FX Brief:

- BoJ’s Kuroda said the central bank will ease without hesitation and pay particular focus to the output gap and heightening risks. BoJ held policy steady this month but they appear to be laying the foundations for a lively meeting.

Quiet on the economic data-front or market moving headlines, it was narrow ranges for FX pairs overall. All majors and crosses remain within their typical daily ranges, but we could see EUR, NZD or AUD pairs break out of range looking at today’s agenda. - Japan’s manufacturing PMI contracted for a fourth consecutive month and at its fastest rate since February. Service PMI slipped to 52.8 but remain in expansive territory.

- Producer prices in South Korea fell -0.6% YoY in September, making it the second contraction in two months.

- EUR/USD is consolidating just below 1.10 ahead of German IFO sentiment. AUD/USD has broken above yesterday’s small, bullish inside candle ahead of Philip Lowe’s speech. NZD/USD has broken to a two-day high ahead of the RBNZ meeting overnight.

Equity Brief:

- Equities inched higher on trade hopes, after US Treasury Secretary Steven Mnuchin said trade talks between US and Chia are set to continue next month. Yet gains were modest at best with global growth concerns remaining on investors radars.

- China have granted tariff waivers for around 23 million tonnes of US soybean imports.

- The US-Japan trade pact may have hit a slight bump in the road after officials sought assurances that the Trump administration won’t impose tariffs on Japanese-built cars and auto-parts. Regardless, Japanese officials believe they’ll have a deal signed by mid-week.

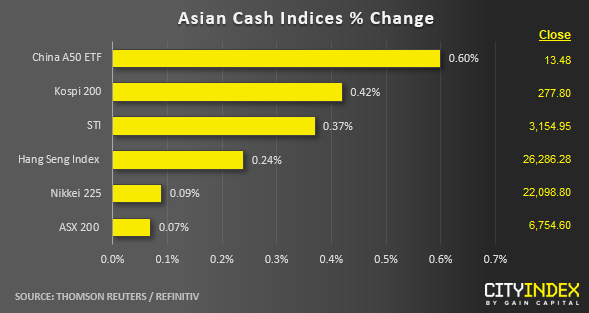

- Equity indices for South Korea and China are leading the pack, although volatility remained contained overall.

- The ASX200 was initially led higher by financials and gold stocks as it tries to tally a 6th consecutive bullish week, although the index is currently flat heading into the close. At the time of writing, 38.9% of stocks advanced, 37.4% declined and 23.6% were unchanged.

Up Next

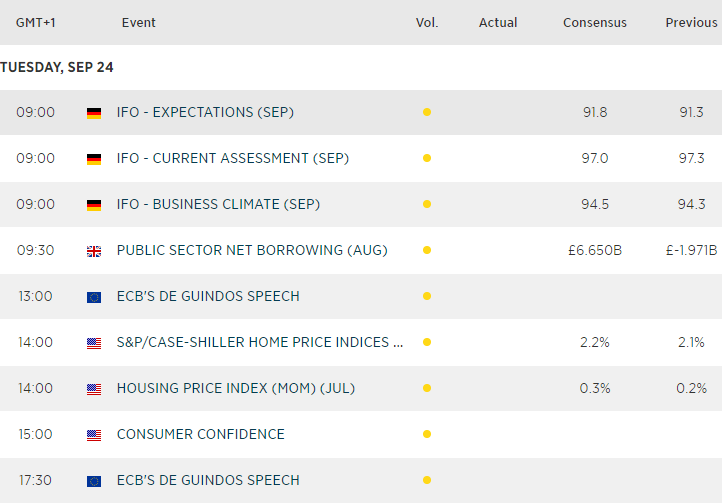

- Weak PMI data from Germany and the Eurozone weighed on Euro crosses yesterday and placed EUR/USD below 1.10. German IFO has is another data set which screams recession for Germany, with business climate, current conditions and expectations indices all firmly within the realms of pessimism. As it stands, climate and expectations are forecast to rise 0.1 and 0.5 ticks respectively, whilst current conditions is expected to fall by -0.3. Yet given the slew of weak data from Germany, it would take quite a beat for it t have a materially bullish impact on EUR/USD.

- RBA’s Philip Lowe speech title “am economic update” warrants a close look, especially now markets are expecting RBA to cut at their next meeting. Public comments have generally been a better guide to future policy over their monetary policy statements, with today’s speech providing the perfect platform for future guidance and move the Aussie.

Latest market news

Today 08:33 AM