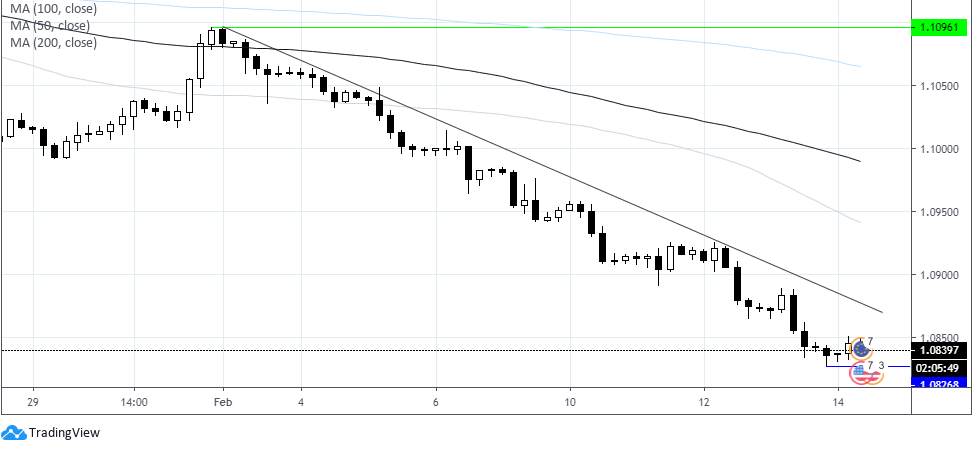

The euro is slipping lower in early trade on Friday, hitting a fresh 34 month low of $1.0828. EUR/USD has fallen in every session in February, bar one, where the gains were so small they are hardly worth mentioning.

February to date EUR/USD has shed 2.2% of its value, extending losses of 1% from January.

German economy vs US economy

Today’s weakness comes following stagnation in the German economy. QoQ Europe’s largest economy recorded 0% growth. However, this is just the tip of the iceberg, industrial production and factory orders are falling, the manufacturing sector remains deep in contraction and the impact of coronavirus remains unknown but potentially hard hitting. Europe’s largest economy is already on its knees and there could be another kicking to come.

On the other hand, recent data from the US paints a solid picture of the US economy. Strong job creation, 3% wage growth and recovering manufacturing sector. Retail sales due for release later today are expected to show strong consumption.

Today’s weakness comes following stagnation in the German economy. QoQ Europe’s largest economy recorded 0% growth. However, this is just the tip of the iceberg, industrial production and factory orders are falling, the manufacturing sector remains deep in contraction and the impact of coronavirus remains unknown but potentially hard hitting. Europe’s largest economy is already on its knees and there could be another kicking to come.

On the other hand, recent data from the US paints a solid picture of the US economy. Strong job creation, 3% wage growth and recovering manufacturing sector. Retail sales due for release later today are expected to show strong consumption.

ECB vs Fed

Given the deteriorating health of the Eurozone but particularly the German economy, rumors are circulating that the ECB could adopt a more dovish stance with more easing on the cards.

Hearing from Jerome Powell earlier in the week, the Fed’s assessment of the US economy continues to be cautiously optimistic. Jerome Powell sees the current expansion of the US economy continuing and current monetary policy appropriate.

Given the deteriorating health of the Eurozone but particularly the German economy, rumors are circulating that the ECB could adopt a more dovish stance with more easing on the cards.

Hearing from Jerome Powell earlier in the week, the Fed’s assessment of the US economy continues to be cautiously optimistic. Jerome Powell sees the current expansion of the US economy continuing and current monetary policy appropriate.

Coronavirus

The extent of damage that coronavirus will inflict on the Chinese economy and the spillover effect on the US or the German economy, is unknown. However, the German economy is primarily a manufacturing, exporter economy. This means that it is more vulnerable than the US economy from a slowdown in China. Meanwhile the US dollar benefits from coronavirus fears owing to its safe haven status.

The extent of damage that coronavirus will inflict on the Chinese economy and the spillover effect on the US or the German economy, is unknown. However, the German economy is primarily a manufacturing, exporter economy. This means that it is more vulnerable than the US economy from a slowdown in China. Meanwhile the US dollar benefits from coronavirus fears owing to its safe haven status.

More downside to come?

Given the above assessment, it seems unlikely that the euro will start to pick up meaningfully anytime soon. In fact, there appears to be more potential for further downside. It would take a sustained improvement in German and Eurozone data to see any real move higher in the euro and that looks to be some way off.

Given the above assessment, it seems unlikely that the euro will start to pick up meaningfully anytime soon. In fact, there appears to be more potential for further downside. It would take a sustained improvement in German and Eurozone data to see any real move higher in the euro and that looks to be some way off.

Levels to watch

“The trend is your friend”, “don’t try to catch a falling knife” these are all relevant here! EUR/USD trades below its 50,100 and 200 sma, with strong downward momentum.

Immediate support can be seen at today’s low $1.0828 before EUR/USD looks towards $1.05. On the flip side resistance can be seen at $1.0870 (trend line resistance) prior to $1.0925 (trendline resistance and high 11th Feb).

Latest market news

Today 08:18 AM

Yesterday 10:40 PM