Gold eyes rebound as stocks remain volatile

- Gold undervalued – bulls need a reversal signal

- Volatility continues for stocks

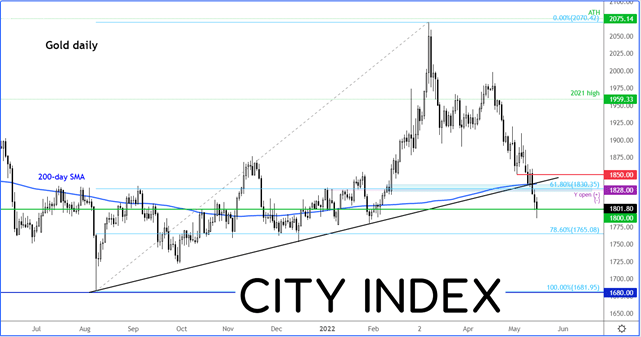

Gold has come off its earlier lows to climb back above $1800. Let’s see if this is the start of a significant comeback or more of what we have seen recently: futile bullish attempts, despite all the volatility in the stock markets and elevated levels of inflation around the globe.

Gold hit by strong dollar and yields

The precious metal has been a victim of a strong US dollar and rising bond yields, making this non-interest-bearing commodity less appealing for yield seekers. Its performance has surprised many market participants, us included. Given the elevated levels of uncertainty, as evidenced by the volatility in the stocks and crypto markets, you would expect to see some haven demand. However, that hasn’t been the case, with the metal giving back some 13% after nearly sitting a new record high but came short by $5 at $2070 on March 8. Those seeking to protect their wealth being eroded by inflation must be equally surprised to see the metal trade around $1800.

Gold undervalued

Undoubtedly, many still regard gold as being significantly undervalued, and would be even more wiling to buy the metal now that prices have weakened, especially when you consider the recent crypto carnage, falling purchasing power of fiat currencies amid rising levels of inflation and the ongoing stock market volatility.

While fundamentally I continue to remain positive towards gold, I just need to see a technical reversal pattern to confirm that prices have bottomed out. One such scenario would be if gold reclaims the broken trend line and goes back above $1850 resistance. But first thing is first: it will need to defend support around $1800:

Source for all charts used in this article: StoneX and TradingView.com

Volatility continues for stocks

Elsewhere, market action continues to remain quite choppy. Overnight data from China for April released was worse than expected, which more or less confirms GDP is headed for a contraction in the second quarter of this year due to anti-Covid lockdowns. But news that Shanghai is re-opening has helped to soothe some investor concerns. Both indices and crude oil prices are off their overnight lows as a result. In FX, interest rate differentials continue to move the markets in the way you would expect. Investors are buying currencies of countries where the central bank is expected to raise interest rates the most and selling currencies of countries where the central bank is expected to remain the most dovish.

How to trade with City Index

You can trade with City Index by following these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade