After two between meetings rate cuts, it was hardly surprising that the BoE stayed pat on monetary policy today. The central bank voted to keep interest rates on hold at record low levels of 0.1% after two cuts in 8 days up to 19th March. During this time the BoE had also ramped up its bond buying to purchase £200 billion extra, measures taken in an attempt cushion the blow from the coronavirus hit to the economy.

The BoE in its accompanying statement today said that it stood ready to expand asset purchases further if necessary.

Given the big gun announcements and large swings that we have seen over the past few weeks, today’s meeting was quite the non-event, with the pound steadily advancing post meeting

The BoE highlighted the uniqueness of the economic outlook, unlike any crisis that the central bank has had to navigate through before. The BoE predicts a sharp hit to global GDP through the first half of the year. Unemployment is expected to rise rapidly. However, the BoE still considers this to be a temporary hit, particularly if business failures and job loses can be avoided.

The BoE highlighted the uniqueness of the economic outlook, unlike any crisis that the central bank has had to navigate through before. The BoE predicts a sharp hit to global GDP through the first half of the year. Unemployment is expected to rise rapidly. However, the BoE still considers this to be a temporary hit, particularly if business failures and job loses can be avoided.

ECB validates its pledge

Meanwhile the ECB has loosened the self-imposed limits, giving itself an unprecedented level of flexibility it its plan to buy €750 billion in additional bonds to limit the impact of the financial fallout from coronavirus. Almost all of the constraints from previous asset purchases have been removed or loosened significantly. This move validates the ECB’s pledge to backstop the markets amid no limit to its commitment to the euro.

These moves from the BoE and the ECB come after the Fed pledged unlimited bond buying if necessary.

Meanwhile the ECB has loosened the self-imposed limits, giving itself an unprecedented level of flexibility it its plan to buy €750 billion in additional bonds to limit the impact of the financial fallout from coronavirus. Almost all of the constraints from previous asset purchases have been removed or loosened significantly. This move validates the ECB’s pledge to backstop the markets amid no limit to its commitment to the euro.

These moves from the BoE and the ECB come after the Fed pledged unlimited bond buying if necessary.

EUR/GBP levels to watch

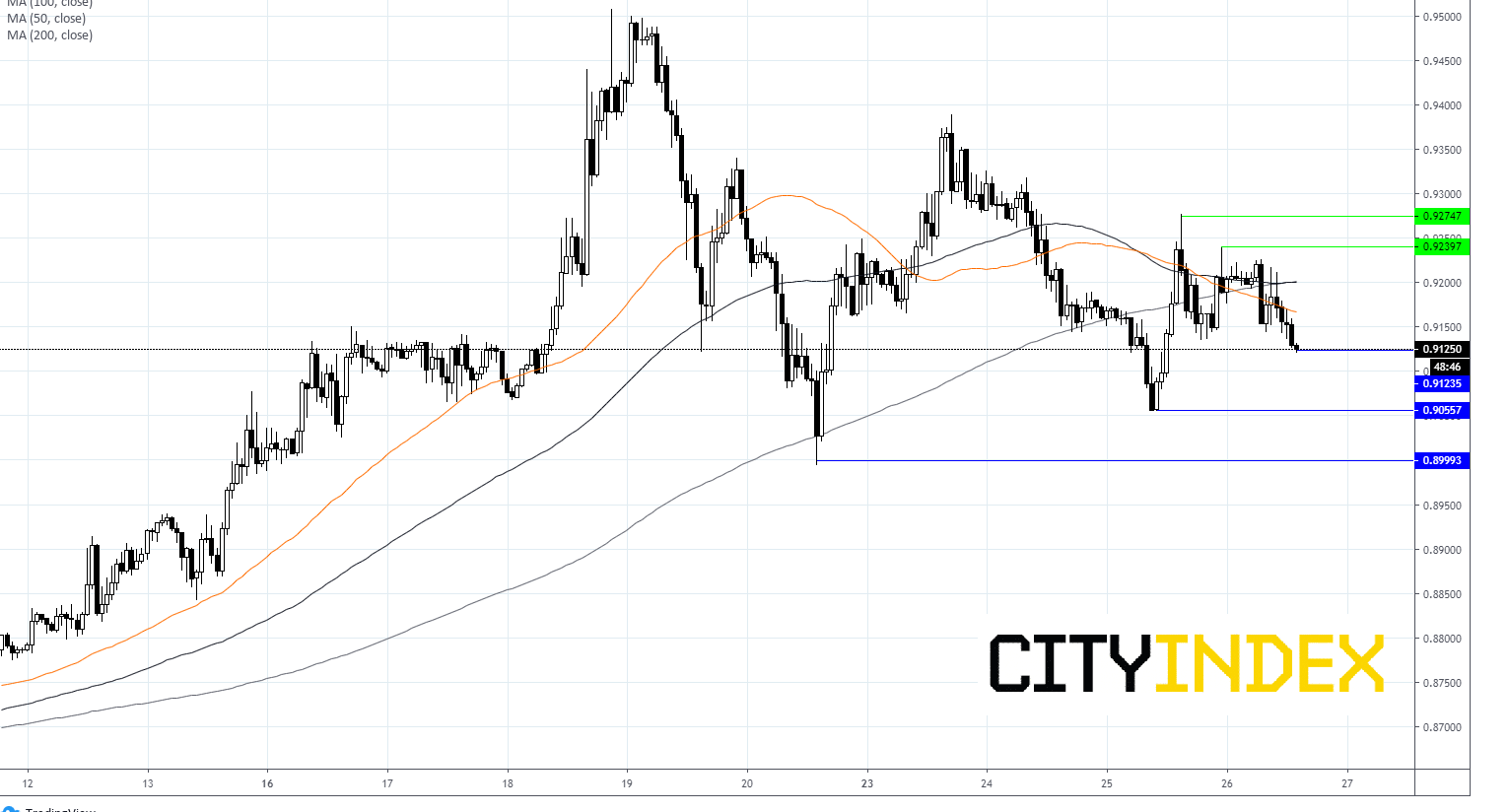

EUR/GBP is trading 0.3% lower at 0.9121, below its 50, 100 and 200 sma on the 1 hour chart, a bearish chart.

Immediate support can be seen at 0.9120 (today’s low) prior to 0.9055 (yesterday’s low) and 0.8995 (low 20th March)

Resistance is seen at 0.9237 (today’s high) prior to 0.9250 (yesterday’s high)

Latest market news

Today 08:33 AM