What a difference one weekend can make!

We saw a massive risk-off move in Friday’s low-liquidity, holiday-shortened session, with WTI crude oil collapsing more than -12%, the US dollar index losing nearly -1%, and major US indices shedding more than -2%, as spooked traders opted to “sell first and ask questions later” about the new Omicron COVID variant.

After a weekend of research and reflection, the market has determined that Omicron is not (yet) reason to panic. Indeed, based on early evidence, the associated symptoms appear to be relatively mild so far, potentially avoiding the need for broad travel and economic restrictions, even if Omicron ultimately proves more transmissible or immune-resistant than the Delta variant.

With the perceived odds that Omicron is the “worst case” COVID variant (read: both more virulent and deadly) falling, traders are rushing to reverse Friday’s panicked selloffs. Both WTI crude oil and the US dollar have recovered about half of Friday’s losses so far, and more impressively, major US indices like the Nasdaq 100 (US Tech 100) have erased almost all of Friday’s losses already.

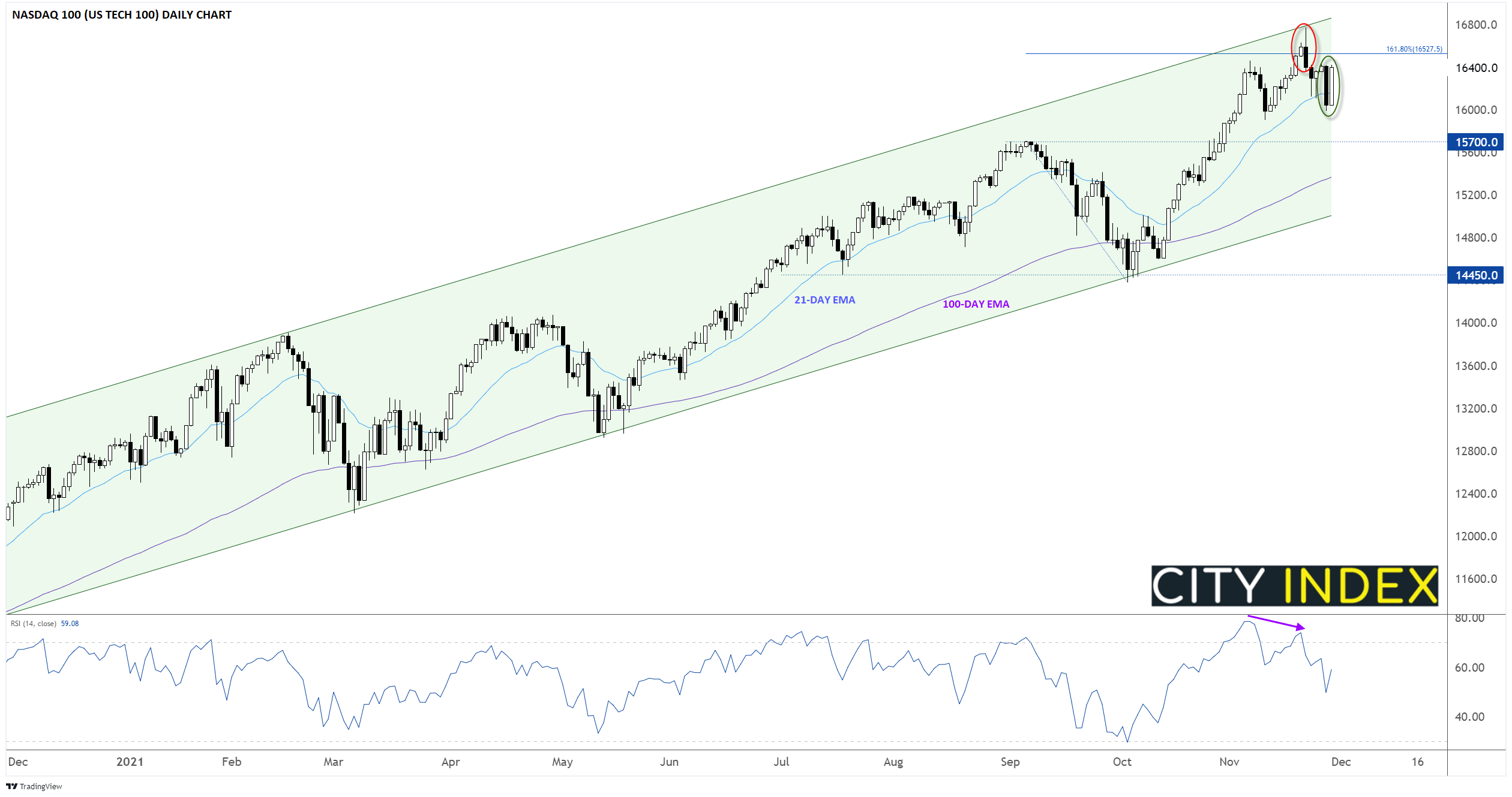

Nasdaq 100 technical analysis

Speaking of the Nasdaq 100, the tech-heavy index remains comfortably within its longer-term bullish trend, with prices bouncing from the 21-day EMA near 16,000 so far. Last Monday’s bearish reversal candle near the top of the bullish channel and the 161.8% Fibonacci extension of the September pullback remains a clear barrier to continued strength, but as long as the index can hold above its 100-day EMA near 15,300 and within the well-established bullish channel (support near 15,000), traders should favor buying short-term dips for a potential “Santa Claus Rally” to fresh record highs by New Year’s Day:

Source: StoneX, TradingView

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade