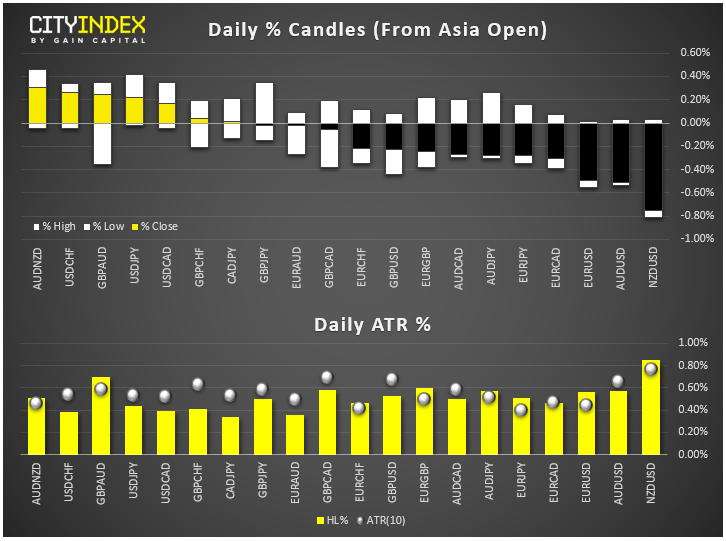

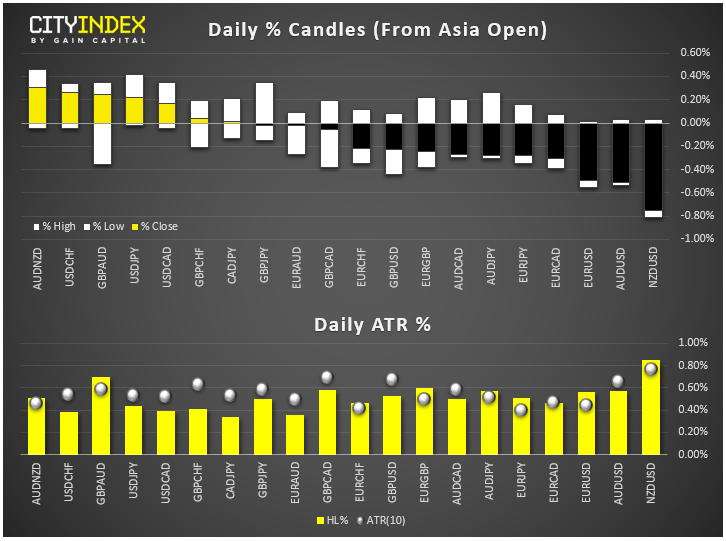

- NZD still bottom of the FX leader board this late in the European session, followed closely by the EUR, while USD and JPY have been the strongest.

- NZD fell after the RBNZ said it was investigating the possibility of using unconventional policy strategy, though it is still at a "very early stage." GBP barely reacted to the expected news of Boris Johnson winning the Tory leadership race today, although the EUR/GBP and EUR/JPY both fell as investors looked forward to the ECB rate decision on Thursday. USD found support from news of a bipartisan deal to suspend the US debt ceiling and boost spending levels for two years.

- The EUR/USD broke below the 1.12 handle this morning, as we had highlighted the possibility on a number of occasions, most recently HERE. Participants trading the EUR/USD are now looking ahead to the upcoming European Central Bank meeting on Thursday. In addition, fresh Eurozone PMIs will be published Wednesday and German Ifo will come in on Thursday morning. Meanwhile from the US, we will have the first estimate of second quarter GDP on Friday, ahead of the FOMC meeting is next week.

- Stocks jumped in Europe in anticipation of a dovish ECB, and on the back of forecasting-beating earnings from the likes of UBS and Banco Santander. In the US, shares in Coca-Cola hit a fresh record thanks to a 6% rise in sales, while Beyond Meat continued to defy gravity as it extended its post-IPO surge to more than 730%, breaking the $200-a-share threshold for the first time. Boeing and Facebook report tomorrow:

-

- Boeing will report its earnings before Wall Street opens today. The aerospace industry has been under increased scrutiny and for Boeing the troubled 737 MAX has been a big headache. However, the company has tried to put this year’s crises behind it after announcing a $4.9 billion after-tax charge tied to the groundings of its 737 Max jets. The aerospace giant has seen its shares fall 15% since peaking in March. That’s when the company’s jet was involved in a second deadly crash within five months. But could shares in Boeing rebound? Investors are relieved the company has put some ring fence around the 737 Max problem. But it will still need to beat earnings expectations of a loss of $0.56 per share on revenue of just under $18 billion.

- Facebook is set to report its quarterly earnings after the markets close tonight. For the social media giant, which has been in regulatory crosshairs since the Cambridge Analytica scandal, even a $5bn fine ranks as small fraction of its annual revenue. More broadly, global official sanctions on Big Tech companies’ size, market dominance, and more, appear to be too distant a prospect for investors to react to, let alone hedge. But Libra could steal the limelight. The thinking is that Facebook’s crypto gambit could activate Instagram monetisation, enabling the group to tap the $1.4 trillion e-commerce market. First though, a likely $3bn-$5bn regulatory fine may get another airing, and ad price falls will be scrutinised. Underlying earnings per share is expected to come in at $1.90 on revenue of $16.45 billion.

- Coca-Cola shares hit a fresh record high Tuesday on the back of news its second quarter EPS and revenue both topped estimates. Quarterly sales jumped 6% thanks to the introduction of ready-to-drink chilled Costa Coffee and this prompted the company to raise its full-year sales outlook. Coke acquired Costa last year as part of a push to diversify beyond fizzy drinks. Shares in Coca-Cola could remain in focus for a while yet.

-

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM