Its been over a month since our last update on gold. During this time the price of gold has remained relatively stable trading between $1480 and $1520. In this note, we look at some of the reasons why gold has remained sidelined and the outlook for gold into year end.

Two of the more significant market events over the past month have been the U.S. and China agreeing to “phase one” of a trade deal. The second is the Fed signalling an end to its easing cycle after cutting interest rates for a third time in 2019 last week. Both events in theory present downside risks to the price of gold.

However, these risks do not appear imminent after reports surfaced overnight that the U.S. – China trade deal will not be signed until December. Furthermore, there is increasing chatter that China would prefer to hold fast and not sign a trade deal before the U.S. election or to ease President Trump's impeachment issues.

On the economic front, despite the better than expected U.S. GDP data and jobs report last week traders still need more reassurance that the Fed is on hold. A continued stabilisation and improvement in global industrial data would help in this respect.

Supporting the price of gold for now, interest rates remain low globally as does the recent resumption of asset purchases in Europe. From an interest rate perspective, there is more chance of interest rate cuts and asset purchases in countries including Japan, Australia, and New Zealand than interest rate hikes.

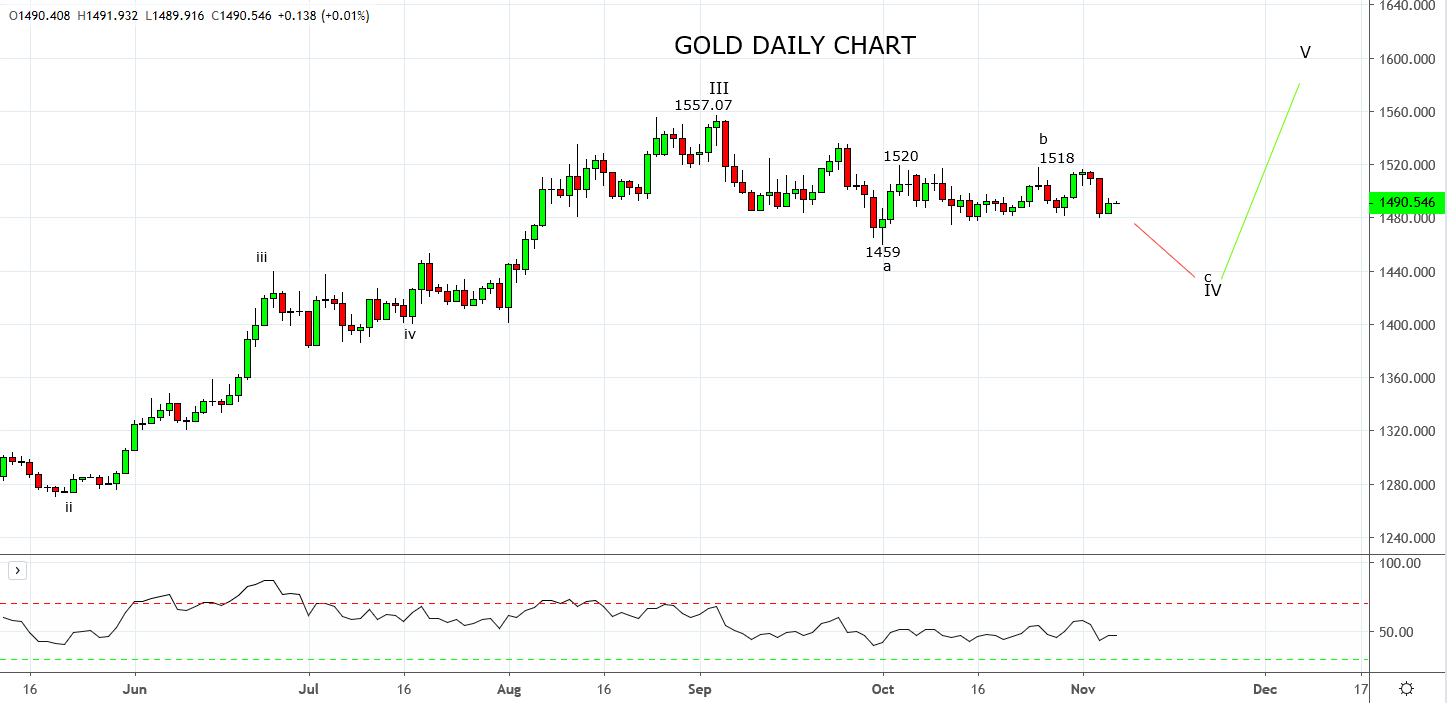

Technically, the bigger picture view of fold remains bullish. However, in the shorter term while the $1520 resistance level continues to cap, gold appears to be missing a corrective wave lower.

Specifically, a break of the October 1 low at $1459 would suggest that Wave c of Wave IV is underway, targeting a move towards wave equality at $1430. Providing a bullish reversal candle then forms in the $1440/1430 support area it would be the setup to re-enter gold longs in anticipation of a move above $1600 for Wave V.

Source Tradingview. The figures stated areas of the 7th of November 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.