Risk off dominated as the new week kicked off. Fears are growing that the escalating US – Sino trade dispute and the new Trump threats against Mexico and now India could tip the global economy into recession.

Global data is starting to show the strain of the US – Sino trade was. Last week Chinese manufacturing pmi showed the sector contracted in May, US consumer confidence also increased less than forecast. Over night South Korean exports which are considered a bellwether for global growth tanked -9.4%, well below the -5.6% decline expected.

All eyes will now turn to US ISM manufacturing data this afternoon. The markets are growing increasingly concerned that Trump’s multiple front trade war is starting to hit the US economy. CME Fedwatch tool is pointing to a interest rate cut fully priced in by the end of the year, with a 50% probability of a rate cut by July now being priced in.

With global recession fears picking up and risk aversion in play, plus the odds of a Fed rate cut on the up gold is starting to shine. Lower interest rates are beneficial for non-yielding gold because the opportunity cost of holding the yellow metal decreases.

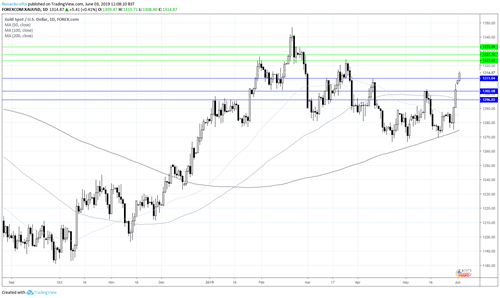

Gold chart

Gold bulls are taking charge on Monday, pushing gold to $1320, its highest level since 26th March. Gold trades above its 50 sma, 100 sma and 200 sma on the 4 hour chart. A sustained hold above $1311 could see gold push on higher to break through resistance at $1323. A break here could open the doors to $1328 before $1333. On the downside a break below resistance turned support $1311 could see a slide extend to $1302 before $1296.

Latest market news

Yesterday 08:33 AM