Ahead of Friday’s US jobs report, bond yields and the dollar have both sold off again, and this has helped to lift gold prices near a key technical level. Will we see a breakout?

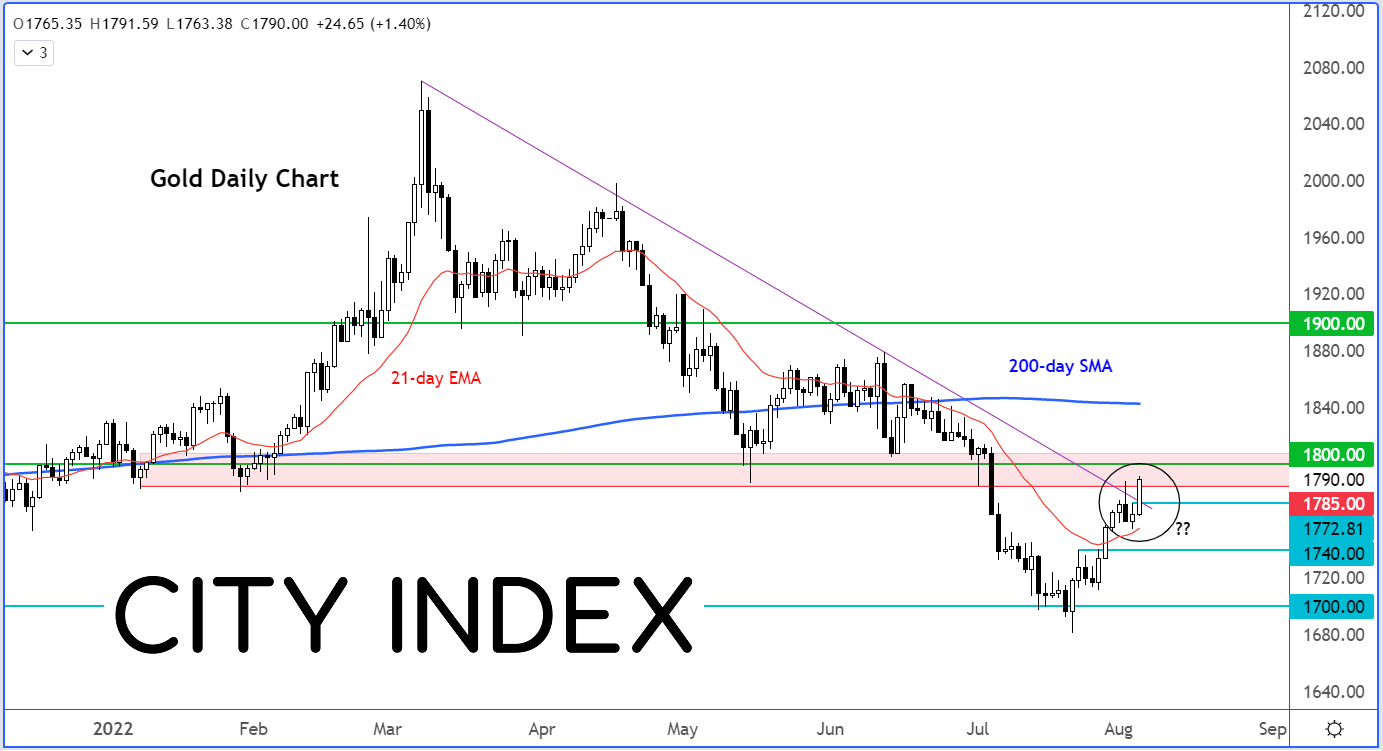

Before discussing the macro influences, here’s a daily chart of gold showing the metal is again trying to break through key resistance between $1785 to $1800:

With yields falling, I think there is a good chance we will see a bullish breakout. Following the publication of mixed data this week, investors appear convinced the Fed will slowdown rate hikes despite officials indicating otherwise. We saw a stronger-than-expected ISM services PMI report for July in mid-week, which pointed to a favourable mix of slowing inflation and some growth momentum. But the week’s other data releases have not been so convincing.

Weakening economy

Among the weaker-than-expected data releases we have seen this week, was construction spending as we found out on Monday and weekly unemployment data released earlier today. Jobless claims rose to fresh 8-month highs, while continuing claims hit their highest level since March. The weekly unemployment data has raised concerns that the July non-farm payrolls report will disappoint expectations on Friday. Earlier in the week, we saw purchasing managers reported employment contracted in July, but at a slower pace than June. Meanwhile, the closely-followed University of Michigan Consumer Sentiment survey has remained near all-time lows, while the official Consumer Confidence barometer is at a 5-year low. Even that strong ISM PMI report had some details which were not so great, with purchasing managers reporting that interest rate hikes had significantly impacted the homebuilding market, while responds in Management of Companies & Support Services said they “can feel the economy weakening.”

More signs of weakening inflation as crude sell-off gathers pace

Perhaps another big reason why US dollar bulls are being kept at bay is the falling prices of crude oil. Today saw crude oil hit levels not seen since before Russia invaded Ukraine, as WTI fell below $90 handle to trade around low-$87s at the time of writing. This is certainly disinflationary. We have also seen other commodity prices falling sharply compared to their highs seen only a few months ago. This has been reflected in purchasing managers reporting falling prices. The ISM services PMI for example showed the ‘prices’ sub-index decreasing for the third consecutive month, down by a good 7.8 points to 72.3. Similarly, the same sub index in the manufacturing sector PMI fell quite sharply from June.

What other factors will drive gold prices?

Looking ahead, Friday’s US jobs report will be the next catalyst for gold and silver prices. In the event we see weaker-than-expected jobs, or more importantly wages, then this could further undermine the dollar and underpin gold and silver, and foreign currencies. My colleague Matt Weller has written everything you need to know about non-farm payrolls report HERE.

Further out, US CPI on Wednesday, August 10 will be the next major data release. As mentioned, signs that inflation is weakening is growing, with a number of key commodity prices falling. We have also seen the prices paid sub-indices of the ISM manufacturing and services PMIs tumble, suggesting we have hit peak inflation. Let’s see if annual inflation rate will decelerate from the 9.1% recorded in June, which was the highest since November of 1981.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade