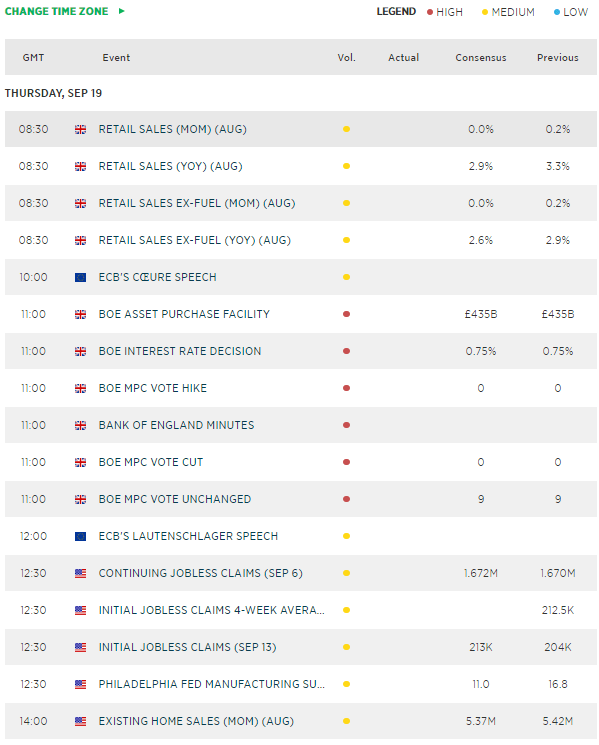

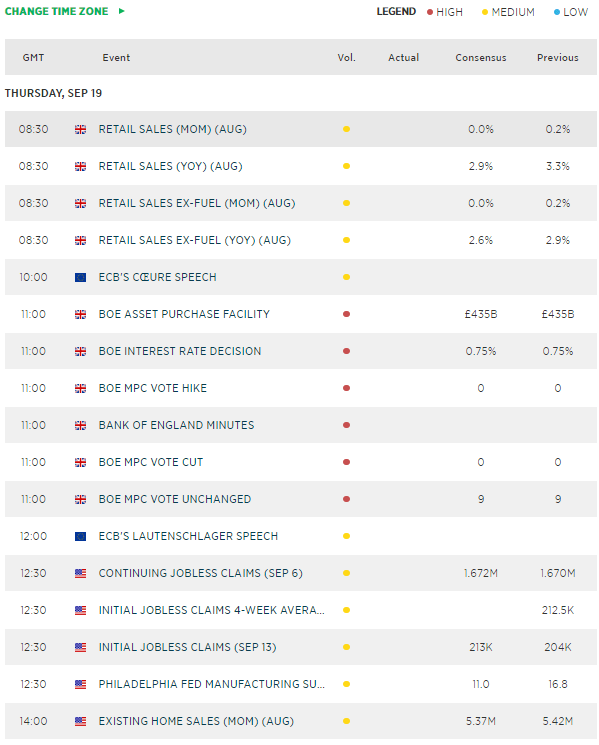

- U.K Retail Sales for Aug where consensus is set at 0% m/m and 2.9% y/y; an expectations of a slower growth trend from 0.2% m/m and 3.3% y/y recorded in Jul.

- BoE monetary policy meeting outcome where consensus is set for a no change in the key short-term interest at 0.75%. The focus will be on the meeting minutes for the highlights on the economic impact from the latest developments on Brexit.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM