Pessimistic growth expectations look baked-in for big U.S. and the European companies

Investors are listening with rapt attention to Federal Reserve chair Jerome Powell’s congressional testimony as his words hold the key to whether the trade-talks related rebound of global shares can continue or will face fresh challenges. But Powell’s reiterated signal of a ‘safety’ rate cut of at least 25 basis points in July might be little use if stocks aren’t able to capitalise on the cheer due to increasing earnings pessimism.

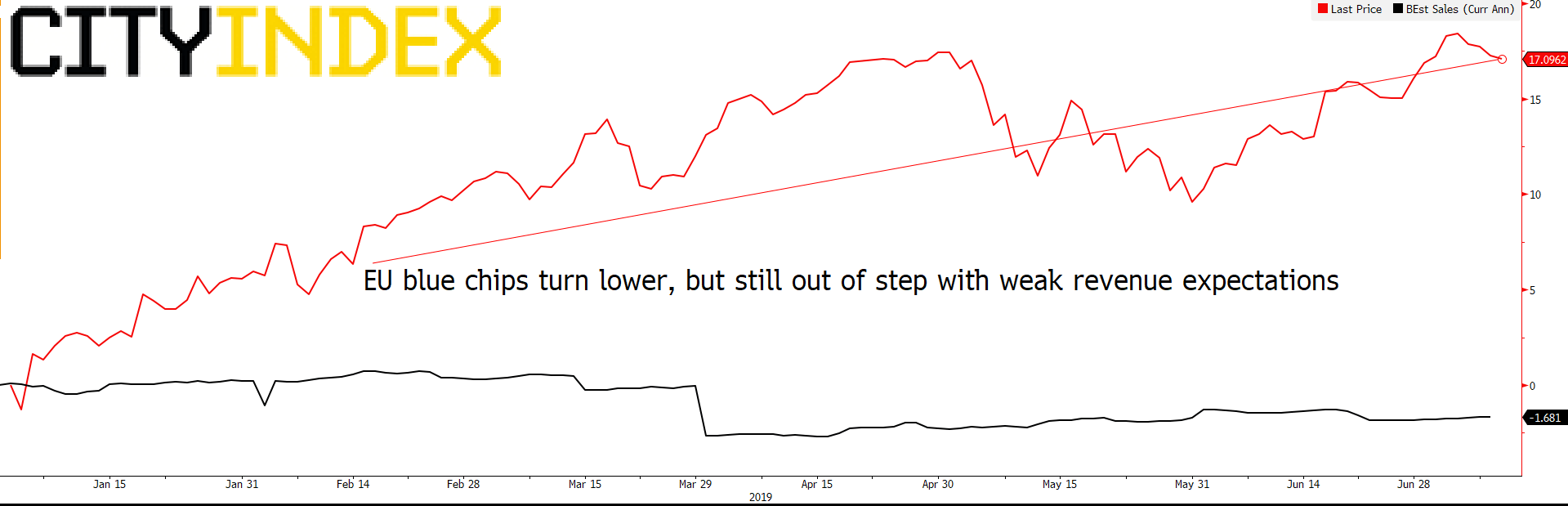

Pessimistic earnings expectations speak to the possibility that in some ways, any resumption of trade talks after Presidents Trump and Xi broke their impasse at the G20 meeting last month, might be too little, too late. In Europe, things are coming to a head quicker than in the States. The region’s STOXX 600 gauge continues to diverge with the largest Wall Street and Asia Pacific markets as anecdotal evidence about weakening profits begins to back up falling forecasts. Though MSCI’s APAC index (which doesn’t include Japanese shares) ended a three-day slide on Tuesday whilst Europe’s blue-chip EUROSTOXX 50 did not, tepid earnings expectations for large caps have been undermining sentiment all year, as shown below.

