- Market made sharp U-turns following the US inflation report, where CPI did not soften as much as expected.

- US CPI rose 8.3% y/y compared with 8% expected, down from 8.5% previously. Core CPI rose 6.3% y/y from 5.9% previously. High food and rent prices were main drivers behind the price rises.

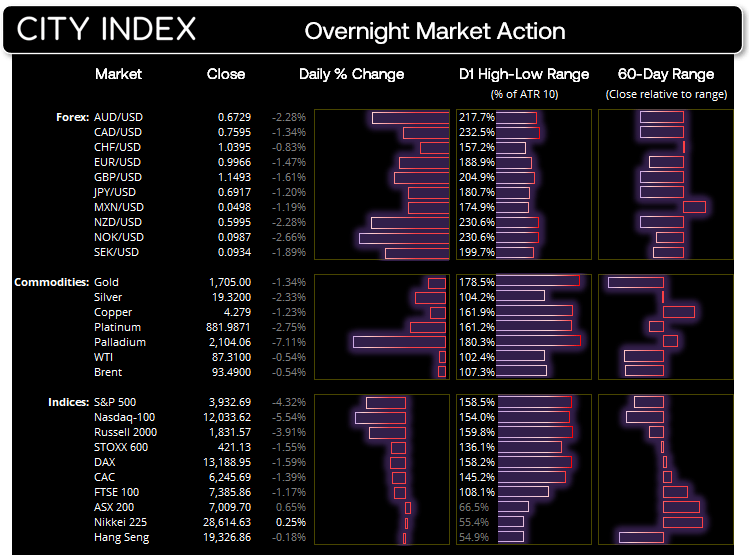

- The US dollar was broadly higher with many major FX pairs producing daily engulfing candles. Most G10 pairs saw a daily range of >200% their average daily range.

- Asian indices expected to endure a volatile and bearish day’s trade, if Wall Street is anything to go by. The Nasdaq 100 fell over 5% and closed at the low of the day, making the Nikkei a likely index to lead losses in today’s Asian session.

- Odds of a 100bp Fed hike next week are now 33% (0% before CPI), and a 36.1% chance of rates raising to 4.75% by May 2023 according to money markets pricing.

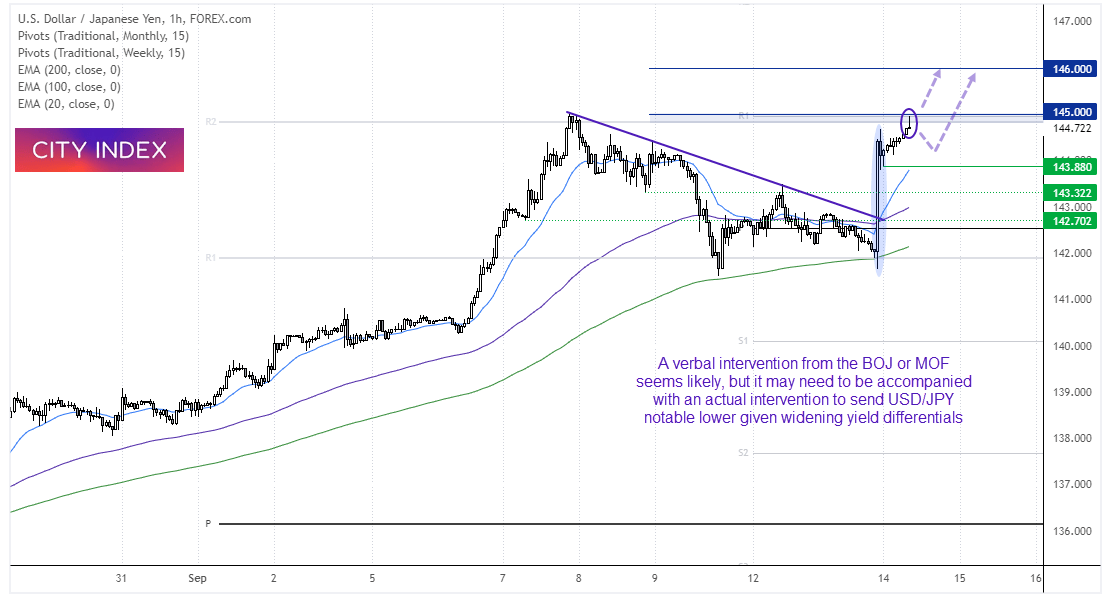

Yield differentials pushed USD/JPY back up to 145, a move which likely has BOJ’s Kuroda rolling his eyes. We recently saw a concerted effort from the BOJ, MOF and government to jawbone the yen but with limited success. And part of that success could be attributed to a weaker dollar at the time. And with expectations of higher Fed rates and widening yield differentials in favour of the dollar, it could make further jawboning efforts feel like they’re shouting into the wind.

So perhaps the BOJ will be forced to defend the JGB market to weaken their currency once more, because in light of recent developments I suspect jawboning would be like shouting into the wind without an 'actual' intervention.

USD/JPY 1-hour chart

USD/JPY may be on the cusp of breaking to its highest level since 1998. Widening yield differentials remain favourable for a breakout with the only caveat being whether BOJ Governor Kuroda will try to jawbone the currency lower. As 145 is a big round number and previous swing high, we may see an initial retracement before the anticipated breakout arrives. But we’re at that stage of the rally where simply aiming for round numbers may suffice – for traders and BOJ or government officials.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade