When will Lloyds release its earnings?

Lloyds Banking Group is scheduled to release its quarterly earnings on Wednesday 27 July before the market open.

Lloyds earnings consensus

Wall Street forecasts revenue will come in at $5.16B and expects $0.07 in EPS.

Lloyds earnings preview

Lloyds Bank is a leading British bank and is often seen as a barometer of the country’s economy; Unlike banks like Barclays and HSBC, Lloyds does not have any major international operations, providing a clearer read on the UK economy itself. In addition, the bank derives most of its revenue from retail and business banking; through Halifax, it is the biggest mortgage lender in the UK.

From a macroeconomic perspective, the bank may benefit from rising interest rates in the UK as the Bank of England seeks to curtail inflation. Generally speaking, banks generate more net interest income when interest rates rise, and this impact will be particularly salient for a consumer- and business-focused operation like Lloyds. That said, the recent rapid rise in rates risks slowing transaction volume in the mortgage market, so even if the company makes more per mortgage, it could still face headwinds from lower overall mortgage volume.

Outside of that, another factor that traders will be watching in this quarter’s earnings will be credit losses. Lloyds has historically focused on the prime+ portion of the market, suggesting that its loan book should be relatively resilient to worsening economic conditions. Analysts will be watching the company’s loan loss reserve for insight into how concerned executives are about the future of the UK economy.

Where next for Lloyds stock?

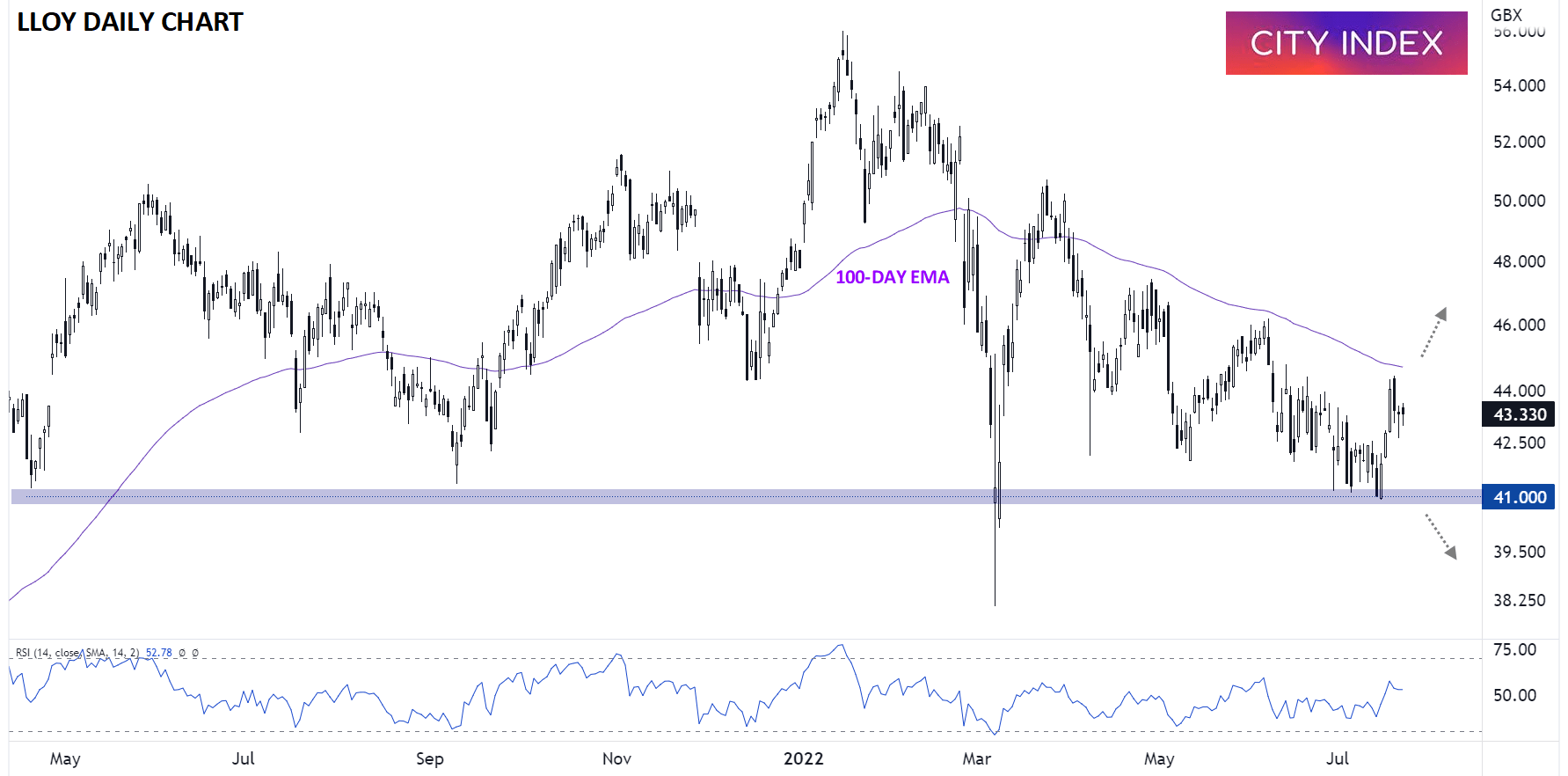

As the chart below shows, LLOY has been trending lower along with the broader market since peaking at the start of the year. That said, shares have recently bounced from support at their previous lows in the 41.00 area, signaling some optimism ahead of Wednesday’s results:

Source: StoneX, TradingView

Looking ahead, bulls will be watching to see if prices can break above the 100-day EMA in the 45.00 area to open the door for a more sustained rally into the upper-40.00s, whereas a break below support in the 41.00 area would be a bearish sign and open the door for continued weakness toward the year-to-date lows near 38.00.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade