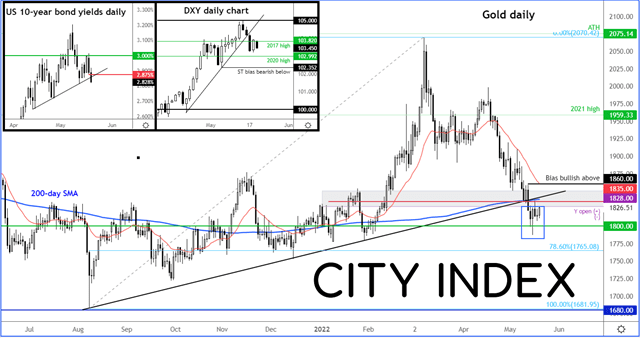

Right about now is when gold ‘should’ be doing what people expect from it: to shine and do so brightly. Until now, the metal has been unable to find much demand from inflation hedging or flight from riskier stock markets. That’s partly because investors have until now been piling into the dollar, weighing down the buck-denominated metal. The precious metal has also been held back all this time due to rising bond yields, making this non-interest-bearing commodity less appealing for yield seekers.

But yields have dropped sharply as investors piled back into the perceived safety of government bonds following Wednesday’s slump in global equities, when spoos slumped some 4% in its most severe sell-off since June 2020. Given the elevated levels of uncertainty, as evidenced by the volatility in the stocks and crypto markets, there is a good chance we will see more haven demand for gold going forward.

Of course, it is not uncommon for gold to fall alongside equities when the markets are in turmoil – as we saw for example in early 2020.

However, given the recent gold-price weakness and rising economic uncertainty, not to mentioned the drop in the dollar and yields, if gold was ever going to rise, you would feel now would be the time as investors continue to seek safety from riskier assets and hedge against soaring inflation. After its recent slump gold is now relatively inexpensive and many people would find it valuable at these levels, at times like now.

Gold therefore should find some haven demand, which, in turn, should boost the appeal of precious metals miners.

I would be very surprised if the precious metal was unable to reclaim its 200-day average and the trend line around $1835ish, before potentially staging a sharp recovery. Still, given gold’s recent behaviour, it is perhaps better to wait for the metal to show us a strong signal such as what I have just mentioned, before potentially piling in on the long side.

How to trade with City Index

You can trade with City Index by following these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade