FX Brief: Kiwi Spikes Aside, It’s Calm Before The Powell Storm

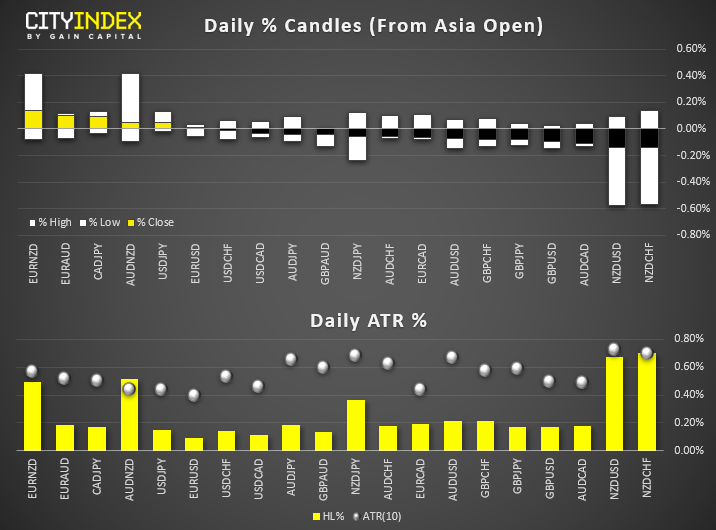

- Were it not for the sudden spike on NZD crosses then ranges would have been typically small, given market are keenly awaiting comments from Powell later. The lack of news and immediate price reversal suggests its liquidity driven.

- USD and NZD are currently the strongest majors, CHF and AUD are the weakest.

- Bitcoin is above $13k against after breaking out of compression this week.

- Despite 2 cuts from the RBA, Australian consumer sentiment fell -4.1% in June, it’s most pessimistic level in Q2. The index has fallen to a 2-year low and fell -9.3% YoY, its weakest annual rate of change since January 2015.

- Chinese producer prices were flat at 0%, their lowest level since August 2018 when prices were last deflating. Inflation rose 2.7% expected, driven by food at +8.3% YoY, 21.1% of which was pork prices. Presumably driven by the trade war, they could prove to be quite an inflationary input.

- Equities and Index futures are trading mostly higher after a couple of subdued sessions ahead of Powell’s testimony and Fed minutes.

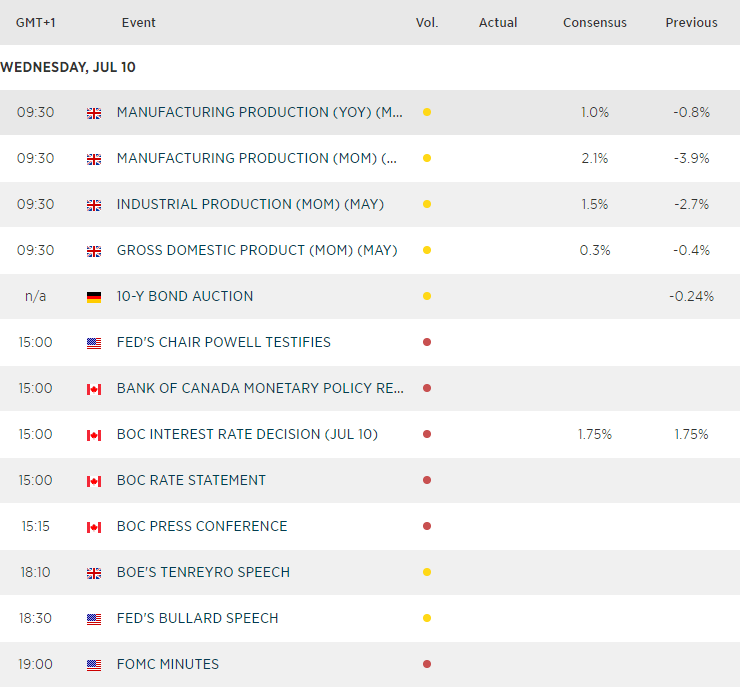

Up Next

- A host of economic data puts Sterling firmly on the radar early session. Car plant shutdown saw manufacturing and industrial output plummet in April, so we’re not expecting a merry turnaround here. GDP is a final estimate so not likely to deviate too far from its prior read of 1.3%.

- From the US, Powell’s testimony is likely to be the highlight of the session as markets want more clarity over how far Fed are likely to cut and when. Fed minutes are also later in the session, but not expected to be as lively as Powell’s testimony.

- BOC are expected to hold rates but, given their strong economic data in recent weeks then be on guard for a slightly hawkish undertone. CAD crosses are clearly the ones to watch around this.

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM