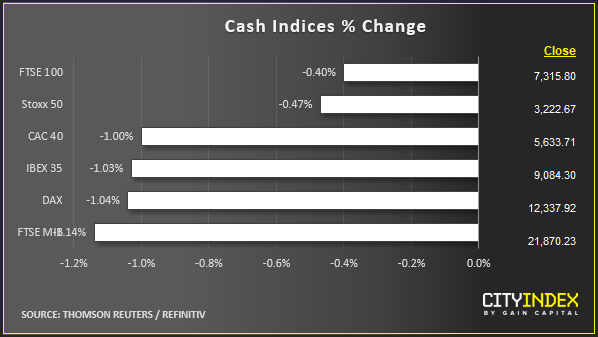

Stock market snapshot as of [23/9/2019 1:24 PM]

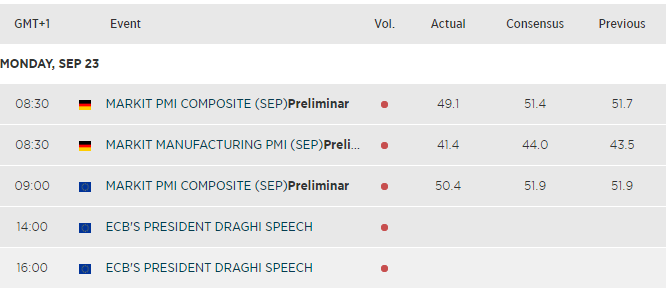

- IHS Markit’s Manufacturing PMI series for the most pivotal European economies has given markets here a cold shower to start the week. Germany’s 41.4 print, well below the 50 level above which signifies growth, was “the sharpest decline in business conditions across the goods-producing sector since the depths of the global financial crisis in mid-2009” said the data provider. Euro zone’s largest economy may not grow for the rest of the year, Markit adds

- Service sector gauges were not much better with new business in ‘soft goods’ industries falling at the faster pace in more than six years. All key readings in the data dump disappointed

- Already struggling stock indices remained pinned near the day’s lows immediately following the data, though subsequently have begun to inch higher. If nothing else, the readings, which may equate to fractional or no GDP growth in the current quarter, all but guarantee that ECB stimulus efforts will expand and be sustained. How effective they may be is another question entirely

- The single currency has seen no such counter-reaction, though as is often the case with macroeconomic data, the market looks to have ‘sensed’ the outcome well in advance triggering a dive from $1.1056 on Sunday night to as $1.0966

- Wall Street futures also flicked off weakest levels, though remained poorly. For now, indices seem unable to regain the poise the showed following reassurances from Washington about a cancelled visit by a Chinese delegation to U.S. farms

- Uncertainty also persists about the state of damage to two Aramco plants attacked several days ago, despite Saudi assurances. Reports suggest that full repairs may take many months rather than the few weeks officially advised. Both Brent and WTI crudes were lower on the day, though both remain at post-attack elevations around $64/bbl. and $57.7 respectively

Stocks/sectors on the move

- Europe’s financial industry is the biggest slider, followed by the mining-orientated materials sector. Steel shares stand out most, with ArcelorMittal tanking 6%, shoved lower by a brokerage downgrade and a fall of spot copper to support as anxieties rebuild over a U.S. trade deal with chief consumer China

- Precious metals miners are being seen in a different light, lifting stocks like Centamin and Hochschild 1%-3%, aided by gold’s safe-haven bid

- Thomas Cook’s bankruptcy reverberates around markets, even though most stock market participants exited over the course of a year in which the shares collapsed 93%. Shares in rivals TUI and On the Beach are reaping some grim reflexive benefit, rising 6%-7%

Stock market snapshot as of [23/9/2019 1:24 PM]

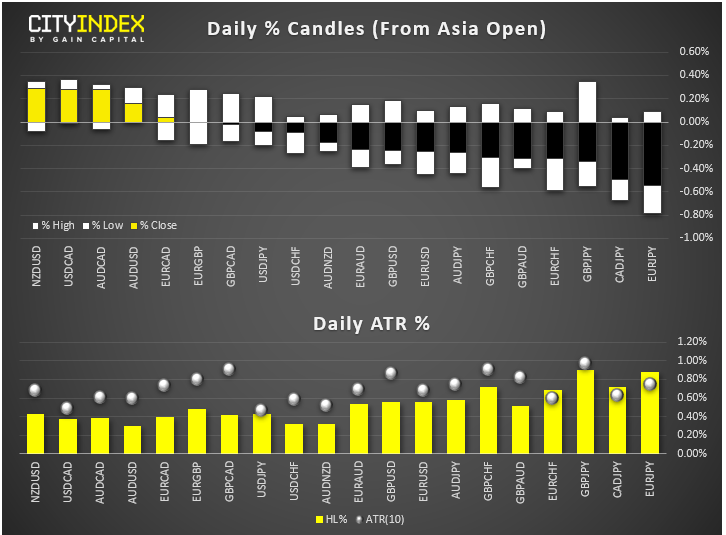

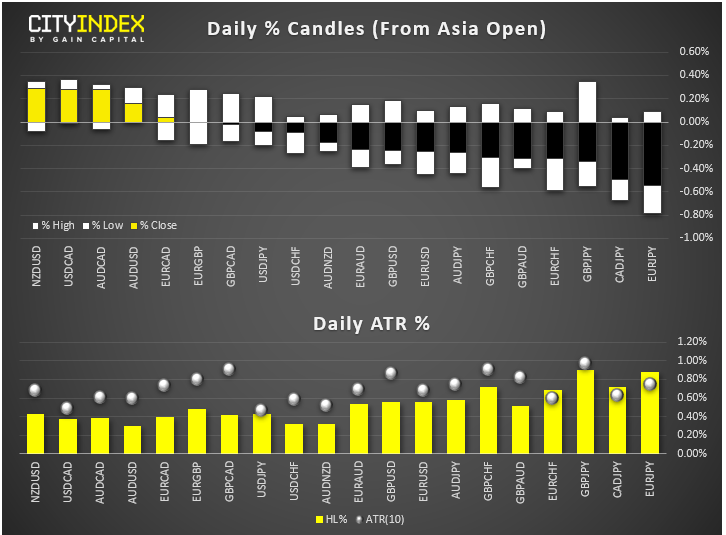

FX markets and gold

- A yen surge against the euro confirms Monday’s switch towards a general risk-off atmosphere as the most contemporaneously challenged currency meets the typical recipient of stressed-out demand. Japan’s currency also shone against the loonie and sterling, just to ram the message home

- Outside the majors, eastern European currencies also catch the eye. The euro-area PMI let-down douses notions of a bottom, sending the zloty and forint tumbling. It’s a warning flash about a possible flare-up of emerging market currency stress, particularly if the dollar resumes its recent safe-haven characteristics. A host of Fed speakers on tap this week will go some way to showing which way the wind blows with regards to any re-firming of the greenback that could add to suspected tighter dollar conditions that last week’s repo drama might have been an alert of.

Upcoming economic highlights

Latest market news

Today 08:15 AM