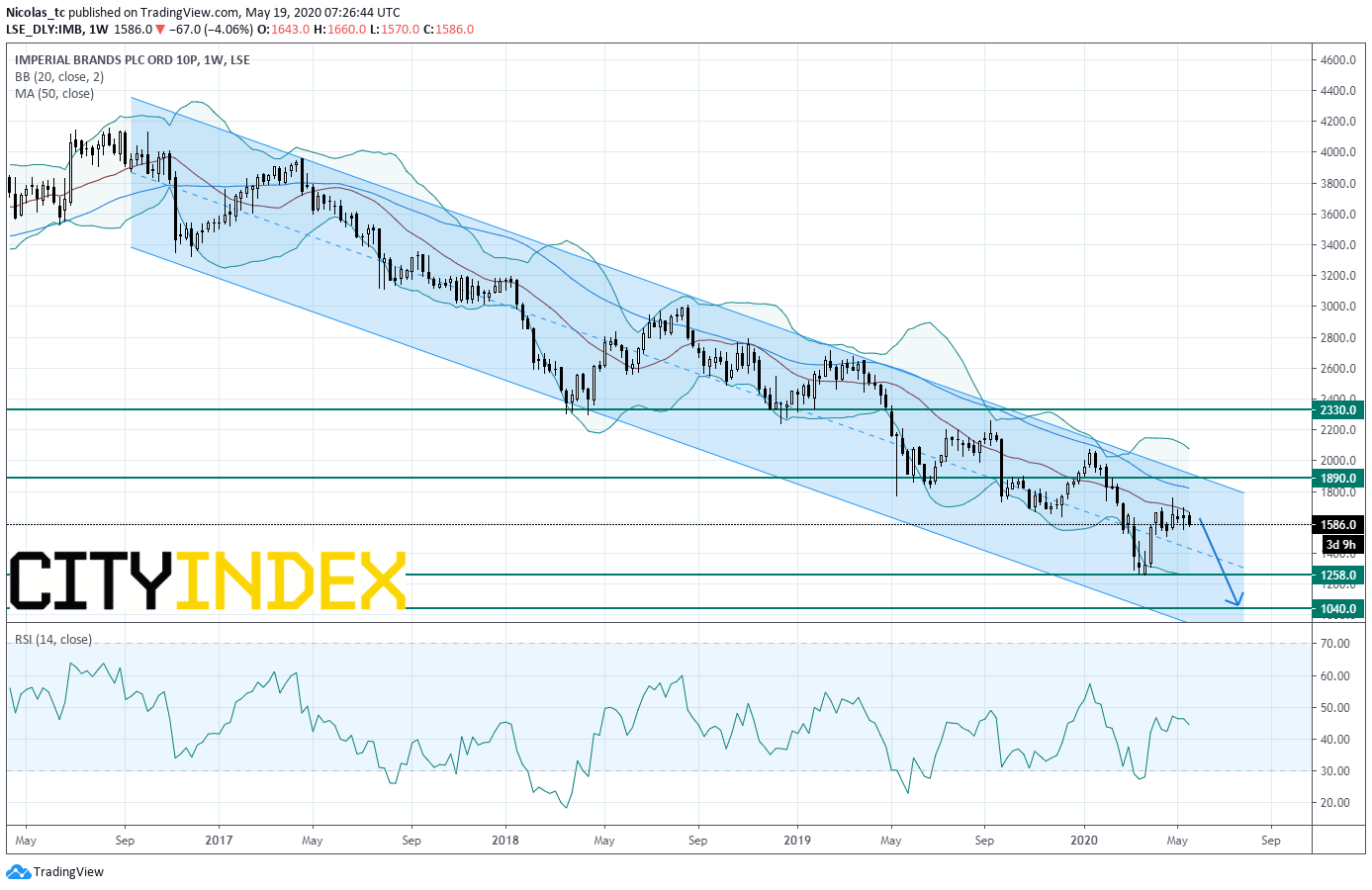

From a technical perspective, the stock price remains in a down trend within a long term bearish channel. The declining 50-day simple moving average is playing a resistance role. The Relative Strength Index (RSI, 14) remains below its neutrality area at 50%. As a consequence, a continuation of the down trend is expected.

Readers may want to consider the potential for short positions below the resistance at 1890p (channel upper boundary) with a first target at 1258p and then 1040p.

Only a break above 1890p would invalidate the bearish scenario and would call for a reversal up trend towards the horizontal resistance at 2330p.

Imperial brands: new down leg in sight?

Imperial Brands, the tobacco company, reported that 1H operating profit dropped 19.6% on year to 925 million pounds on revenue of 14.67 billion pounds. The Company said it will rebase its dividend by one third, implying an annual dividend for 2020 of 137.7p per share.

The Company said: "We are disappointed with these results; COVID-19 has so far had only a small impact on trading but we expect this to be more pronounced in the second half due to continued pressures on our duty free and travel retail business."From a technical perspective, the stock price remains in a down trend within a long term bearish channel. The declining 50-day simple moving average is playing a resistance role. The Relative Strength Index (RSI, 14) remains below its neutrality area at 50%. As a consequence, a continuation of the down trend is expected.

Readers may want to consider the potential for short positions below the resistance at 1890p (channel upper boundary) with a first target at 1258p and then 1040p.

Only a break above 1890p would invalidate the bearish scenario and would call for a reversal up trend towards the horizontal resistance at 2330p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM