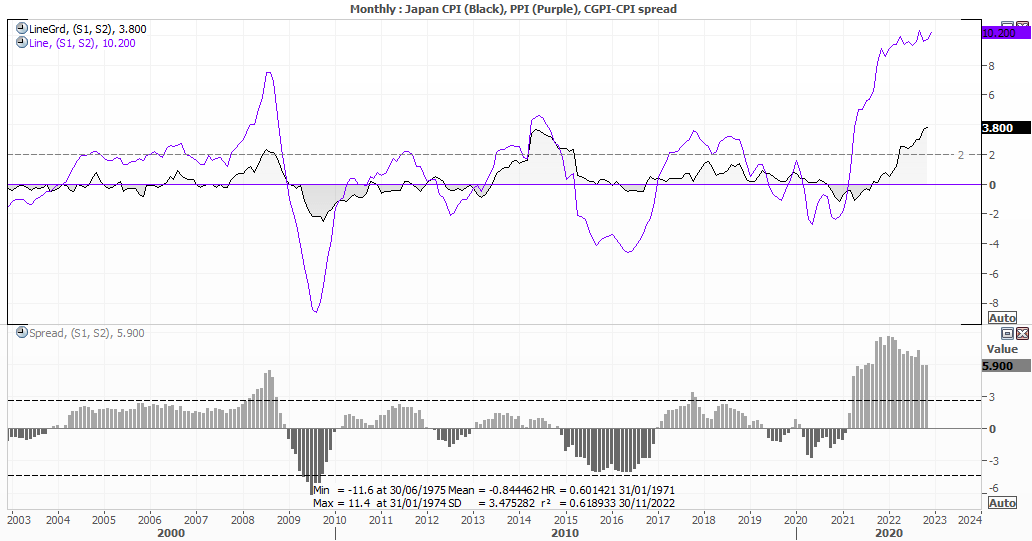

Japan’s producer prices rose 10.2% y/y in December, which us well above the 9.5% forecast and 9.7% prior. It’s the second highest print since 1980, and just 1 percentage point below the 10.3% print set in September. With consumer prices also trending higher and forecast to rise to 4% on Friday, we should be on guard for a hotter-than-expected print.

It also piles further pressure on the BOJ to step away from their ultra-loose monetary policy. The BOJ meet on Wednesday and, whilst they’re expected to maintain rates at -0.1%, there is a decent chance they will announce some form of QT (quantitative tightening). They surprised markets in their January meeting by adjusting their yield curve control – which is something they denied they intended on doing for months ahead of that very action – by allowing the 10-year JGB to trade between +/- 0.5% from +/- 0.25%.

