Last week, three possible scenarios were outlined that might come from the G20 meeting in Osaka between Presidents Trump and Xi. The outcome of the meeting has fallen squarely between the bearish and bullish scenarios outlined; a type of middle ground scenario described in the article as “an uneasy type of truce.”

This is because while the two leaders agreed to delay pending U.S. tariff increases and resume negotiations, little or no progress has been made on the key issues dividing the countries. The easing of U.S. restrictions on exports to Huawei is a flimsy olive branch which according to National Economic Council chairman Larry Kudlow who spoke to Fox News, will only apply to products widely available around the world. More sensitive equipment will remain restricted.

An uneasy type of truce, unfortunately, does little to remove the uncertainties business face as a result of ongoing trade tension. Evidence of this on display as the latest global manufacturing PMIs have fallen in contraction territory and to their lowest level since February 2016. As Morgan Stanley highlighted in a note overnight “Underlying details were also less encouraging – with new orders now contracting (and well below 2015-16 cycle lows) and the new orders/inventory ratio dipping to a new low since July 2012.”

Returning to last week’s G20 article, it was outlined that “an uneasy type of truce” should result in risk assets including commodity currencies rallying post the G20 announcement before the move faded. Evidence of this on display as the AUD, NZD and CAD all rallied on the open yesterday morning, before falling into the close.

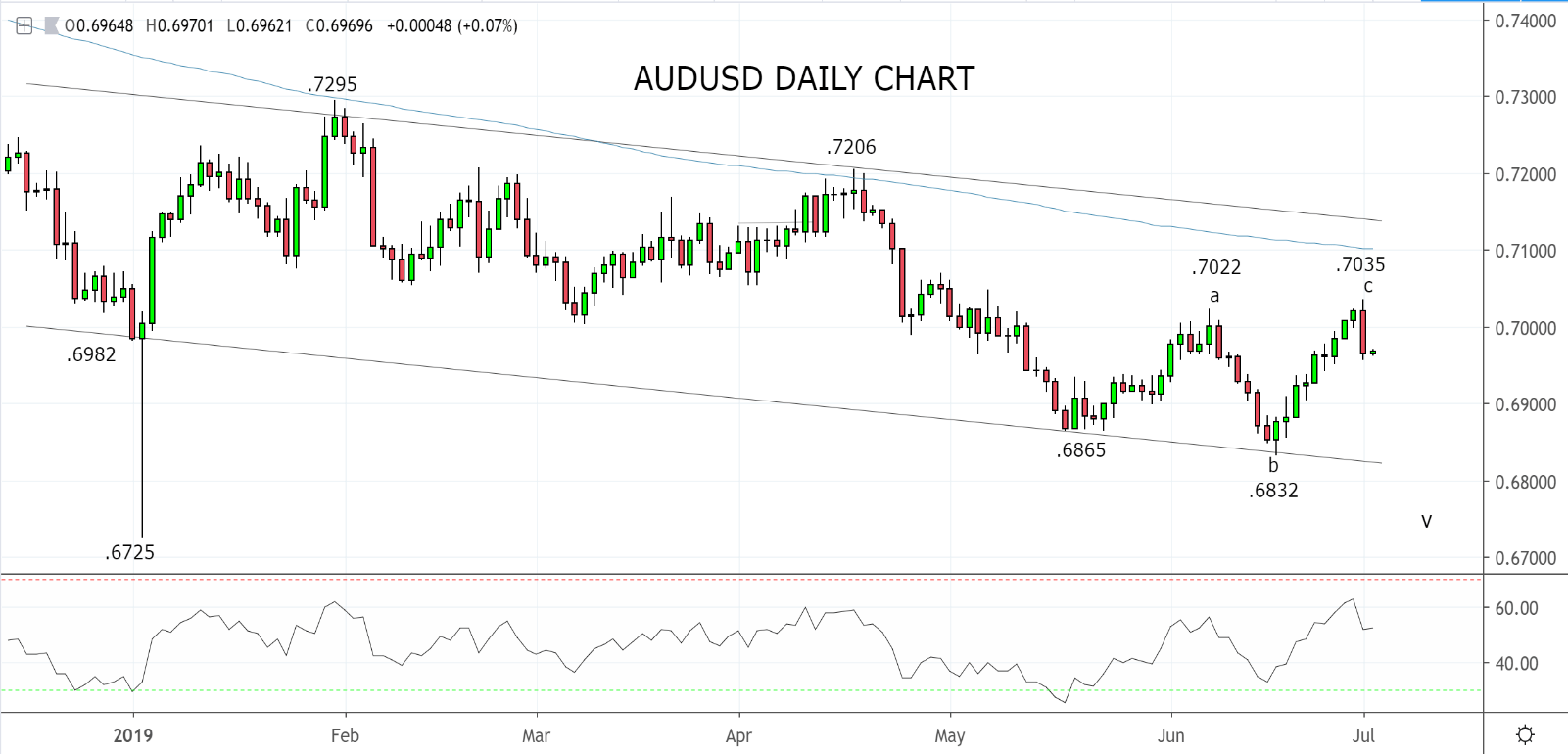

Specifically, for the AUD, the overnight fall has left signs of rejection from the .7025/35 resistance level. Providing the AUDUSD remains below this resistance zone, the bias is for the AUDUSD to retest and break the recent .6832 low.

Of course, there is still this afternoons RBA interest rate meeting to get through. Assuming the RBA chooses to act and cut rates this afternoon, rather than elect to wait until August, the down move is likely to commence sooner than later.

Source Tradingview. The figures stated are as of the 2nd of July 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.