Rebased chart: EUROSTOXX 50 / EUROSTOXX 50 2019 revenue forecast

Source Bloomberg / City Index

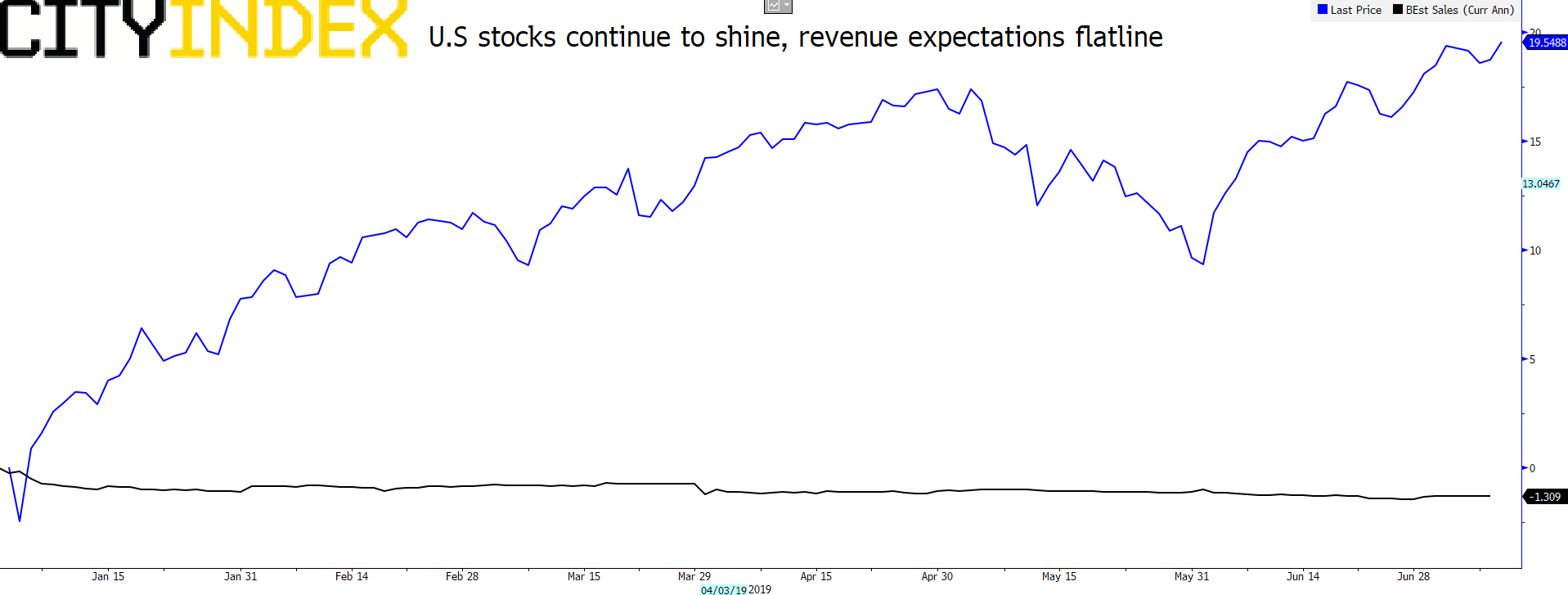

Hopes aren’t particularly high for U.S. large-cap earnings either. The mood there is damped by the weakest S&P 500 company earnings guidance since the first quarter of 2016. The index’s aggregate EPS growth is seen dropping to 2.7% in the second quarter according to Bloomberg data, which would make it the worst of three-month stretch of the year. Some companies reported their second quarter months ago, others will not do so for months, depending on their financial year. Even adjusted for calendar variations though, guidance points to the third-worst quarter since 2012. In turn, investors’ expectations of S&P 500 revenue growth this year, are stuck just below zero.

Rebased chart: S&P 500 / S&P 500 2019 revenue forecast

Source Bloomberg / City Index

U.S. blue chips have been here before. Q1 was supposed to mark the low point initially this year, looking at consensus. In the end, low forecasts for that quarter were easy to beat, even if growth didn’t exactly end up as stellar. A similar dynamic applies to European estimates, though reported Continental revenues have been even more mediocre so far. The rise for the year tracks at around 0.9% year-on-year, from a combination of firms that have reported one quarter or more. That compares to S&P 500 companies’ 1.7% revenue rise so far in 2019. Whilst it should not be a surprise that both regions have outperformed forecasts, they have also achieved anaemic revenue growth so far this year. With stock indices in Asia and U.S. leading global markets higher and even Europe still up by a double-digit percentage in 2019, global companies have not been able to offset trade and slowing economic growth very much. That leaves them vulnerable should the trade situation turn sour again. The upcoming reporting season offers the chance to get ahead of the danger, but all evidence suggests it’s only a small probability right now.