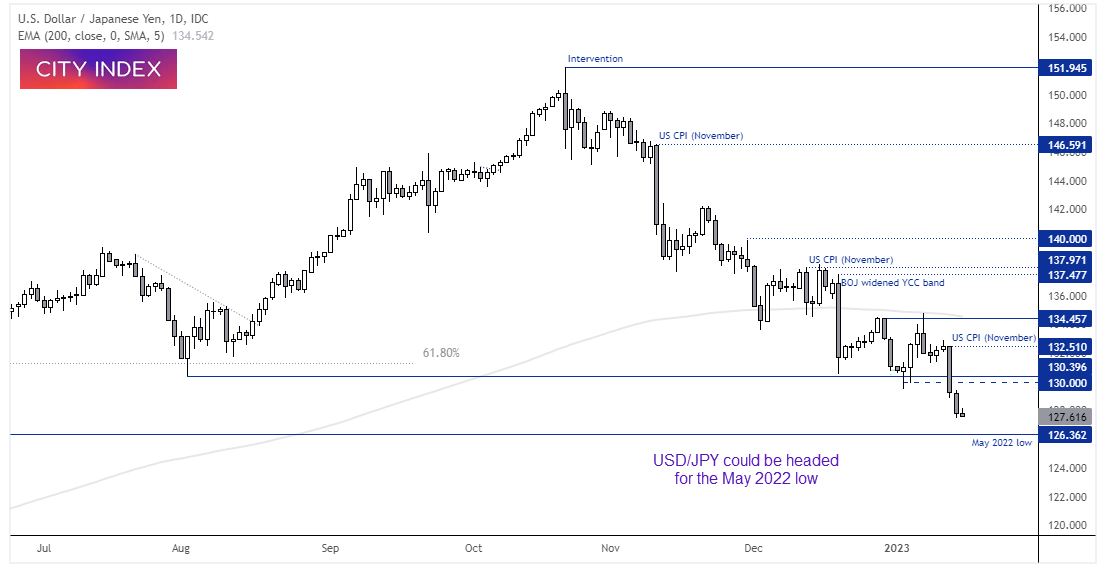

USD/JPY daily chart:

The surprise move was seen by many as a first step towards raising interest rates this year, and that has seen the yen rise against ahead of Wednesday’s meeting – with softer US inflation and expectations of a less aggressive Fed pushing USD/JPY down to an 8-month low.

The daily chart remains within an established downtrend, with softer US inflation data accounting for three of the lower highs. The 200-day EMA provided resistance before its latest move lower, and Thursday’s solid close beneath 130 and the August lows showing bears are firmly back in control. Today’s hot PPI print has seen a bid for the yen ahead of Wednesday’s BOJ meeting and Friday’s CPI print, and we suspect it could test or even break the May 2022 low ahead of these key evets given it is less than a day’s trading range away.

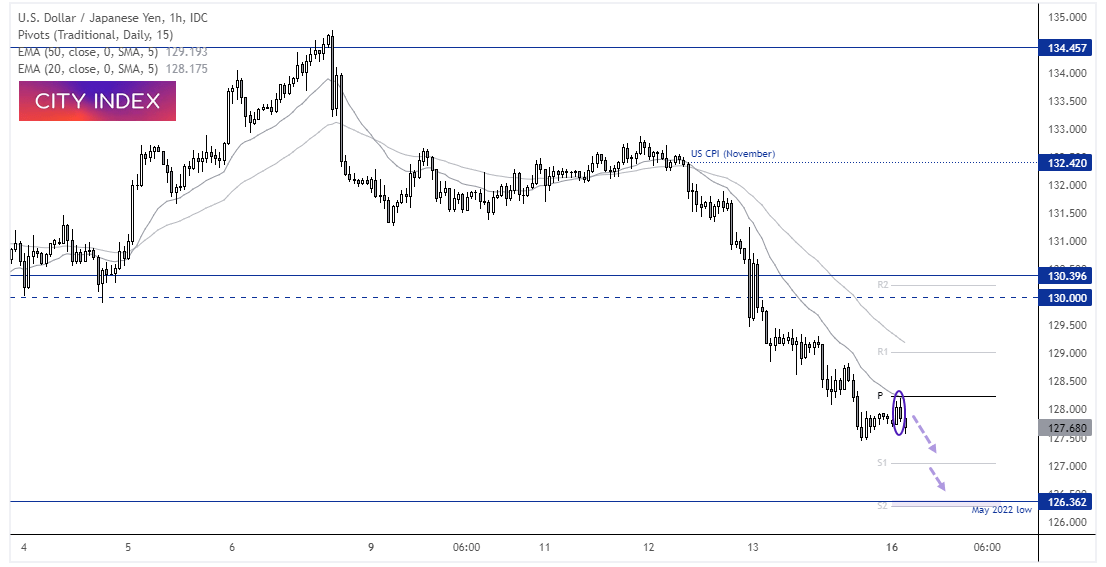

USD/JPY 1-hour chart:

The 1-hour chart remains within an established downtrend, and a shallow retracement met resistance at the 20-bar EMA and daily pivot point. A two-bar bearish reversal has formed which suggest a swing high has formed, and our bias remains bearish beneath today’s high and for a run to 127 / daily S1, a break beneath which brings the 126.36 / daily S2 pivot into focus.